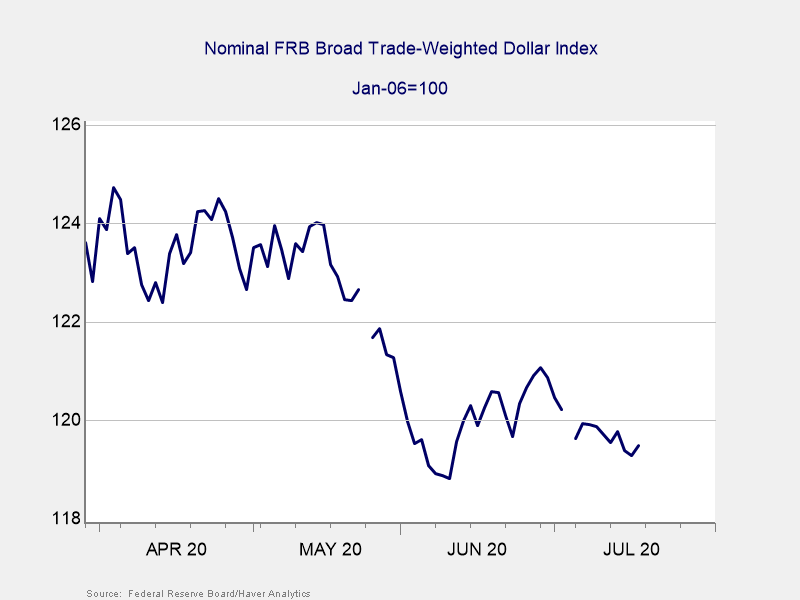

We’ve got returned to that time within the cycle the place the greenback begins transferring down and the doomsayers come out of the woodwork. Because the headlines have begun to level out the decline of the greenback in latest months, worries have began to rise. In actual fact, in case you have a look at the chart for the latest couple of months, you may see the place these headlines are coming from.

And Now for Some Context

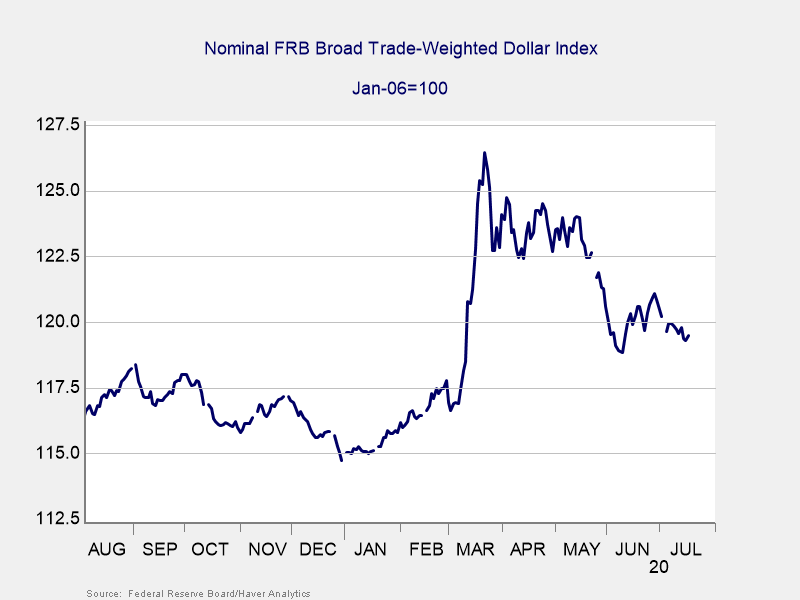

The factor is, although, the chart above is a cheat. Sure, the numbers are true sufficient, and the decline over that point interval is actual. However what’s lacking is context. To offer this context, beneath is a chart of the previous 12 months.

Sure, the greenback is down from its latest peak. However it’s nonetheless above the degrees we noticed by most of 2019 (which, bear in mind, was a great 12 months).

The Actual Story

The actual story is just not the latest decline. As a substitute, it’s the spike within the greenback’s worth when the pandemic hit across the globe. Everybody needed {dollars} when dangers began to rise, which is why the worth went up. The latest decline has all the pieces to do with issues wanting much less dangerous in the remainder of the world—and nothing to do with the U.S. wanting shaky. If something, the greenback in 2020 reveals simply how a lot of a commanding place it nonetheless has.

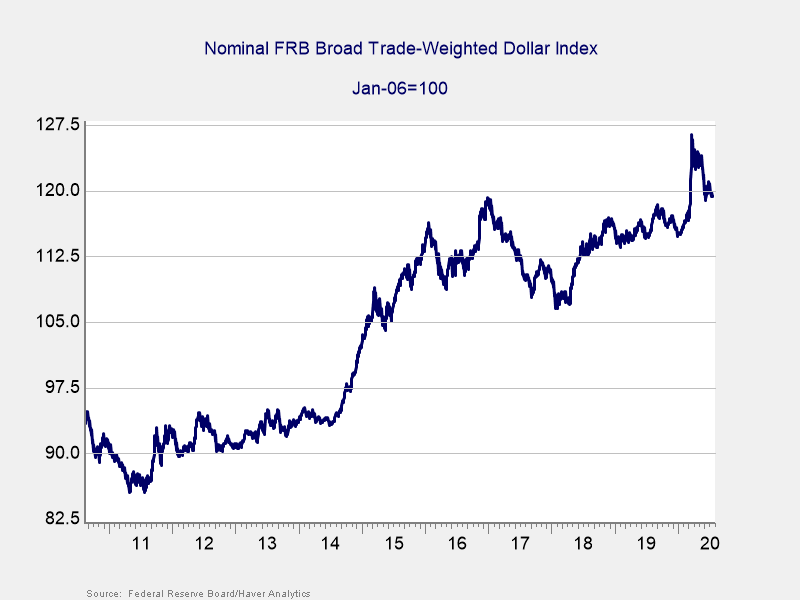

If we have a look at the previous 10 years, we see the identical story. The greenback stays at its highest degree over that point, aside from the previous couple of pandemic months. The greenback has gotten steadily extra invaluable over that point interval because the U.S. financial system has continued to outperform many of the remainder of the world. In that point, we have now seen spikes and reversals earlier than, and that is simply the most recent spherical.

A Response to Financial Situations

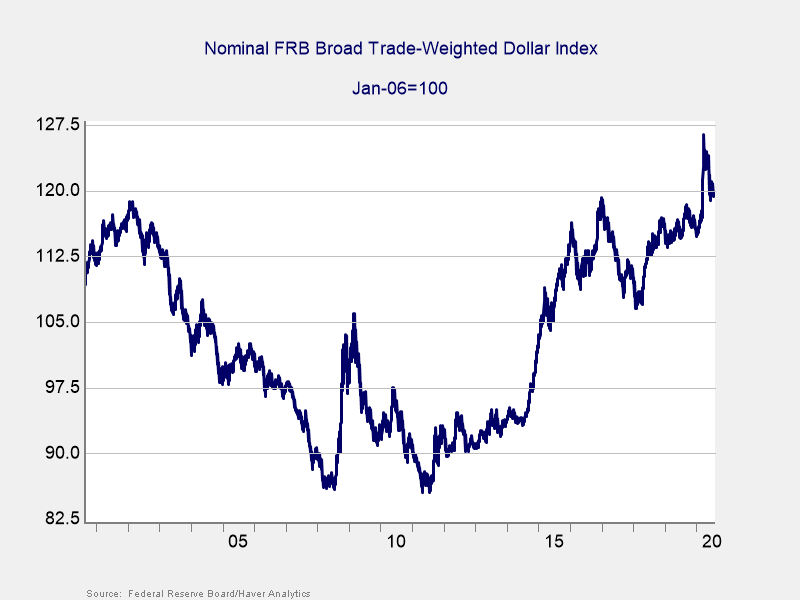

Now, that doesn’t imply the greenback all the time goes up. If we return 20 years, we are able to see that the greenback went from roughly the place it’s now, then down considerably, after which again up with a number of vital bounces alongside the way in which.

Loads has occurred over that two-decade interval, together with the monetary disaster, the pandemic, and lots of smaller crises. The greenback has responded, in numerous methods, to the information by various considerably in worth. The headlines and the fluctuations within the greenback’s worth are actual. This is smart, because the greenback (like every foreign money) is a monetary asset. As such, its worth will change in response to financial circumstances. We see the identical factor in shares, bonds, and different currencies, for a similar causes.

The Amazon of Forex

In case you consider currencies as shares, you can consider the greenback as being the Amazon of the foreign money world. Like Amazon’s inventory, generally it’s value extra—and generally much less. Volatility in a foreign money’s worth doesn’t imply the foreign money will collapse any greater than a drop in Amazon’s share worth means the corporate goes away.

In actual fact, the Amazon comparability is an efficient one for greater than the inventory worth. Amazon is a dominant presence in its market, with deep market share, substantial commitments from consumers, and a longtime vary of companies and infrastructure that makes it exhausting to dethrone. Walmart, one other behemoth, has been attempting for years—and shedding floor. It’s exhausting to shake the dominant participant, and it takes a concerted assault, by a product that’s not less than pretty much as good, for a few years. If Amazon finally cedes its dominance, will probably be years from now, and everybody will see it coming.

So, consider the greenback as Amazon, with a deep and commanding presence in its market, deep market share, substantial commitments from customers, and a longtime array of companies and infrastructure that makes it exhausting to unseat. On this comparability, Walmart is China, which has been working very exhausting to exchange the chief over a interval of years however with restricted success. And, the comparability continues, in that if China finally does handle to exchange the greenback, will probably be years from now—and we’ll see it coming properly forward of time.

Due to this actuality, the motivation to vary away from the greenback is even much less. I simply acquired a query asking if the Saudis can be switching away from the greenback for the oil markets any time quickly, as that might break the greenback’s maintain on the world financial system. Setting apart for the second the truth that Saudi Arabia stays depending on the U.S. for navy safety (which it is vitally conscious of), oil is a really international market, with buying and selling around the globe, and all denominated in {dollars}. For the Saudis to desert the greenback would require a complete new international buying and selling structure. As soon as once more, it may occur. However we might see it coming, and it could be neither low-cost nor straightforward. As soon as once more, Amazon advantages from inertia.

Will the Greenback Collapse?

That is the third spherical I’ve been by of “will the greenback collapse” since I’ve been at Commonwealth. And I’m certain there will probably be future rounds. The greenback won’t collapse now and can very doubtless not collapse for the remainder of my profession. If it does, we’ll see it coming—however it isn’t coming now.

Editor’s Observe: The authentic model of this text appeared on the Unbiased Market Observer.