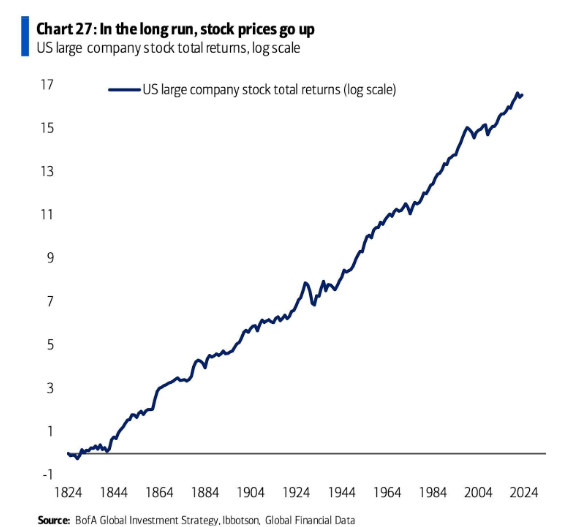

I noticed a chart this week from Financial institution of America that roughly sums up my whole funding philosophy:

In the long term, inventory costs go up.

I view the inventory market as a method to put money into innovation, income, progress and other people waking up within the morning trying to higher their present scenario.

Whereas I like the truth that this chart illustrates my long-term philosophy it’s a bit deceptive. Sure, the inventory market goes up over the long term however it might probably additionally get crushed within the quick run. That may be troublesome to see on a log chart with 200 years of knowledge.

The Nice Despair, 1987 crash and Nice Monetary Disaster seem like minor blips on this chart. And whereas each crash ultimately turns right into a blip on a long-term chart, they don’t really feel prefer it within the second.

this chart acquired me enthusiastic about what different visuals I’d use to assist clarify the inventory market in higher element. Listed here are a couple of extra:

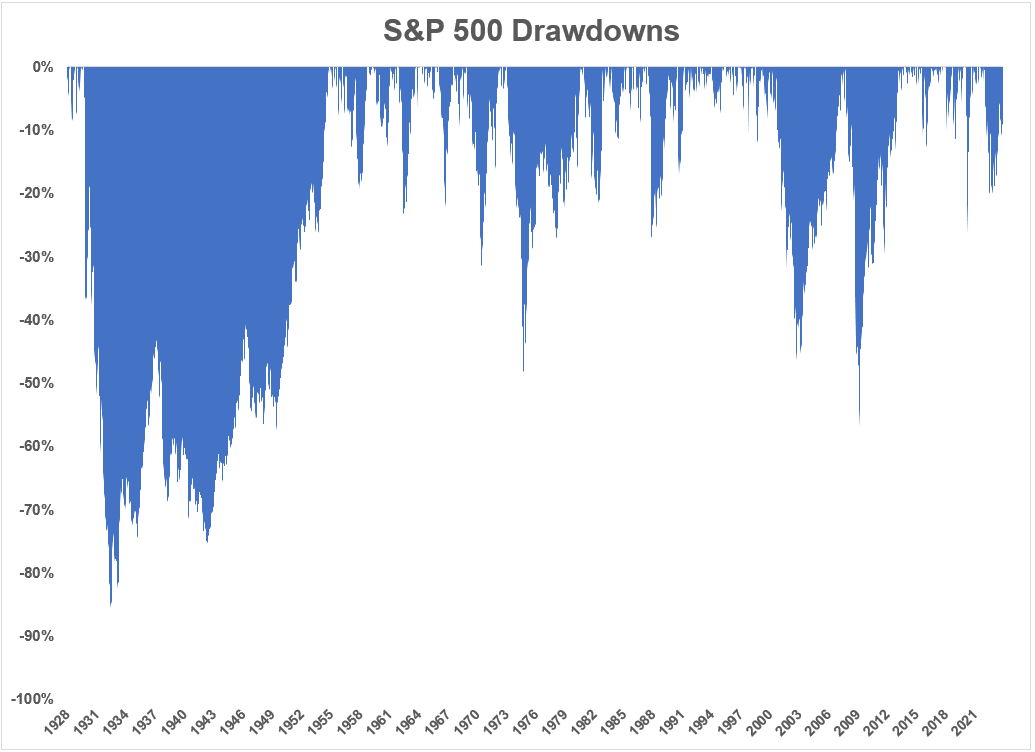

You may’t have a look at an up-and-to-the-right chart of the inventory market with out considering the drawdowns alongside the best way:

The Nice Despair was not a blip. It was a tsunami. Folks thought the 1987 crash was going to result in a melancholy. The monetary system was teetering getting ready to extinction in 2008.

