Ringing in a brand new 12 months has a method of serving to us wipe the slate clear – giving us a recent begin and getting us enthusiastic about this being the 12 months we crush all our objectives.

It’s a good time to replicate on what labored and what didn’t, what really issues to us, and what we are able to in all probability stay with out.

That reflection is the important thing although. This must be about your needs. What issues most to me seemingly received’t be what issues most to you. And if our objectives don’t align with what we would like most, it’s troublesome to remain motivated and maintain taking the actions that may get us nearer to success.

However once we outline what we actually need, for ourselves and for our households, it permits us to take small steps each day to direct our time, vitality, and cash towards making a life full of what’s most vital to us.

As we sit up for what we would like in 2021, think about these methods to afford extra of what issues to you.

Affording Extra of What You Need

1 – Change Your Mindset About Budgeting

It’s like your mama telling you ‘no.’ However that’s not the case!

Budgeting is empowering. Consider it this manner: would you are taking a street journey with no map? Most individuals wouldn’t. Now, consider your cash because the automobile – it wants course. If you inform it the place to go, it can save you and spend extra.

All of it begins with making a funds. It doesn’t need to be restrictive. Right here’s learn how to begin:

- Have a look at your bills during the last 12 months. Write down the necessities – the payments you could pay, just like the mortgage or hire, utilities, telephone, meals, automobile cost and insurance coverage. These are non-negotiable. It’s a must to pay them otherwise you received’t have a spot to stay, meals to eat, or a solution to get your children to the physician.

- Assessment your negotiable bills. These are the bills you could possibly cut back or eradicate, and it’s the place the ability of budgeting shines. If you see the place you may reduce, and also you select to chop, it received’t really feel restrictive. There’s a distinction between being instructed what to do and selecting to do it. (Simply ask your children!)

My favourite solution to funds is zero-based budgeting with You Want a Funds. With zero-based budgeting, you solely funds the cash you may have, giving every greenback a job till there are not any {dollars} left.

As a result of budgeting this manner encourages you to consider cash in another way, it will possibly take some getting used to. However when you get YNAB arrange, it’s a very highly effective device that may fully change your relationship with cash.

The secret’s to seek out the system that works greatest for you and your loved ones.

