Traders have solely a lot management over the gross returns their portfolios understand. Even when constructed properly, a portfolio’s efficiency is generally topic to the whims of the market. However traders do have some diploma of management over their internet returns: by limiting the charges they pay their funding managers and what they must ship to Uncle Sam.

One of many instruments at an investor’s disposal for enhancing the tax effectivity of their portfolio, and limiting their tax legal responsibility, is tax-loss harvesting (TLH). Tax-loss harvesting is a technique that entails promoting one asset to understand a capital loss so as to offset present or future-year capital positive factors created from the promoting of one other asset.

By serving to to defer the conclusion of capital positive factors, TLH permits enhanced compounding of funding returns till tax liabilities are finally paid. Typically, a tax legal responsibility incurred might be eradicated in its entirety by benefiting from the step-up in value foundation when an asset proprietor passes away and transfers their property.

Instance of TLH Advantages

The next instance helps exhibit how TLH can help in deferring taxes. Think about two traders who’re equivalent in each respect, each people invested two million {dollars} and each investments doubled to 4 million {dollars} over ten years. The one distinction is that one investor utilized tax-loss harvesting whereas the “conventional” investor didn’t.

Subsequent let’s think about that every investor partially liquidates their portfolio to generate $200k in money. For simplicity, we assume every investor is topic to an all-in 25% marginal capital positive factors tax charge.

Due to this 25% tax charge, the standard investor should promote $228,571 of their holdings to boost $200k internet of taxes. In so doing, they understand $114,286 in capital positive factors and pay $28,571 in taxes. They’re left with their desired $200k in money move from the funding sale, they usually now have $3.771m in inventory with a price foundation of $1.886m.

Take into account the investor who has been tax-loss harvesting over the ten-year funding span. The calculations are somewhat extra complicated. Let’s say their tax-loss harvesting exercise realized $800k in losses over the last decade, resetting their value foundation from $2.0 million right down to $1.2 million.

These realized losses carry ahead from one 12 months to the subsequent and can be found to offset some or all capital positive factors realizations, relying on the scale of a inventory sale. This investor sells $200k of inventory with a price foundation of $60k.

Thus, this sale realized $140k of capital positive factors. However this $140k capital achieve is greater than offset by the $800k in current carry-forward losses. No taxes are owed, and the carry-forward loss shrinks to $660k.

The TLH investor now owns $3.800m in inventory with a $1.114m value foundation. If their funding worth is unchanged, they’ll promote a further $943k in inventory earlier than exhausting their carry-forward losses. Regardless of having investments which have doubled in worth, TLH permits this investor to liquidate over $1.1m of their holdings earlier than producing any tax legal responsibility.

Relying on their lifetime liquidity wants, it’s doable that this investor might pay little, or no, capital positive factors taxes, and their heirs can get pleasure from a full reset of the remaining shares’ value foundation at their time of passing.

I’ll provide a fast caveat that the advantages of deferred capital positive factors realizations are usually not common. For individuals who would possibly quickly discover themselves in low marginal tax brackets, the strategic realization of capital positive factors could possibly be smart.

For now, let’s focus our consideration on high-net-worth traders who don’t profit from low marginal tax brackets. For these traders, attaining the next TLH yield is mostly useful.

Enhanced TLH Yield Potential When Shopping for Particular person Shares

Does the construction of an investor’s portfolio materially affect the effectivity of a TLH program? In search of to reply this query, I just lately co-authored a paper with Jason Lu that horseraces automated TLH when shopping for a broad-based fairness index ETF in opposition to shopping for a direct listed portfolio of particular person shares. The paper demonstrates a fabric potential profit to proudly owning particular person shares: larger common TLH with extra constant tax-loss harvesting efficiency.

A portfolio of particular person shares sometimes gives many extra alternatives to understand losses than an ETF that holds the identical positions. This is likely to be most simply demonstrated by setting up a easy index that owns two shares. Think about two shares, ticker symbols WIN and LOSE, which are every initially priced at $50. The index owns one share of every and has an preliminary worth of $100. The worth of WIN will increase to $70 and the worth of LOSE declines to $40. The index worth has climbed to $110.

Somebody who owns the index ETF has no alternative to reap a loss as their funding worth has elevated by 10%. However, somebody who as an alternative owns one share of WIN and one share of LOSE can harvest a loss. They promote their share of LOSE for $40, realizing a $10 loss (10% of their complete preliminary funding). They reinvest the proceeds in a inventory that serves as an alternative choice to LOSE.

Each the inventory investor and the index investor have a portfolio that has grown in worth from $100 to $110, a ten% achieve, however the index investor has a price foundation of $100, an unrealized $10 capital achieve, and $0 in realized capital positive factors/losses.