Generally the inventory market crashes. Generally it takes years to make your a refund.

You don’t get a long-term chart of shares that strikes up over time with out getting your face ripped off from time to time. In case you can’t survive the short-term drawdowns, you don’t get to take part within the long-term positive factors.

That is true for market crashes, run-of-the-mill bear markets, horrible years and even good years within the inventory market.

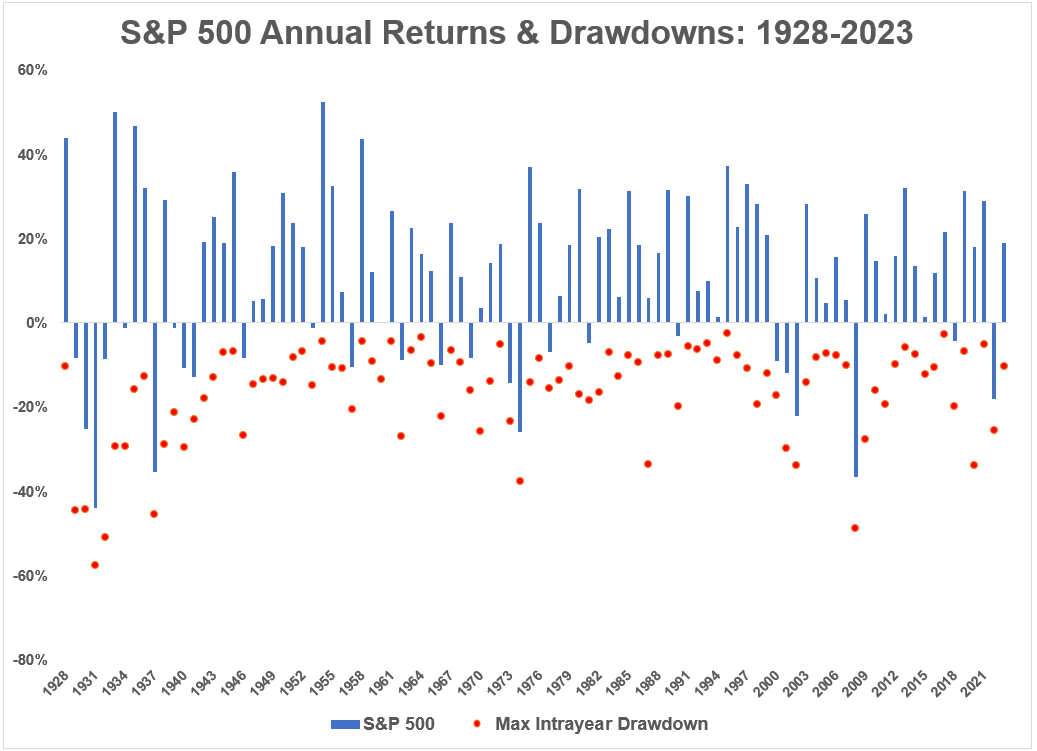

One other favourite chart of mine that helps clarify the inventory market is by trying on the annual returns matched up with intra-year drawdowns:

The common intrayear peak-to-trough drawdown since 1928 was -16.4%. Losses within the inventory market needs to be anticipated.

The opposite takeaway from this chart is that drawdowns occur even when the inventory market finishes the 12 months in constructive territory.

The common intrayear drawdown in years which have completed with a constructive return for the S&P 500 going again to 1928 is -11.6%.

So you must anticipate to expertise draw back volatility even when shares are in an uptrend.

