You might have sufficient to retire if you’re snug together with your state of affairs, professional says

Evaluations and proposals are unbiased and merchandise are independently chosen. Postmedia could earn an affiliate fee from purchases made by means of hyperlinks on this web page.

Article content material

By Julie Cazzin with Allan Norman

Commercial 2

Article content material

Q: My spouse Caroline is 61 years previous, retired from her job in southern Ontario final 12 months, and is now doing somewhat part-time work. I’m 63 and deliberate to retire from my consulting job on the finish of this 12 months, however I’m undecided I can afford to, given the prolonged downturn within the inventory markets. My registered retirement financial savings plan (RRSP) has $210,000 and my tax-free financial savings account (TFSA) has $61,000. I even have $180,000 in my company, however it will improve to $250,000 by year-end. My spouse has $200,000 in RRSPs and $50,000 in a TFSA in addition to an listed pension of $55,000 per 12 months. Our house is price about $1 million and our retirement revenue objective is about $90,000 per 12 months after tax. Can I nonetheless retire on the finish of this 12 months? — Simon and Caroline

Article content material

Article content material

Commercial 3

Article content material

FP Solutions: It appears there are a few points right here that require some pondering by means of: Do you come up with the money for to retire? And what’s one of the best ways to optimize your retirement revenue?

I hear your concern that retiring now could not be real looking with the markets being down. As , markets are going to maneuver up and down all through your retirement. Maybe it is a signal that even in the event you mathematically come up with the money for, you don’t have sufficient to offer you the reassurance to attract on that cash. Let’s work out the maths a part of the equation and see if that helps.

Simon, you might have three completely different accounts from which you’ll be able to draw an revenue or a mixture of incomes: a RRSP, TFSA and your funding firm (Investco), they usually all have completely different tax traits.

Commercial 4

Article content material

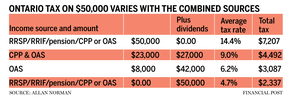

Within the accompanying desk, I’ve proven the typical tax fee and whole tax paid based mostly on $50,000 revenue from differing sources.

Wanting on the desk, you’ll be able to see the tax differential between non-eligible dividends and your different kinds of revenue. The query is, learn how to benefit from the tax variations? What in the event you delay Canada Pension Plan (CPP) and Previous Age Safety (OAS) to age 70 and draw $50,000 in dividends till you deplete the Investco investments and shut it up?

I don’t see an apparent purpose for delaying withdrawals out of your Investco. The prices of investing inside a company are an annual tax return and accounting charges. Plus, the taxable parts of curiosity, dividends and capital beneficial properties are taxed at about 50 per cent, though there’s a refund mechanism that returns a few of the tax when a dividend is paid out.

Commercial 5

Article content material

Deferring your OAS and CPP to age 70 means growing them by 36 per cent and about 42 per cent, respectively. Mixed, that’s about $33,000 in immediately’s {dollars} and $40,000 in precise {dollars} in comparison with a CPP plus OAS fee of $29,000 in precise {dollars} in the event you began them at age 65. Delaying CPP and OAS till age 70 is price about an additional $11,000 per 12 months listed for all times.

I do know some persons are involved that in the event that they die early, they could not acquire as a lot CPP or OAS and that’s true. Nevertheless, take into account, on this case, you’re saving $5,000 per 12 months in tax, and you’re winding down your Investco as soon as the investments are gone, saving you $1 to $2,000 in annual accounting charges.

The opposite purpose you could not like my suggestion of delaying your CPP and OAS is the concern of spending cash. It’s good to have some assured revenue and I’ve shoppers who inform me they don’t wish to draw a lot from their investments till their CPP and OAS begins. In your case, Caroline has a great base revenue for each of you, so this shouldn’t be a priority.

Commercial 6

Article content material

Now, what is going to mess up the suggestion of utilizing dividends first and delaying CPP and OAS is Caroline’s pension revenue. It’s seemingly that she’s going to break up a few of her pension revenue with you, supplying you with some taxable revenue. However it doesn’t matter since there’s nonetheless a bonus in drawing down out of your Investco first.

-

Ought to we use TFSA financial savings to repay our mortgage?

-

What are the subsequent steps after paying off scholar debt?

-

How ought to a brand new widow greatest arrange funds and investments?

After modelling this with prudent assumptions, I discovered that you should have no hassle retiring on the finish of this 12 months, and might spend $90,000 per 12 months after tax, to age 100, after which depart an property with an after-tax worth of about $4 million. Should you determine to start out CPP and OAS at age 65, meaning leaving an property worth of $3.8 million as a substitute. It’s whenever you and Caroline flip ages 83 and 81, respectively, when your web price is bigger by taking CPP and OAS at age 70 quite than 65.

Commercial 7

Article content material

Simon, you might have sufficient to retire if you’re snug together with your state of affairs. There are various methods to assemble retirement revenue and one of the best plan immediately is probably not one of the best plan when circumstances change. Don’t get too hung up on looking for probably the most optimum plan, however quite give attention to one which works and that you’re snug with.

Allan Norman offers fee-only licensed monetary planning companies by means of Atlantis Monetary Inc. and offers funding advisory companies by means of Aligned Capital Companions Inc., which is regulated by the Funding Business Regulatory Group of Canada. Allan could be reached at alnorman@atlantisfinancial.ca

_____________________________________________________________

Should you like this story, join the FP Investor Publication.

_____________________________________________________________

Feedback

Postmedia is dedicated to sustaining a full of life however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the positioning. We ask you to maintain your feedback related and respectful. Now we have enabled electronic mail notifications—you’ll now obtain an electronic mail in the event you obtain a reply to your remark, there’s an replace to a remark thread you comply with or if a consumer you comply with feedback. Go to our Neighborhood Tips for extra info and particulars on learn how to regulate your electronic mail settings.

Be part of the Dialog