2 – Earn Money Again on Your Purchases

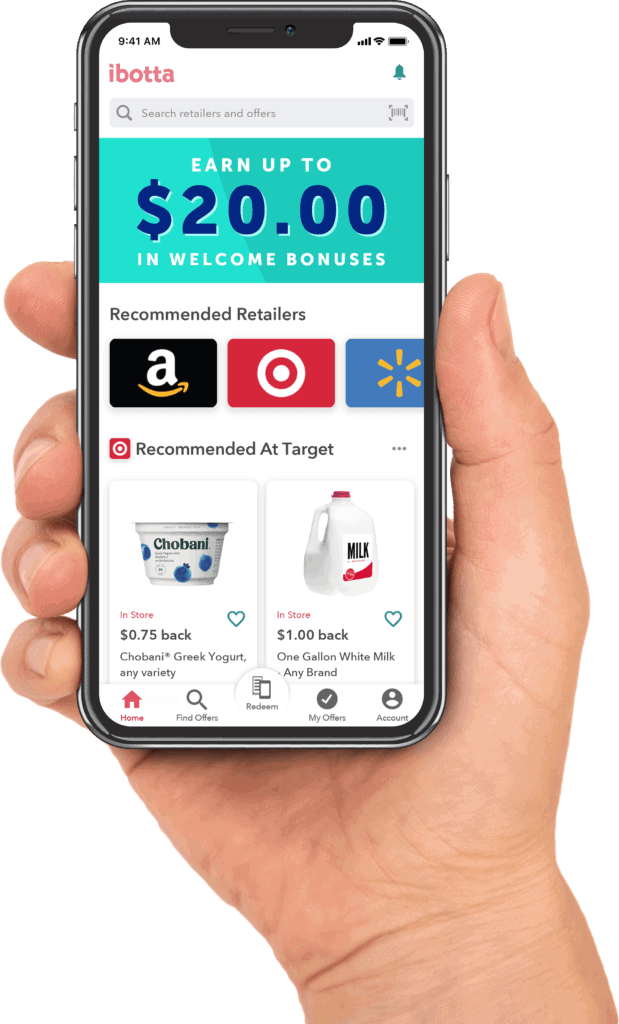

Mamas have to spend – groceries, clothes, toys, and family items are a should. Discovering methods to avoid wasting is essential to stretching your {dollars} to afford extra of what you need. For me, Ibotta is an enormous a part of how I lower your expenses on on a regular basis objects.

Ibotta is a free money again app that permits you to earn rebates on objects you buy. It additionally has a number of bonus promotions that provide you with money again above and past what you normally save.

This January, Ibotta is working a ‘Resolutions with Rewards’ marketing campaign. That will help you meet your New 12 months’s decision for a wholesome life-style, you’ll earn money again once you purchase wholesome grocery objects.

Getting money again with Ibotta is a good way to make wholesome selections for your loved ones, even should you’re on a good funds.

3 – Put together for Emergencies

Specialists suggest you put aside not less than three to 6 months of bills for emergencies. Ideally, this is a superb purpose. However many households felt the sting of shrinking paychecks and unemployment in 2020.

Many households had little saved for an emergency. Practically 60% of Individuals must use a bank card or borrow cash to cowl a $1,000 emergency – and that was earlier than the pandemic started.

If 2020 taught us something, it’s the significance of being financially ready when catastrophe strikes. You might not have the ability to save a lot should you misplaced your job or have been furloughed, however each little bit helps.

Create a plan to succeed in your financial savings purpose. Begin with $5, $25 or $50 per week and contribute what you may. When you attain your emergency financial savings purpose, you received’t have to put your self additional in debt when an emergency pops up.

And that may unlock extra freedom to spend cash on extra of what you need.

4 – Align Your Spending with Your Values

Listing your values and embrace the vital issues in the way in which you reside and work. What means essentially the most to you in life? Your record may encompass time together with your children or vital different, touring, serving to others and your hobbies.

Subsequent, take into consideration how one can match this stuff into your funds. Contemplate it an funding in your self, which is essentially the most precious funding you can also make.

5 – Lower Out What Doesn’t Serve You

To afford extra of what you need, you might want to chop out the issues that don’t serve you. Take into consideration what you spend cash on that doesn’t add worth to your life. Listed here are a couple of concepts to begin:

- Subscriptions you don’t use

- Purchasing habits that make you are feeling remorseful moderately than fulfilled

- Bank cards or different debt that expenses curiosity

- Consuming out when it exceeds your meals funds

By not spending on issues that drag you down, you’ll have extra money accessible to spend on what you need.

6 – Make Your Cash Work for You

However there are different methods to make your cash be just right for you.

In the event you’re not a risk-taker, leaving your money in excessive yield checking or financial savings accounts may be your best choice. Many banks don’t have a minimal steadiness requirement, and also you’ll earn a better charge of curiosity than you may get at your native establishment.

In the event you’re able to take some danger, think about investing. Robo-advisors are a good way to leap into investing for novices. You may even make investments your spare change with money-saving apps like Acorns.

The purpose is to let your earnings compound and let your curiosity earn much more curiosity.

7 – Observe Your Progress to Afford Extra of What You Need

Monitoring your progress is a superb solution to attain your objectives. Upon getting these steps in place, take a while to evaluate the way you’re doing. Are you reaching your objectives? Or does your funds really feel extra painful than obligatory?

If it doesn’t really feel proper, give your self grace and make changes.

It could actually require some trial and error whilst you work out the kinks, and that’s okay! The important thing to creating it work is to waft whereas protecting your eye on the prize. Then, you may afford extra of what you need and revel in your cash the way in which it’s meant to be loved.

How are you aligning your funds with what you most need this 12 months?