The 401(ok)—the commonest method People save for his or her retirement years—is simply just a little over 4 many years previous. Established by the Income Act of 1978, the 401(ok) grew to become a approach to defer compensation tax-free beginning in January 1980. Since then, retirement has by no means been the identical, for higher or worse.

Right now, taking part in 401(ok) plans is nearly computerized for anybody with a company job. It’s the first method to save cash to your golden years (since pensions are more and more uncommon outdoors sure public sector fields), and if there’s an organization match (that means your employer contributes cash to your account as properly) it’s free cash—why wouldn’t you wish to make the most of that?

However not all 401(ok) plans are created equal, and blindly taking part in a single simply because it’s there isn’t all the time one of the best plan of action. If you happen to’ve been invited to take part in a 401(ok) plan, right here’s what to search for to find out if it’s the precise resolution.

The charges are excessive

Many individuals are stunned to find that 401(ok)’s can embody quite a lot of charges. Most of them are completely respectable, in keeping with Mark Weber, tax director at CliftonLarsonAllen, a CPA and monetary advisor. “A typical plan can have a number of prices which might be required,” he notes. “Direct prices of the investments, prices for the file keeper ([who] maintains the data for all individuals to allow them to decide the worth of their accounts), and the prices of the platform. The 401K supplier may pay a fee to a gross sales consultant, however this could come out of their charges, not the funding returns.”

Moreover, most 401(ok) plans should supply investor training (these annual or biannual seminars many workers attend to study their funding and different plan choices) and cling to quite a lot of compliance guidelines, all of which must be paid for. In different phrases, a 401(ok) will be an costly profit.

Tips on how to know when a 401(ok)‘s charges are too excessive

So how excessive is just too excessive for 401(ok) charges? A great rule of thumb is so as to add up all of the charges listed in your statements or the plan’s web site. In the event that they quantity to greater than 1.5%, investing the plan may not be the precise transfer.

Andifferent factor to search for when evaluating a 401(ok) plan’s charges is what’s often called income sharing. Most 401(ok) plans pay the required administration charges immediately—deducted out of your account in a clear method. Income sharing is a type of oblique fee culled paid by the plan investments, which makes them so much tougher to quantify—and so they develop with the scale of your account, which suggests they will change into an enormous drain in your retirement financial savings over time.

The plan provides no flexibility

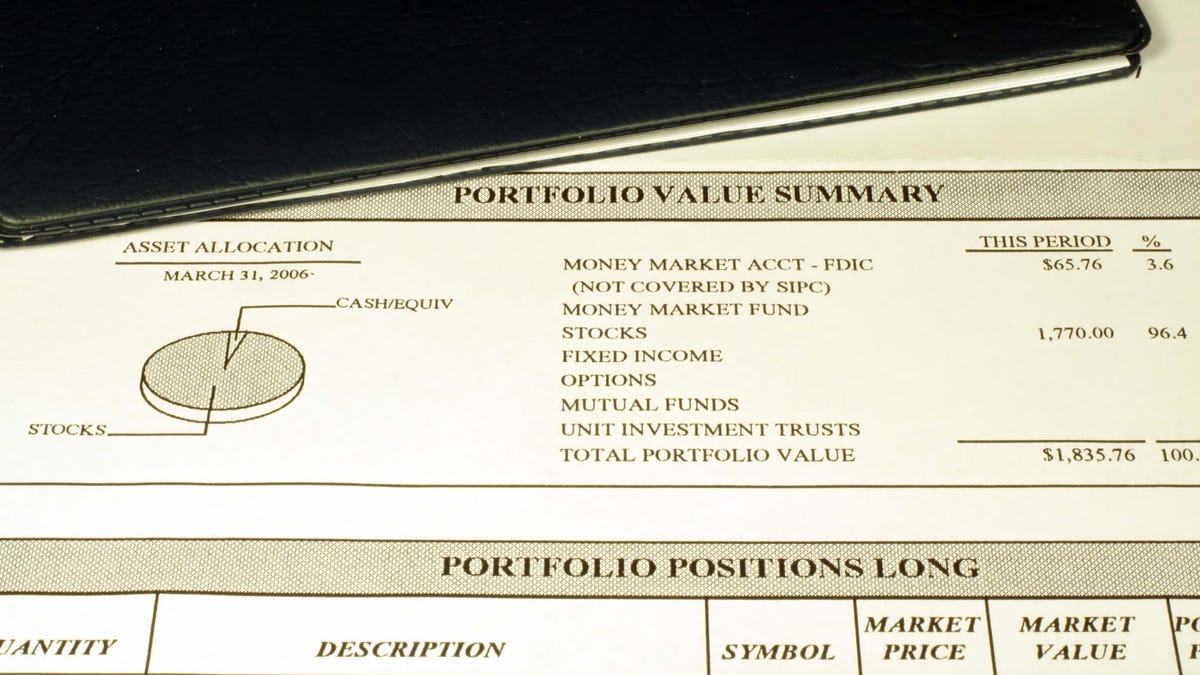

A 401(ok) plan places your cash in a tax-deferred method in a variety of investments—and the extra decisions you will have, the higher. “You must take a look at the fund decisions to find out if there are ample decisions when it comes to asset allocation and value,” notes Weber. “A great 401k can have a number of fairness funds masking many asset lessons (giant cap, mid cap, small cap, worldwide, rising markets, and so forth.) in addition to mounted revenue (authorities bonds, company bonds, rising market bonds, and so forth.). The plan would sometimes even have a cash market-type alternative and presumably some age-based funds—for instance, a retirement 2030 fund.”

Most 401(ok) plans are pretty restricted within the funding choices they provide. Extra choices is healthier, however on common there are a few dozen decisions. In case your employer’s plan solely has a handful of funding choices (perhaps as few as three), it may not be price your time.

The corporate match isn’t nice

An employer match is without doubt one of the most respected facets of the standard 401(ok) plan. The specifics of an employer match components fluctuate from plan to plan, however they’re sometimes expressed as a proportion of your annual revenue and your private contribution. For instance, your employer may supply a 100% match as much as 6% of your wage, that means in case you contribute 6% to your 401(ok) your employer will match that quantity. These formulation can vary from very beneficiant to very not beneficiant—however irrespective of how giant or small the provided match is, in case you’re going to take part within the plan you need to seize it, as a result of it’s free cash.

In case your employer provides a miserly match or no match in any respect, that doesn’t robotically imply your 401(ok) isn’t price investing in, nevertheless it’s an enormous issue to think about. If there’s no match and there are different issues—excessive charges, few funding decisions—which may point out this specific plan may not be price taking part in.

There are lengthy eligibility delays or vesting schedules

Two remaining facets of your 401(ok) plan to take a look at are the eligibility and vesting intervals. In case your employer trumpets a 401(ok) profit however you’re not eligible to take part for an unreasonable time frame—a yr or extra—that’s an indication you may have to take your retirement financial savings into your personal palms, a minimum of briefly.

One thing else to search for is the size of the vesting interval. When an employer matches your contributions to a 401(ok), that matching cash just isn’t yours instantly. There’s sometimes a vesting schedule that slowly offers you full possession over these funds, sometimes tied to the size of your employment. Frequent vesting intervals will be wherever from 2 to 4 years, which suggests in case you depart the corporate earlier than you’ve labored there for a minimum of that lengthy, you don’t hold the corporate match.

Clearly, a 401(ok) plan with no vesting interval in any respect—that means all the cash is yours from day one—is greatest. But when there’s a vesting interval, ensure it isn’t unreasonably lengthy.

Alternate options to your organization’s 401(ok)

So what are you able to do in case your employer provides you a 401(ok) that doesn’t appear like a great funding? The excellent news is, you will have some choices.

“If you happen to resolve a plan just isn’t enticing as a result of perhaps it has poor funding decisions, excessive prices, or no employer match, you’ll be able to contemplate saving by yourself,” suggests Weber. “This may be finished by an IRA or a Roth IRA. A standard IRA will be tax deductible relying on a wide range of components. If not, you’ll be able to all the time contribute on a non-deductible foundation.”

Remember that you’ll be able to contribute much more to a 401(ok) than an IRA; the 2023 limits are $22,500 and $6,500, respectively (there may be totally different limits relying in your age and different circumstances), so even a mediocre 401(ok) may be the higher alternative. But when your 401(ok) really stinks, an IRA may be a greater long-term alternative.