The inventory investor, then again, has an up to date value foundation of $90, an unrealized $20 capital achieve, and $10 in realized capital losses. By proudly owning the underlying positions, the inventory investor has been capable of harvest a loss that’s merely unavailable to the index (ETF) investor.

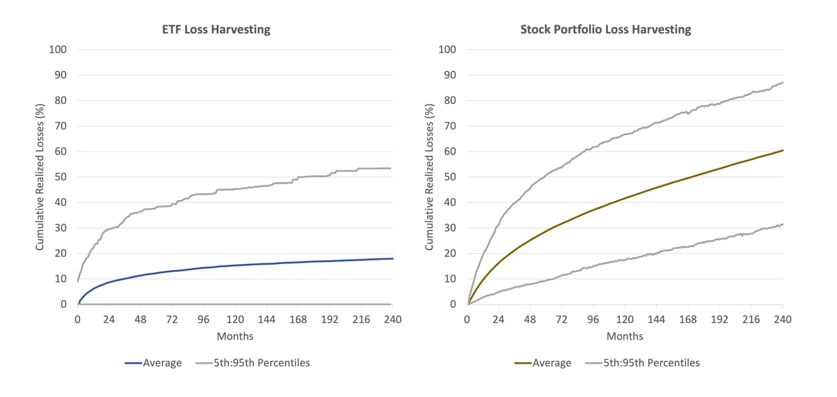

The affect of this distinction in funding construction on TLH yield is materials. The next determine (Determine 5 from the paper) reveals the extent of the benefit we measured. Over a twenty-year interval:

- The inventory portfolio harvested about triple the losses of the ETF;

- The worst 5% of outcomes for the inventory portfolio had a few 50% larger TLH yield than the common TLH when proudly owning ETFs; and

- The common TLH yield for shares was larger than the perfect 5% end result for ETFs.

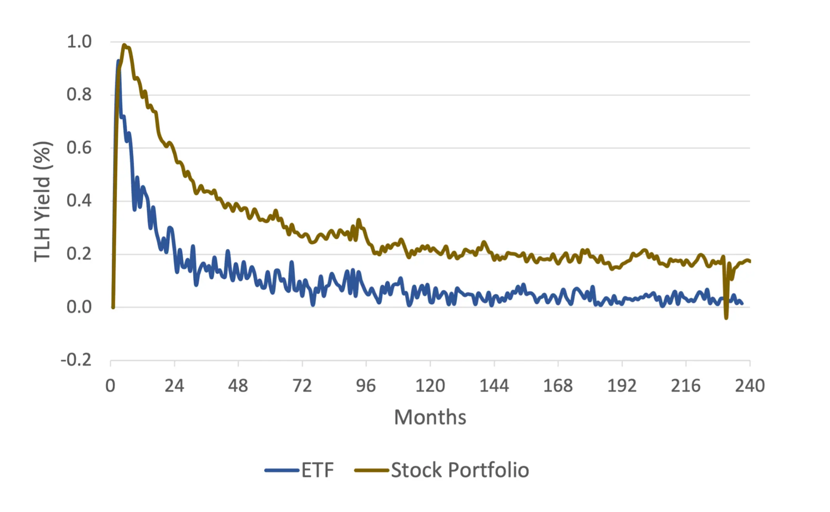

Loss harvesting advantages are front-loaded, however then exhaust over time. Our paper demonstrates this impact when harvesting losses on ETFs or on a portfolio of direct shares (Determine 6 from the paper). Nonetheless, just a few fascinating findings emerge:

- The preliminary harvesting yield for ETFs and particular person shares have been practically comparable;

- TLH yield decayed considerably faster for ETFs than for particular person shares;

- After about 5 years, TLH yield for ETFs was barely above zero; and

- TLH alternatives – albeit modest – continued to materialize for a portfolio of particular person shares over an prolonged time-frame.

Tax-loss harvesting might be an efficient device for bettering the tax effectivity of a portfolio. It might be used to financial institution realized losses that may be carried ahead to offset future capital positive factors. Doing so can defer the conclusion of tax liabilities, and in some cases when coupled with the step-up in value foundation at dying, can eradicate them altogether.

Nonetheless, the construction of a portfolio performs an essential function within the productiveness of a TLH algorithm. Proudly owning particular person shares sometimes presents extra alternatives to reap bigger losses. Even a naïve harvesting algorithm utilized to a portfolio of shares is prone to finest a classy harvesting algorithm utilized to ETFs.

There are a lot of concerns at play when an investor chooses whether or not to personal shares or ETFs. For the tax effectivity arising from TLH, and the power to carry onto extra of your personal cash, our analysis reveals that proudly owning particular person shares simply wins the horse race.

Roni Israelov is Chief Funding Officer and President at NDVR.