In reality, the typical drawdown when the S&P 500 has been up by 20% or extra throughout a given 12 months is -11%. You’ve needed to dwell by way of a double-digit drawdown in roughly half of all 20%+ up years within the inventory market over the previous 95 years of returns.

Take into consideration that — to get to twenty% or extra you must dwell by way of a correction in half of all years.

The opposite stunning stat right here is the sheer quantity of 20%+ returns you see within the inventory market in a given 12 months.

In 34 of the previous 95 years, the U.S. inventory market has completed the 12 months with positive factors of 20% or extra. That’s a higher proportion of years (36%) than the variety of years that end with a loss (27%).

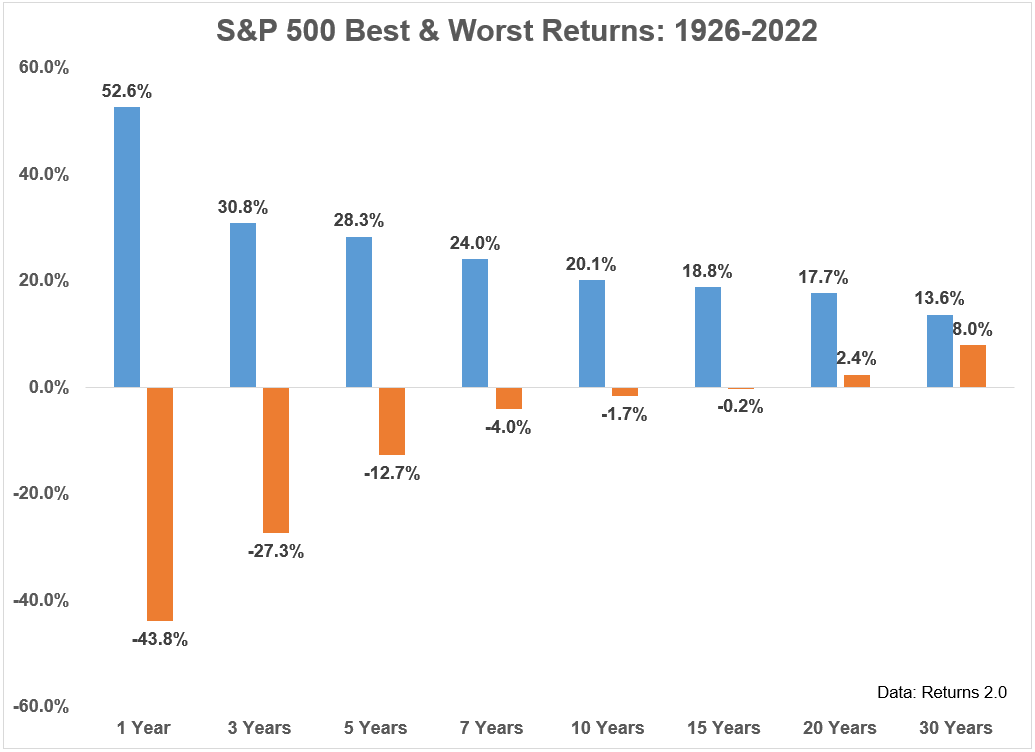

In fact, positive factors or losses in anybody 12 months are meaningless. All clever buyers know the one time horizon that actually issues is the long-term.

Historic numbers have proven the longer your time horizon, the higher your odds for fulfillment and the much less variable your vary of returns are:

There aren’t any ensures when investing within the inventory market.

Dangerous issues can and can occur.

However when you’ve got a time horizon that’s measured in a long time versus days, months or years, you’re going to be higher off than most buyers.

I can’t promise these relationships will proceed sooner or later.

However I’ve a tough time believing we’re going to have a future the place individuals aren’t innovating, making progress and waking up making an attempt to raised their station in life.

That’s the lifeblood of company income and that’s why I’m a believer within the shares for the long term.

Michael and I talked about long-term inventory market charts and rather more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

The Inventory Market is Not a On line casino

Now right here’s what I’ve been studying these days:

Books: