Over the previous couple of years, I’ve actually given quite a lot of thought on learn how to be wealthy and develop wealth.

I’ve spoken with numerous millionaires and I’ve responded to over 20,000 reader feedback on this website. In every occasion, there are frequent themes which are both serving to the particular person develop wealth, or stopping the particular person from getting wealthy.

Being wealthy does not at all times imply having cash, however 90% of the time it does. Nonetheless, there are habits, behaviors, and “guidelines” basically, that may can help you get wealthy and develop wealth. It isn’t an in a single day course of. There are not any get wealthy fast schemes right here.

What you are going to learn under are my ten guidelines for learn how to get wealthy and develop wealth – over time.

Rule #1 – You Have To Earn It (Your Cash, Your Wealth)

If you wish to get wealthy and develop wealth, it’s a must to earn it. There isn’t any method you are going to get to what you need and the place you need to be should you’re not making an attempt to get there.

With cash, that is fairly darn easy. You need cash? Get on the market and begin making it. Get a job. Get a second job. Get a 3rd job. Begin facet hustling and doing facet initiatives to make more cash. Are you in school? Get a facet hustle in school to pay for varsity.

The underside line is, if you wish to develop wealth, it’s a must to earn revenue. There are doubtlessly 1000’s of the way to earn revenue, and you want to discover probably the most that you are able to do and get to work. There’s no one stopping you. There’s nothing in your life stopping you. The one roadblock to you incomes extra is your self.

So, cease with the justifications and concentrate on rule #1 to get began – it’s a must to earn your wealth.

Rule #2 – You Want To Save Till It Hurts

The second rule to getting wealthy is saving. It isn’t sufficient to only earn cash – it’s a must to put it aside as properly. In any other case you will simply find yourself like all variety of well-known celebrities who’ve gone bankrupt. Revenue alone simply does not reduce it. It’s a must to save.

However the true “rule” to get wealthy right here is saving till it hurts. How a lot is that? Effectively, should you’re not hurting but, it is not sufficient.

For instance, final 12 months, I saved roughly 40% of my after-tax revenue. Seems like loads, does not it? However there are many folks on the market which are saving extra – many over 50% of their revenue if no more.

The reality is, following Rule #1 makes this rule simpler. The extra revenue you might have, the simpler it’s to save lots of extra. However even on decrease incomes, you may nonetheless save. Listed below are 15 methods to save lots of an extra $500 per 30 days. Growth!

Rule #3 – You Want To Optimize Your Spending

The third rule to develop wealth is to optimize your spending. I am not one to guage your spending – spend extra or spend much less. My private perception is you can purchase no matter you need – simply earn more cash so you may afford it.

However it doesn’t matter what, actually rich folks optimize their spending. This implies they discover good offers – even when they will purchase a Ferrari, you may guess they searched round for a deal or negotiated the worth.

The trick right here is to easily spend correctly – particularly in your greatest bills. For most individuals, this may very well be automobiles, insurance coverage, healthcare, and extra. Too many individuals right here simply go for “no matter” or do not take into consideration what the alternatives actually are. Rich folks cease, assume, and elect a alternative that maximizes their advantages whereas minimizing their bills.

So, should you’re able to develop wealth, begin figuring out and optimizing your spending.

Rule #4 – You Should Put Your Cash To Work For You

The fourth rule is that it’s a must to put your cash to give you the results you want. Incomes it’s your a part of the heavy lifting. You want your cash and the ability of compound curiosity to work collectively over time to develop wealth for you.

What does this imply? It implies that you want to make investments. Why? As a result of the common inflation-adjusted return for the S&P500 for the final 60 years has been over 7%.

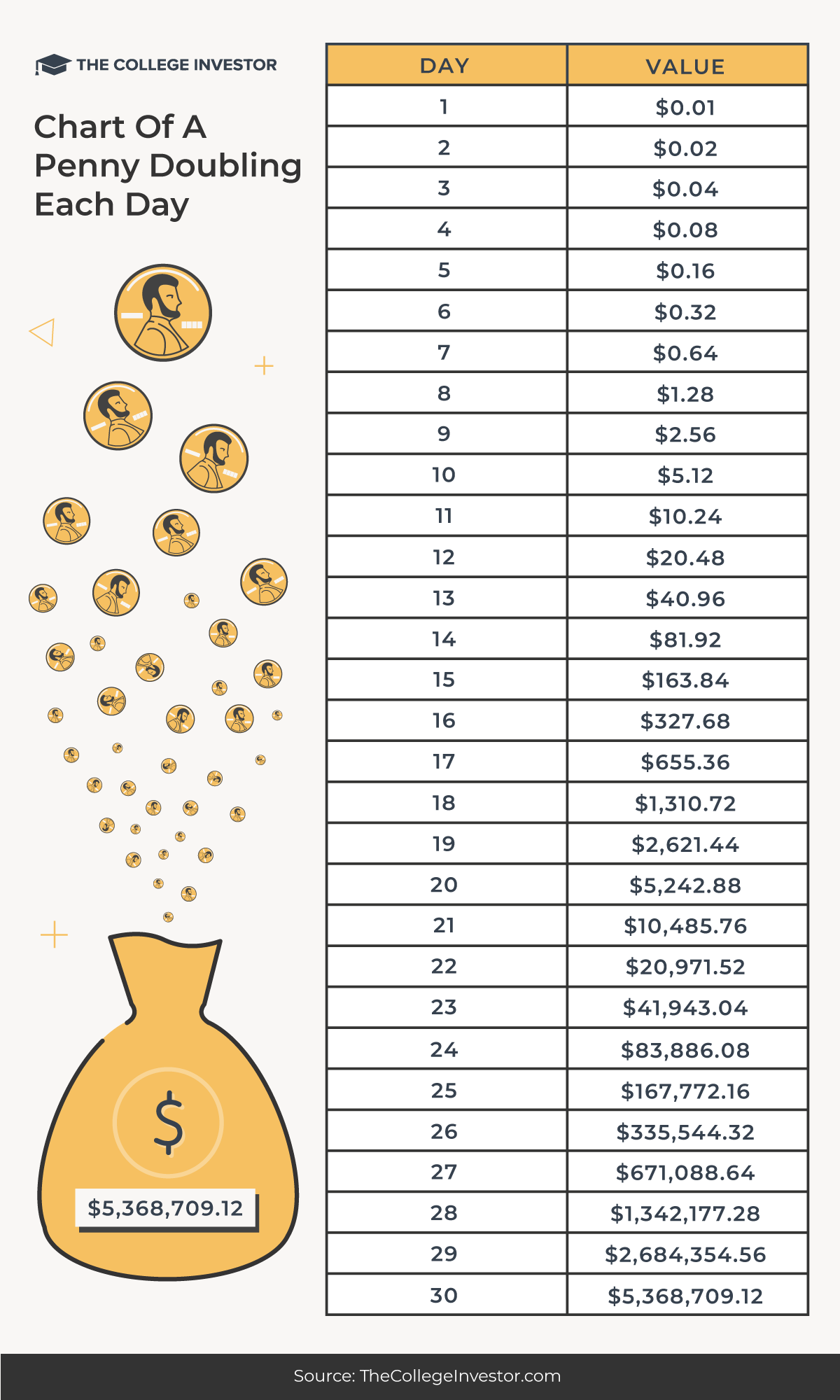

Have you ever heard the story about whether or not it is higher to have a penny double on a regular basis or $1 million? Effectively, it is higher to have a penny double on a regular basis – due to the ability of compound curiosity.

You want your cash to develop and earn you more cash. You have to begin constructing revenue streams along with your cash. The objective is that your onerous work up entrance may help you construct passive revenue streams for the long run.

Do you need to earn $50,000 per 12 months with out working? Here is a easy breakdown of learn how to make your cash work to do it for you. It is all about making your cash give you the results you want, not towards you.

Associated: The Rule Of 72 For Investing

Rule #5 – You Want To Marry Good

The fifth rule for constructing wealth is to marry good. Why? As a result of an ideal partner generally is a large pressure multiplier in relation to constructing wealth, whereas on the similar time the largest destroyer of wealth is divorce. The truth is, a current examine discovered that divorce destroys 75% of private internet value.

On the constructing wealth entrance, an ideal duo can earn collectively, accumulate collectively, and watch their double-earnings compound over time. That is an enormous pressure multiplier for constructing wealth. The curiosity on $2 is at all times increased than the curiosity on $1.

Nonetheless, divorce has the potential to smash monetary lives should you did not marry good. Past dividing issues 50/50, there will be lawyer charges and extra. Plus, compound curiosity now solely has a small quantity to work with – so it simply grows slower.

The very fact is, although, that based on the American Psychological Affiliation, 40-50% of marriages finish in divorce in the US. That does not imply that divorce must be a monetary catastrophe. For those who married good to start with, hopefully your ex-spouse may even be financially savvy in relation to divorce and you may work issues out as amicably as potential.

Rule #6 – You All the time Want To Reduce Your Taxes

The sixth rule for getting wealthy is at all times be minimizing your tax legal responsibility. Regardless of your revenue stage, you at all times must be enthusiastic about learn how to reduce your taxes. Taxes can forestall you realizing wealth over time as a result of they constantly eat away at your revenue and funding returns.

For instance, the S&P 500 posted a median annual nominal return over the past 30 years of 11.09%. Nonetheless, after taking into consideration taxes, charges, and inflation, the true return an investor would have seen would have solely been about 7%. That is 46% of your return eradicated by taxes, charges, and inflation.

Nonetheless, there are numerous actions you may take to attenuate your taxes. First, reap the benefits of tax deferred funding accounts. Max out your 401k or 403b, reap the benefits of an Particular person Retirement Account (IRA), leverage a Well being Spending Account (HSA).

For those who do not need to quit your wealth to the federal government, then taxes must be close to the highest of your thoughts when making any cash resolution.

Rule #7 – Insure Your self And Shield Your Household

The seventh rule for getting wealthy and constructing wealth is that you want to insure your self to guard your wealth and your loved ones. I am not even speaking about life insurance coverage right here – I am speaking about ensuring that you’ve got medical insurance and incapacity insurance coverage.

Within the final 12 months, I’ve had two teaching shoppers which were impacted by well being points they weren’t ready for, and so they’ve turn into financially jeopardized by them as a result of they did not put together. I’ve additionally had one other a number of cases of individuals changing into disabled to the purpose they or their member of the family could not work any longer. The end result? Monetary peril.

The time to insure your self is when every little thing goes properly. Each one that desires to construct wealth and get wealthy must have, at a minimal:

- Well being Insurance coverage

- Life Insurance coverage

- Brief Time period and Lengthy Time period Incapacity

Do not watch all the cash you might have accrued go away in a second.

Associated: The Important Property Planning Paperwork Each Household Wants

Rule #8 – You Want To Take Care Of Your self First

The eighth rule of constructing wealth is to deal with your self first. This is not as a lot of a cash rule as a life rule.

Whenever you fly on an airplane, the flight attendant at all times does their security speech the place they remind you to place your oxygen masks on first earlier than serving to another person? There is a motive for that – should you’re unconscious, you may’t assist anybody else.

On the subject of constructing wealth, it’s a must to deal with your self first – even when coping with household. This may be actually onerous for some folks, particularly people who did not have a lot, and now have one thing that they might share. And others might notice it and ask.

If you wish to assist others, be sure to’ve put your self on strong floor first and have adopted all the principles. I’ve seen it too many occasions when generosity results in monetary smash.

Rule #9 – Encompass Your self With Folks Higher Than You

The ninth rule to get wealthy is to encompass your self with folks higher than you in all elements of your life. On the household entrance – if they’re holding you again, distance your self. Married upward. Do not let household be the explanation you are not attaining your desires.

Mates? Discover ones which are making you a greater particular person. Drop the moochers. Drop the haters. Drop the lazy ones.

Work? Discover a mentor that’s doing what you need to do and is killing it. If they do not have the bandwidth to satisfy you, simply watch them and see what they do. You’ll be able to be taught loads from a distance.

Similar to Rule #1, it’s a must to earn it. Discover folks that may allow you to with that. You do not have to accept the life you had been born into if that is not what you need.

Rule #10 – It is Okay To Go Gradual

Lastly, the final rule for constructing wealth is, keep in mind it is okay to go sluggish. That is very true for millennials.

I really feel like everybody below 30 at the moment desires the following factor, the following job, the following milestone, the following huge paycheck. However they have not even carried out this factor, realized this job, achieved the present milestone.

Constructing wealth takes time. It is about incomes at the moment, and leveraging time tomorrow. That is how wealth is made. Even should you landed a $150,000 per 12 months job at the moment, you are not any wealthier. Your first paycheck at this nice new wage is perhaps $5,000 take dwelling. That is not wealth. That is a place to begin. That is one thing to construct on.

In line with The Spectrum Group, the common millionaire in the US is 62 years outdated. Simply 1% of all millionaires are below 35. Maintain that in thoughts in your wealth constructing journey.

What monetary guidelines do you reside by?

The put up How To Be Wealthy: 10 Guidelines To Develop Wealth appeared first on The Faculty Investor.