Eleven years in the past this spring, a startup referred to as Betterment revealed a weblog submit stating that human monetary advisors have been out of date and that the individuals who work within the recommendation {industry} are pigs. The premise of their submit was an NBER research that despatched secret consumers out to satisfy with “monetary advisors” who then acquired high-cost, unsatisfactory recommendation. Sadly, the advisors within the research turned out to have been commission-based brokers, hopelessly conflicted and extremely incentivized to promote costly merchandise based mostly on their compensation construction. These weren’t fiduciary funding advisor representatives. They have been principally Collection 7-licensed retail stockbrokers. And I ought to know – I’ve been each in the course of the course of my profession.

When Betterment’s submit started to unfold, it provoked an enormous response among the many advisor group. Mike Alfred, who was working Brightscope on the time, did an article refuting it at Forbes. Brooke Southall picked up the controversy at RIABiz (I want I liked something as a lot as Brooke loves controversy!), Michael Kitces took to Twitter to dismantle the premise and filet the main points. As for me, I did what bloggers usually do within the presence of rank disinformation being disseminated among the many common public – I destroyed it.

Betterment makes use of the phrases “dealer” and “monetary advisor” interchangeably of their submit, both as a result of they don’t perceive the distinction or as a result of their weak level advantages from the intentional obfuscation.

The underside line: In the event that they knew higher, they’re disingenuous and nasty. In the event that they didn’t know higher, then they’re silly.

And lest you suppose this was all an overreaction, right here is the picture Betterment used for example their authentic submit:

However that was then. Let me deliver you on top of things on what’s occurred since.

First, Betterment deleted the submit. Don’t trouble searching for it, it’s gone.

I believe they did the appropriate factor in taking it down. And I perceive the motivation behind placing it up within the first place.

Jon Stein, Betterment’s founder after which CEO, alongside along with his authentic employees, noticed themselves because the insurgents and this was them waving the Jolly Roger to place the {industry} on discover. I used to be a bit of little bit of an asshole myself after I began running a blog. I wrote all types of stuff I want I hadn’t in the course of the early, rebellious part of this web site. In addition to, Betterment did have some extent concerning the {industry} and its motivations, regardless of their inarticulate effort at exposition.

Advisors vs Brokers

You see, within the early 2010’s there was a struggle over whether or not or not the brokerage companies who have been holding themselves out the general public as “advisors” must be held to a fiduciary commonplace of care versus the much less stringent “suitability” commonplace. However they wished to have their cake and eat it too – promote as advisors however promote like transactional brokers. The general public didn’t perceive the distinction between brokerage providers and fiduciary advisors. I wrote an entire e book about it, however the gist was that the majority civilians had “my monetary man” they usually didn’t know that somebody doing fee-based enterprise beholden solely to purchasers was giving recommendation whereas somebody promoting them merchandise, paid a fee by the issuer of the safety, was, due to this fact, not a fiduciary or giving them recommendation underneath the authorized definition.

This has largely resolved itself over the past decade as Regulation Greatest Curiosity (BI) has raised the usual of look after brokers. Many brokerages have gone extinct whereas the practitioners have reworked themselves into fee-only advisors. The recommendation aspect gained, the product gross sales aspect is slowly fading away with each passing yr. The rise of commission-free buying and selling within the late 2010’s was the ultimate nail in its coffin. You’d be hard-pressed to discover a respected agency that focuses on product gross sales nowadays (outdoors of insurance coverage). It’s just about over.

And to Betterment’s credit score, whereas they didn’t appear to grasp the distinction between fiduciary recommendation and the conflicted brokerages, a variety of smaller traders have been, the truth is, left with an absence of fine options. Dealer-dealers lobbied to retain the flexibility to promote high-cost merchandise to the general public utilizing the argument that accounts of a sure measurement weren’t value servicing in the event that they couldn’t be f***ed over. They didn’t put it that manner, after all, however that was the argument (see: The Most Horrendous Lie on Wall Road, my piece at Fortune Journal from 2016). They laundered this angle underneath the guise of “we’re offering extra alternative” to the general public and letting folks resolve for themselves what’s of their finest curiosity. However after all, unsophisticated traders had completely no concept what was of their finest curiosity. Simply take a look at how they vote. Info asymmetry was how brokers made most of their cash. After which they offered these smaller purchasers entire life insurance policies rather than index funds, personal REITs rather than bonds, closed-end funds rather than ETFs, unit funding trusts rather than mutual funds, and so forth.

So should you have been an investor whose portfolio didn’t meet the standard wealth administration minimal of $1 million, there was probability the one companies keen to talk with you have been those that might promote you merchandise for embedded concessions and commerce securities for you on a fee foundation. Folks with over 1,000,000 {dollars}, then again, had fee-only fiduciaries tripping over themselves to construct them monetary plans and managed accounts with affordable prices.

The Revolution

This was earlier than the appearance of a variety of the applied sciences we’ve got now. Betterment was answerable for ushering in a world with nice options for the mass prosperous, sub-$1 million retail investor. They’d an awesome concept even when I disliked the disingenuous manner they have been selling it. And it labored. On the time of their submit, Betterment had about $50 million in belongings underneath administration, with common account sizes of $2500. At present, simply over a decade later, they handle over $32 billion. Extra importantly, the revolution they helped spark has put a variety of the unhealthy options out of fee (pun supposed) and has impressed a technology of like-minded startups to construct one thing higher than what used to exist.

A few of the largest brokerages within the {industry} used the thought to construct robo-advisory platforms of their very own, most notably Schwab’s Clever Portfolios and Vanguard’s Digital Advisor. Merrill Lynch remade their name heart into Merrill Edge, chopping the price of cold-callers, reams of paperwork and 1-800 numbers with a extra fashionable e mail + digital consumer interface. Merrill Edge doesn’t invoice itself as “robo-advice” per se and does employees itself with human advisors, however in actuality it’s most likely the most important robo-advisor on the earth with over $320 billion in belongings underneath administration. Vanguard’s service oversees $130 billion and Schwab’s product is claimed to handle roughly $70 billion (I google-searched these figures, they won’t be completely updated). It’s vital to level out that that is cash these companies would most likely be managing anyway. Turning name heart operations into digital recommendation platforms was extra an evolution than a revolution, however both manner the purchasers are getting one thing higher than simply having a brokerage account with all types of random merchandise thrown into it, which is what the {industry} used to appear to be. Now there’s cohesion. Portfolios being pushed by investor objectives. It’s not attractive or technologically superior – these accounts principally resemble an unbundled lifecycle mutual fund with some tax loss harvesting advantages – however it works. Affordable asset allocation delivered – at scale – to thousands and thousands of unsophisticated individuals who, a technology prior, would have been both utterly ignored or ravaged by unscrupulous salesmonsters.

The Creation of Liftoff

A humorous factor occurred since that pig submit. We made buddies with the Betterment guys and began doing enterprise with them.

About ten years in the past, my agency determined to launch a robo-advisor of our personal simply to see if we might provide a greater different to our followers who had lower than 1,000,000 bucks. Previous to launching, we have been turning down lots of of people that had emailed us for assist, sending them out into the wild to be mauled by wolves. “Sorry, you don’t meet our minimal” was a horrible reply, particularly contemplating that these weren’t simply random folks reaching out, these have been our readers. Our followers. It felt terrible, however we merely didn’t have the sources or employees to take these traders on. We launched a platform referred to as Liftoff to service these purchasers and had been bouncing backwards and forwards between know-how suppliers for just a few years earlier than we lastly acquired it proper. In 2019 we moved the platform over to Betterment’s Betterment for Advisors, working with Jon Stein and our good friend Dan Egan to lastly understand the total potential of our providing.

You may watch the video of our launch, reside from Betterment headquarters beneath:

At present, we service about 500 purchasers at Liftoff with an mixture account worth of roughly $44 million. The common account measurement is $93,000 versus a mean of $77,000 as of the top of 2022. These 500 purchasers wouldn’t have certified underneath the industry-standard million greenback minimal. With out Liftoff, we’d by no means have gotten to know these folks or have been in a position to assist them. Now, due to Betterment’s underlying know-how, we’ve got an answer that may assist. These households symbolize the way forward for our apply. We’ve a number of licensed monetary planners working with them on the whole lot from inheritances to annual retirement contributions to goal-setting to tax points. Liftoff purchasers get common updates on the standing of their portfolios, together with common e mail alerts detailing tax loss harvesting exercise and dividend funds. Now, $44 million may not sound like some huge cash to you, however for the thirty-something yr previous dad on our platform who’s managed to place away $50,000 regardless of the entire cost-of-living challenges in at this time’s financial system, that’s all the cash on the earth to him. And we deal with it as such.

Who is aware of the place these purchasers can be invested at this time if not for Liftoff? Now I do know that our followers who will not be but liquid millionaires are being taken care of and brought care of. It feels nice to have the ability to sort these phrases and I might be eternally grateful to Jon, Dan and the remainder of the staff there, together with Betterment’s present CEO, Sarah Levy. Sarah might be talking reside at this September’s Future Proof Competition they usually have been fantastic companions to us since day one. I wished to spend just a few traces clarifying this as a result of there have been just a few articles within the press speculating on our partnership. I don’t fault the reporters for asking these questions. We simply weren’t at liberty to debate these items as we accomplished our latest transaction – extra on that in a second.

Robo At present

Let’s spend a second discussing the place robo-advice is now to deliver this historical past full circle. To a big extent, robos have grow to be commoditized and the shopper acquisition prices have been the ache level for these corporations’ capability to scale. I believe everybody would acknowledge Betterment as being the {industry}’s chief and the corporate has had a variety of success in areas like constructing instruments for human monetary advisory companies in addition to Betterment for Enterprise, their a lot lauded 401(ok) platform. Wealthfront, one other early entrant, has additionally amassed roughly $30 billion in belongings, however the founder’s imaginative and prescient of a world with out human advisors has not precisely performed out. Actually, human monetary advisors are managing extra money than ever earlier than and symbolize one of many quickest rising segments throughout the complete monetary providers {industry}. Each main financial institution, brokerage and funding agency has instructed its traders that it sees wealth administration as being key to their future development, from JPMorgan to Goldman Sachs. Non-public fairness has been pouring into our house over the past ten years in a tidal flood of capital. RIAs throughout America have constructed billions and billions of {dollars} value of fairness worth by providing human-driven and administered recommendation. This growth exhibits no indicators of letting up any time quickly as 69 million boomers and 75 million millennials more and more select an individual or folks to assist them with among the hardest, most consequential selections they may ever must make of their lifetime.

Robo-advice as a class has discovered itself in competitors with present do-it-yourself options like on-line brokerage accounts. There is no such thing as a RIA founder in America at this time who sees robo-advice as a main and even secondary competitor. It’s a unique buyer and, most definitely, it’s a future buyer. Within the accumulation part, a youthful individual including to their accounts whereas specializing in beginning a household and a profession may be very nicely served by robo- or automated advisory providers. After which, when a life occasion occurs or the complexity of their state of affairs will increase, they exit and search for knowledgeable to assist out or take over.

The State of Recommendation

TurboTax didn’t eradicate the human accountant. Actually, there are most likely extra CPAs and enrolled brokers than ever earlier than. Monetary recommendation is not any completely different. Our enterprise is teeming with new entrants and, if something, there aren’t sufficient folks giving monetary recommendation to service all of the demand. Don’t take my phrase for it. Take a look at the statistics. The beneath information comes from Chip Roame’s keynote presentation finally month’s Tiburon CEO Summit in Boston, which I attended.

In 2015, wealth administration companies had $17.5 trillion underneath administration and as of the top of 2022 it’s $35.3 trillion. In seven years our {industry}’s belongings have doubled. No matter phrase is the other of “disruption” would absolutely be relevant right here. Between 2012 and 2022, Tiburon finds, the expansion in {industry} belongings has been 30% attributable to natural development (which means not from market results).

Registered Funding Advisor companies had internet inflows of $342 billion in 2022. In 2021 it reached an all-time excessive of $411 billion. Evaluate that to 2012, the yr the robo-advisors got here on the scene. Ten years in the past RIAs had solely taken in $43 billion. To be 10xing the annual influx quantity a decade after the appearance of robo-advice makes it clear that the {industry} hasn’t been phased within the least. You may launch one other Sofi or one other Private Capital yearly, purchase up all of the naming rights to all of the soccer stadiums within the NFL and none of that can change the truth that wealthy folks need to be suggested, not emailed. Asset allocation isn’t recommendation. Recommendation is recommendation.

A thousand would-be disruptors have come and gone, their enterprise backers too, and the established order has solely gotten standing quo-ier. The primary recorded story of a monetary advisor in human historical past was Joseph, advising Egypt’s Pharaoh by a fourteen yr stretch of feast and famine. Joseph was paid an AUM-based payment within the type of a share of the farmland. Look it up.

Whither Wealthfront?

In a twist of irony extra scrumptious than a thousand Cinnabons, the aforementioned Wealthfront really tried to promote itself to none aside from the aggressively human advisor-driven UBS Wealth Administration final yr. No firm on earth higher encapsulates the antithesis of Wealthfront’s imaginative and prescient for the long run than UBS. It will be like if a sequence of yoga studios tried to promote itself to Arby’s. And, irony on prime of irony, the deal really fell aside, with UBS sustaining a small fairness stake whereas strolling away from the acquisition. Nobody is aware of why. It’s been speculated that shareholders have been sad with the acquisition worth ($1.4 billion) as tech valuations broadly collapsed. There have been rumors of banking regulators taking problem with the transaction – most likely nonsense, take a look at how relieved everybody was when UBS was prepared to soak up its largest competitor, Credit score Suisse, six months later. Regardless of the purpose, it didn’t seem that UBS was significantly devoted to creating it work. Chilly toes is pretty much as good an evidence as any. Wealthfront is now the robo-advisor decided to dislodge human advisors, having tried and did not promote itself to maybe the world’s largest human advisory agency. “Your revolution is over, Mr. Lebowski. Condolences.”

The factor most of the first-generation robo-advisor companies acquired backwards was the worth proposition. This was as a result of not one of the first-gen founders have been monetary advisors. They have been technologists and consultants. They thought the worth was within the portfolio administration, fund choice and the consumer interface. That stuff is vital – can’t have horrible efficiency and clunky web sites – however it’s not the massive factor.

The large factor was all the time and can all the time be the connection. Anybody who’s spent any time in our enterprise might have instructed them that. Ric Edelman tried, in an on-stage debate with Adam Nash, Wealthfront’s former CEO. Ric stated that a variety of monetary advisors wouldn’t be right here in just a few years. Then he turned to Adam and stated “I’m not so certain you’ll be right here both.” Edelman Monetary Engines is each the most important RIA in America in addition to one of many largest automated recommendation platforms. He made the wager that the long run can be a mixture of individuals and tech. He gained his wager, to the tune of $291 billion in belongings underneath administration.

How do we all know that relationships are the massive factor? Effectively, why do you suppose hundreds of advisors are in a position to transfer companies yearly and convey their purchasers with them? Higher tech? LOL. No one chooses an advisor or a agency on that foundation. Know-how will get commoditized. If a device is helpful, finally everybody else could have entry to it or some approximation. Know-how flattens the taking part in subject because it proliferates. Nonetheless, shut relationships with folks we like or belief by definition can’t be commoditized. How many individuals in your life do you really like? What number of do you really consider in? What number of are you able to belief to be there when it issues? Not lots of. In all probability not even dozens. Like, 5? Six? Now think about the belief constructed between an investor and her monetary advisor having been by the shared expertise of a large bear market collectively. Robust instances construct bonds between folks. Now think about making an attempt to pry that relationship aside with a TV industrial or a banner advert.

A Comedic Interlude

One thing else value mentioning: The failure of the advertising. Within the early going, there was this intuition on the a part of the robo-advisors to play up the robo side of what they have been doing. The adverts and imagery had all types of cybernetic connotations and goofy-looking humanoid automatons working their lacquered white fingers throughout keyboards. It was by no means cool. And even when it was, no person needs something to do with that. The common investor couldn’t consider something much less interesting than entrusting their financial savings to an Isaac Asimov novel.

Some chosen samples of this period’s iconongraphy beneath (captions are mine):

Look, it’s the Wolf of Wall Server!

Cash coming out of a laptop computer? Is that this crypto?

Nice assembly, guys. Need us to plug you again into your charger now?

I believe it’s shopping for NVDA

Okay, this one’s awfully…anatomical

Truthfully what the hell have been these folks pondering?

No Contest

Betterment properly steered away from this form of aesthetic and performed up the humanity of its purchasers as a substitute. Private Capital, since acquired, was the primary of the robo-advisors to function its human monetary planning ingredient as a part of the package deal. This was the appropriate angle. Those that went full Wall-E World didn’t fare as nicely. Regardless, life went on for the remainder of the enterprise, because the robo tide ebbed from the entrance web page and washed out to the margins. I most likely spoke on fifteen or twenty panels about robo recommendation between 2013 and 2018 at varied monetary advisor conferences. Then they simply form of stopped having them. The {industry} trades stopped writing about them. Why was robo out of the blue previous information? As a result of the idea acquired commoditized, the menace was neutralized and readers misplaced curiosity. Information is a enterprise. When folks cease clicking on a subject, editors cease assigning tales on that subject. Reporters focus elsewhere.

The RIA house has been so profitable, regardless of this imagined problem from robo-advice, that we now have over 258 companies in our {industry} that handle over $10 billion in belongings. In 2011, there have been simply ten. The 6% of RIAs which have grown bigger than $1 billion captured 76% of all internet flows final yr. The opposite 94% of RIAs, who’re managing lower than $1 billion pulled within the different 24% of internet flows. Energy legal guidelines nonetheless apply, however there isn’t any query that RIAs have risen to the problem and never solely survived, however thrived.

The Future

So what comes subsequent? In all probability growing human advisor utilization of robo-advice instruments and techniques. Once more, image accountants utilizing TurboTax inside their very own practices to serve extra purchasers extra effectively. They’re augmented, not disintermediated.

One different factor that’s going to be humorous – they’re going to take all of the previous articles from ten years in the past and re-publish them however swap out the time period Robo-advisor and exchange it with AI. I might write considered one of these articles with my eyes closed – a headline teasing what share of monetary advisors could lose their jobs by 2030, a Gartner research, a quote from Kitces, a vignette about such-and-such startup elevating cash from Point72 Capital, a point out of no matter Envestnet is constructing, a cautionary concluding paragraph about the way it’s too quickly to inform. The same old. I’ll have a extra in depth take of my very own about how AI will have an effect on the {industry} however it’s too early for me to write down something of worth. We’re taking part in with among the innovative stuff that individuals invite us to strive however it’s not even the primary inning.

Shifting on…

The Boomer technology has roughly $61.4 trillion in investable belongings plus one other $29.4 trillion in retirement plan belongings, which provides as much as a complete of $90.8 trillion. A few of that might be liquidated to reside on, most might be transferred. Take note the Boomers nonetheless have one other $50.3 trillion in private belongings like homes and property, to not point out a further $16.9 trillion in small enterprise possession valuation. They couldn’t spend this down within the time they’ve left in the event that they tried. And if you recognize something about advising Boomer purchasers, you recognize they will’t bear to spend their very own cash on themselves. It’s really one of many largest challenges advisors face at this time.

