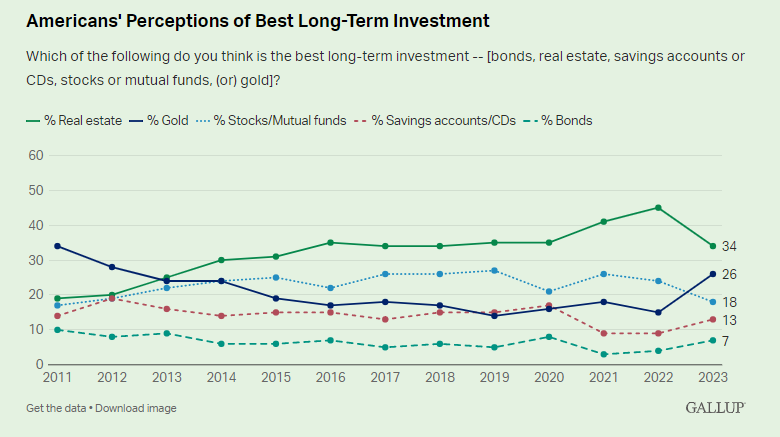

Every year Gallup performs a survey that asks a bunch of People what the perfect long-term funding is among the many following choices:

- Shares

- Bonds

- Money

- Gold

- Actual property

These are the newest outcomes:

Actual property has been on the high of the charts for over a decade at this level however it noticed a giant drop from 2022 to 2023.

Following the 2022 bear market shares fell to 3rd place behind gold. Apparently sufficient, gold was within the pole place in 2011:

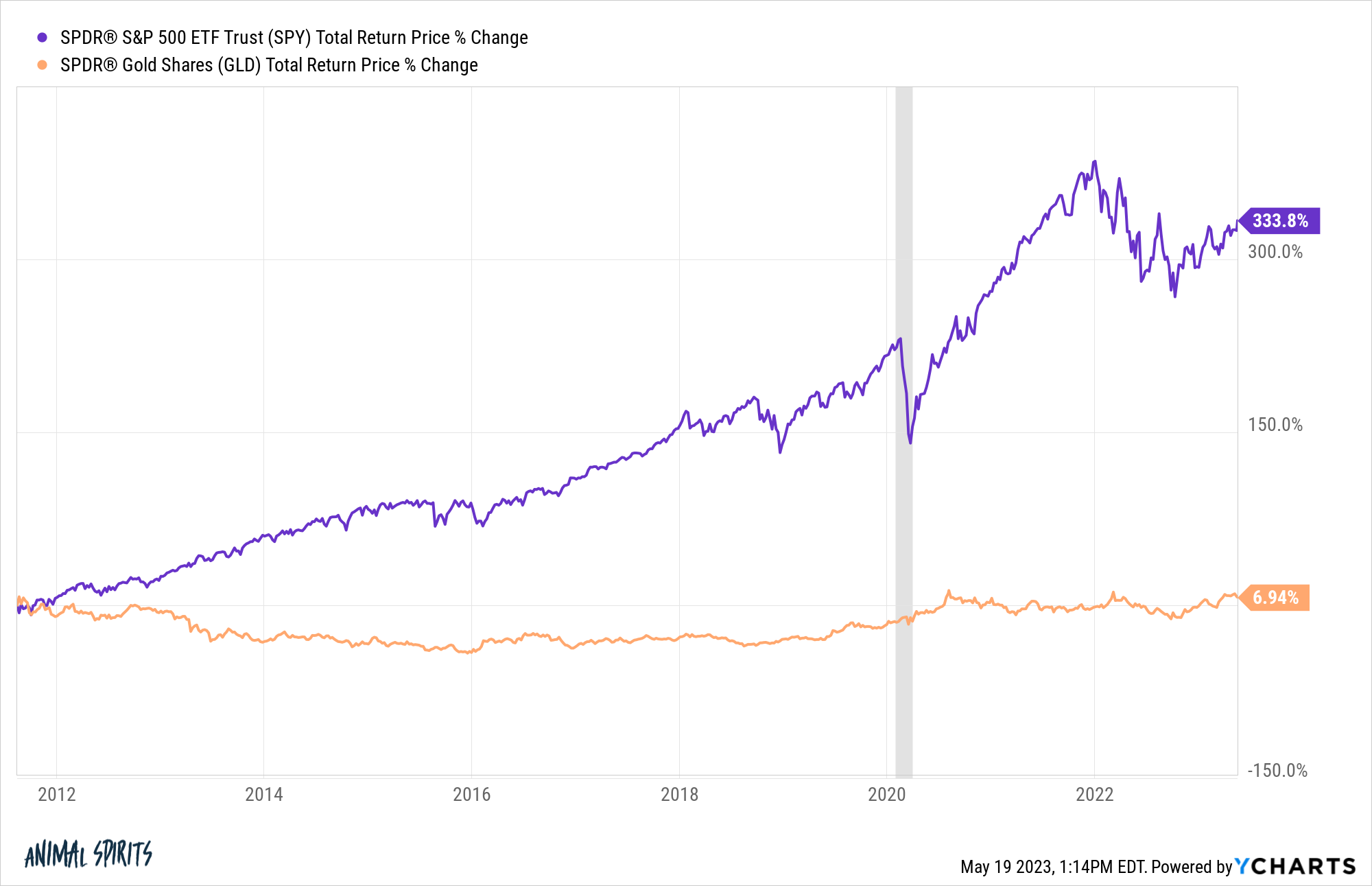

This was a great contrarian indicator if there ever was one since gold peaked the exact same month this survey was launched. The yellow metallic has mainly gone nowhere ever since:

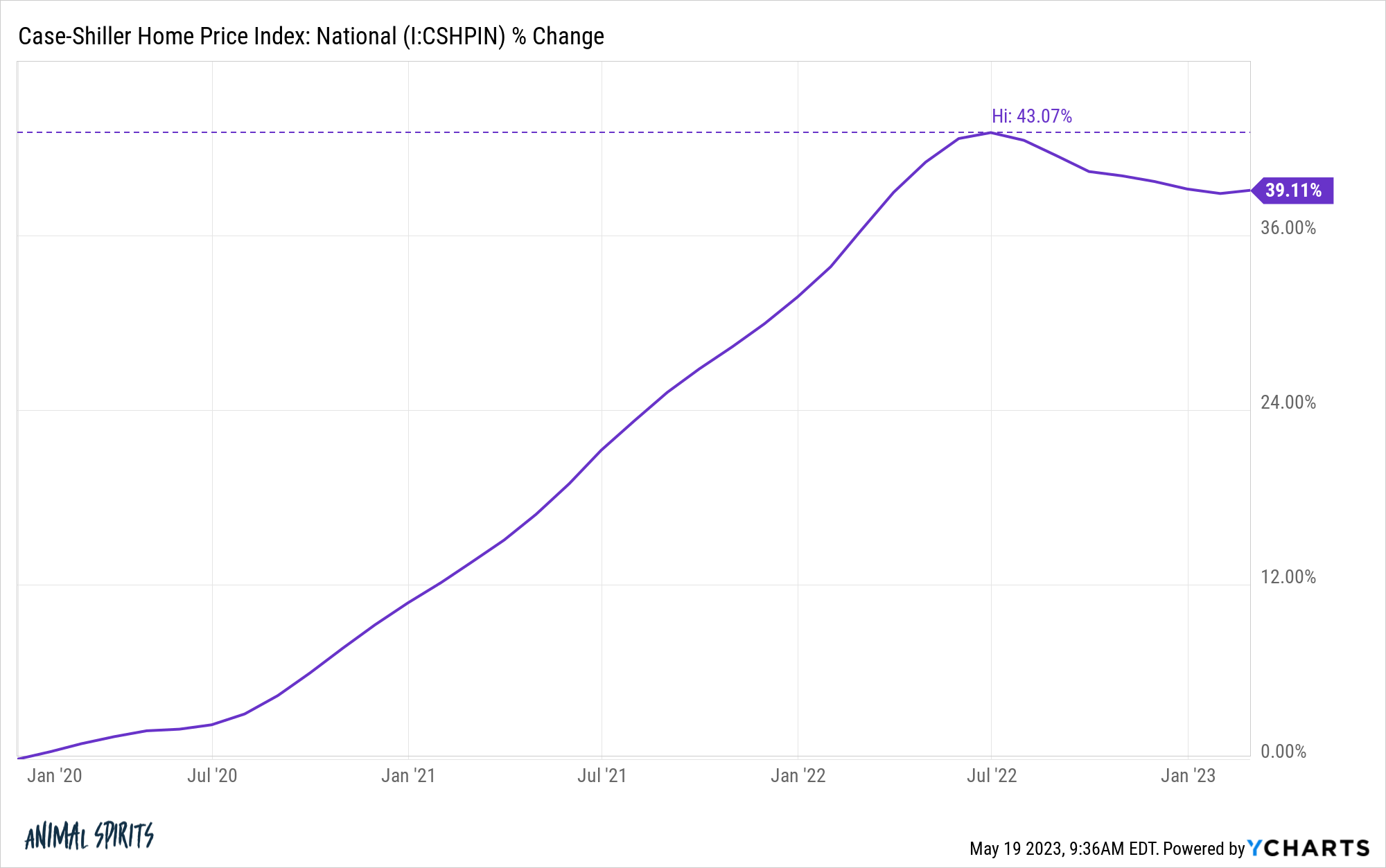

With actual property within the high spot will there be an analogous comeuppance within the years forward?

With affordability ranges off the charts and the truth that we mainly pulled ahead a decade’s price of positive factors after which some in 3 years, it could make sense.

I don’t know what future home worth returns will appear like however it’s exhausting to see large positive factors from present ranges of costs, mortgage charges and affordability ranges.

It does make sense that so many individuals assume actual property could be the perfect long-run funding alternative.

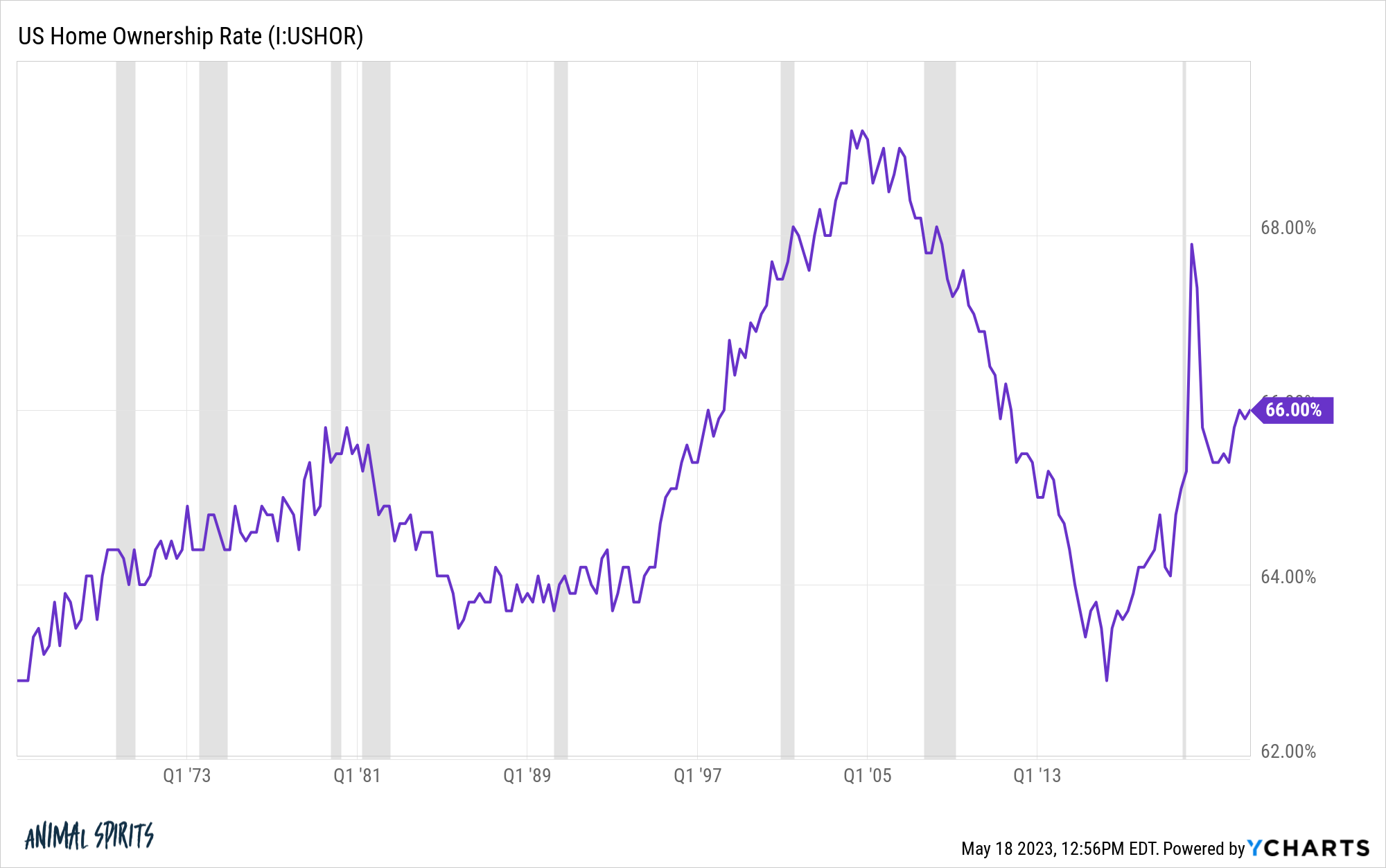

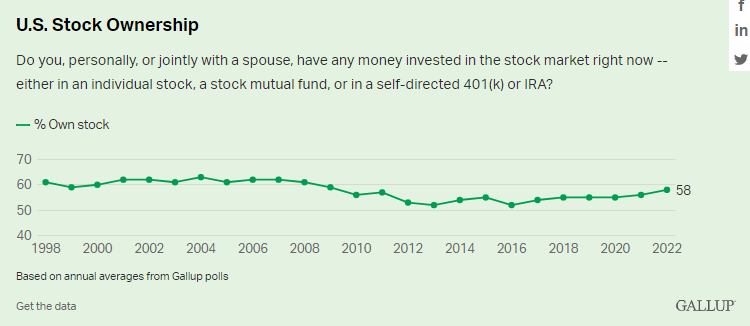

The house possession fee on this nation is larger than the inventory possession fee:

We’re all informed from an early age {that a} home is the largest funding you can also make. Proudly owning a house is a type of compelled financial savings so it additionally is sensible that it turns into the greatest monetary asset for many People.

Plus everybody has a guardian or relative who purchased a home for like $50k within the Seventies or Nineteen Eighties that’s now price $500k.

Housing is probably the most private of all belongings since you’ll be able to’t reside in your shares of shares.

The most important downside with taking a look at a home as a monetary asset is that it’s additionally a type of consumption. You could have property taxes, insurance coverage, upkeep, reworking, maintenance, landscaping and the entire different issues it’s a must to purchase as a house owner to maintain it useful.

There may be additionally leverage concerned since most of us can’t afford to purchase a home with money. This sometimes works in your favor however it’s price mentioning. It could appear loopy if everybody put 5-20% down on their inventory investments and borrowed the remainder however that’s precisely what occurs with most residence purchases.1

The illiquidity concerned within the housing is usually a professional or con relying on the way you have a look at it.

You possibly can’t spend your home so the inherent illiquidity is usually a draw back should you want the money for another use. However the illiquidity of the housing market is a optimistic from the standpoint of forcing folks to carry a monetary asset over the lengthy haul.

You should buy and promote a home in a brief time period however it’s not financially useful to take action contemplating the entire frictions concerned within the course of (realtor charges, shifting prices, closing prices, inspections, and so forth.).

It’s exhausting to imagine shares by no means received larger on this record in the course of the 2010s bull market however traders have constructed a sturdy wall of fear concerning the inventory market ever because the Nice Monetary Disaster.

I’m not so certain you should use a majority of these surveys for contrarian indicators like you would previously. Positive, traders will all the time chase efficiency however the timing is all the time what will get you on these items.

The excellent news is you don’t have to choose only one asset class to spend money on over the long-term. You possibly can personal shares, bonds, money, gold, actual property or the rest you need in a diversified method.

And most traders do personal a house together with a diversified portfolio of extra liquid monetary belongings.

Nobody ever forces you to place your whole eggs in a single basket like they do in a survey.

I desire to stay diversified as a result of I don’t know what’s going to occur sooner or later with any of those asset lessons.

Michael and I talked about the perfect long-term funding and extra on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Why Housing is Extra Necessary Than the Inventory Market

Now right here’s what I’ve been studying currently:

- You will be profitable with out being unbearable (Younger Cash)

- How local weather change and demographics may maintain inflation excessive for years (Vox)

- Ben Graham noticed that he was wounded (Past Ben Graham)

- How a lot does it truly value to personal a house? (The Lengthy Sport)

- ChatGPT isn’t any risk to actual advisors (Nerd’s Eye View)

- The best wealth switch in historical past is right here (NYT)

1Clearly, inventory costs are extra unstable than residence costs however you get the thought.