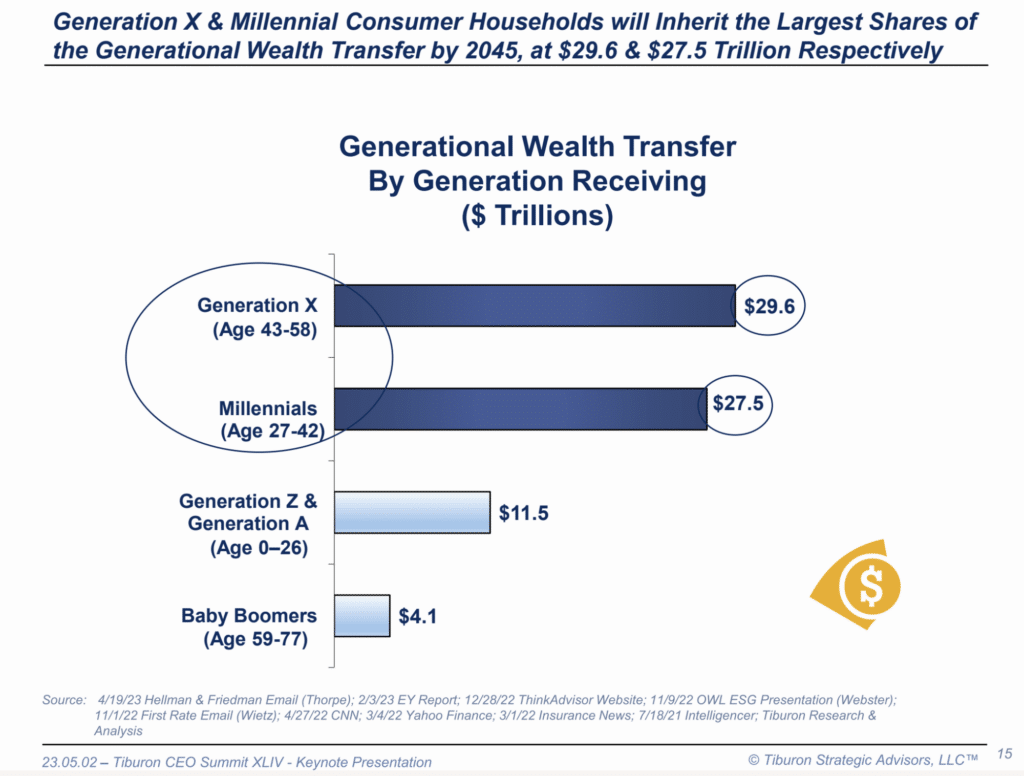

(courtesy of Tiburon Analysis, used with out permission however they’ll forgive me)

Whereas Boomers have the lion’s share of the belongings our {industry} manages, issues are altering. The {industry} is altering to adapt. The cash is transferring and RIAs are transferring to higher serve the brand new clientele.

Most of this cash will will proceed to be managed because it passes all the way down to the subsequent generations – folks aged 27 to 58 who’re inheriting from their mother and father and coming into their very own peak incomes and investing years concurrently. Tiburon pegs this inheritance as being on the order of $29.6 trillion and $27.5 trillion for the Gen Xers and Millennials, respectively, by 2045. It’s not going to occur, it already is.

We’ve been constructing our agency to organize for this for the final ten years. 1,000,000 hours spent creating helpful, useful content material and constructing a military of followers who at the moment are on the receiving finish of this ocean of cash. The wager we’ve made is that they’re going to flip to folks they know and belief when the time comes. That wager pays every time we get an e mail to the impact of “My dad doesn’t know what to do along with his cash so I’d wish to arrange a gathering with you guys to speak to him about it.” Or “My mother wants your assist, she doesn’t have anybody she will be able to belief to speak to.” In more moderen years, these emails have sounded extra alongside the traces of “I’m making some huge cash however my hours on the legislation agency are loopy and I’ve no time to get organized and nobody to ask questions.” We’ve been paddling in entrance of this wave for a decade and now we’re beginning to get up on the board.

There may be one other RIA agency in America higher positioned for this, however I couldn’t guess who that may be. I believe it’s us. Constructing that belief with the viewers is my life’s work. Each day somebody in our orbit is experiencing the loss of life of a liked one, a promotion at work, a enterprise sale, a wedding, a divorce, a toddler born or another main life occasion. We’re standing by prepared to assist they usually comprehend it. We is not going to ship them away. We is not going to allow them to down. There is no such thing as a query or state of affairs too onerous for us to tackle. And now there isn’t any capability restraint both.

Because of know-how, our readers, listeners, viewers, followers and buddies don’t have to attend till they’ve 1,000,000 {dollars}. We’re prepared to satisfy folks the place they’re, proper now, of their second of want.

Which brings me to my remaining level (thanks for sticking with me this lengthy). This week, proper right here at The Reformed Dealer, I might be unveiling what I think about to be the end result of the whole lot I’ve realized concerning the intersection of know-how, monetary planning and asset administration. There have been a variety of questions on our acquisition of Future Advisor from BlackRock, what our intentions are, whom we might be serving and the way. I’ll reply all of them now that the transaction has closed and our new service is prepared for the general public. I actually hope you want what we’ve been engaged on.

See you then.