Opposite to standard perception, it is not the Federal Reserve however the bond market that controls mortgage charges. The Federal Reserve regulates the Fed Funds charge, the in a single day lending charge for banks, which sits on the shortest finish of the yield curve.

When the quick finish of the yield curve rises, it impacts longer length charges. As an illustration, if cash market funds supply a 5% return and are simply accessible, traders would demand even greater rates of interest for longer-dated Treasury bonds to justify holding them.

The Fed will increase the Fed Funds charge to curb inflation, which ends up from elevated demand for items and providers surpassing the out there provide, together with financial coverage changes. Elevated rates of interest elevate borrowing prices and the chance price of not saving and investing, thereby exerting downward strain on inflation.

Amid international anticipation for the Federal Reserve to chop charges, let’s dissect the elements influencing mortgage charge fluctuations. Understanding these elements will assist handle expectations concerning how a lot a lower within the Fed Funds charge may affect mortgage charges. In flip, this data will assist you to make higher actual property funding selections.

Parts That Have an effect on Mortgage Charges

Within the first quarter of 2022, the Federal Reserve commenced a collection of rate of interest hikes in response to inflation, which reached its peak at 9.1% in mid-2022. Following 11 charge hikes, mortgage charges additionally skilled a major uptick.

Under, we analyze the elements contributing to this rise, which noticed mortgage charges quickly spike from 3% to eight%. Out of the 5% enhance in mortgage charges:

- 2.5%, or half of the motion, stemmed from changes in Federal Reserve coverage charges.

- 0.8%, or 16% of the rise, was attributed to the growth of the Time period premium.

- 0.8%, additionally constituting 16% of the motion, was pushed by prepayment danger.

- 0.4%, equal to eight%, resulted from adjustments within the Choice-Adjusted-Unfold (OAS), measuring the yield distinction between a bond with an embedded possibility (akin to an MBS or callables) and Treasury yields.

- 0.3%, representing 6% of the rise, was as a result of lender charges.

- One other 0.3%, additionally accounting for six% of the rise, was influenced by inflation.

The figures offered are estimates by Aziz Sunderji from Dwelling Economics, derived after analyzing information from the Fed, Barclays, and Freddie Mac. Whereas it is not possible to pinpoint the precise share weightings for the elements influencing the mortgage charge motion, these estimates are thought of sufficiently correct.

How A lot Will Mortgage Charges Decline As soon as The Fed Begins Slicing Charges?

The first purpose of this evaluation is to forecast the potential decline in mortgage charges if the Federal Reserve begins chopping charges by the top of 2024 or in 2025.

In response to the evaluation, each 25 foundation factors (0.25%) lower within the Fed’s charges is anticipated to scale back mortgage charges by roughly 12.5 foundation factors (0.125%). If the Fed implements 4 consecutive 25 foundation factors cuts, leading to a complete 1% discount within the Fed Funds charge, mortgage charges are prone to lower by 0.5%.

Moreover, mortgage charges might probably decline even additional than this 1:1/2 ratio if different contributing elements additionally lower. These elements may embrace decrease inflation expectations, heightened competitors, and elevated confidence within the economic system’s resilience.

Associated: 30-12 months Mounted versus An Adjustable Price Mortgage

Newest Expectations For The Fed Funds Price

The most recent market expectations for Fed Funds Charges by April 2026 point out a delay in anticipated charge cuts following higher-than-expected inflation information within the first quarter of 2024.

Nonetheless, if the Fed adjusts charges based mostly on this revised outlook, it is projected that mortgage charges might lower by 25 foundation factors (0.25%) by the top of 2024 and by 65 foundation factors (0.65%) by the top of 2025.

Regardless of these reductions being considerably modest in comparison with earlier expectations, the strong state of the economic system means that mortgage charges could stay elevated for an prolonged interval.

The Mortgage-Treasury Unfold May Slender

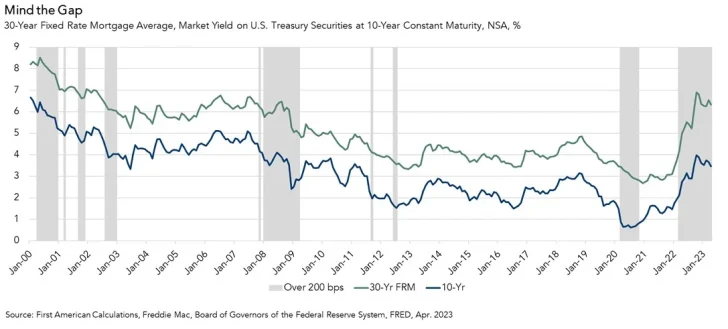

One other issue that would probably drive mortgage charges decrease is the imply reversion of the unfold between the common 30-year mortgage charge and the 10-year Treasury charge. That is known as the Mortgage-Treasury Unfold as proven within the yellow elements of the primary chart above.

Because the conclusion of the Nice Recession, the 30-year fastened mortgage charge has sometimes remained 1.7 share factors (170 foundation factors) greater than the 10-year Treasury bond yield, on common.

Nonetheless, the Mortgage-Treasury Unfold widened to over 3 share factors (300 foundation factors) in 2023. A part of the reason being as a result of extra volatility and financial uncertainty, which requires banks to earn a better return.

In 2024, we have seen a decline within the Mortgage-Treasury Unfold to round 270 foundation factors as banks are reducing their lending charges and providing extra aggressive mortgage charges given a decrease likelihood of a tough touchdown. That mentioned, the unfold continues to be about 1% greater than its historic common.

Why Mortgage Charges Cannot Go A lot Greater

Contemplating the robustness of the U.S. economic system, there’s a risk for each the Fed Funds charge and mortgage charges to rise. Nonetheless, this state of affairs seems unlikely given the present stage of the financial cycle.

A number of elements contribute to this evaluation: inflation has already peaked, the S&P 500 is buying and selling at greater than 20 occasions ahead earnings, the risk-free charge exceeds inflation by no less than 1%, and the extent of U.S. authorities debt is changing into more and more burdensome.

An examination of the U.S. curiosity cost state of affairs reveals a major burden. With none charge cuts by the top of 2024, the annual curiosity cost on U.S. Treasury debt might soar to $1.6 trillion. This staggering determine underscores the significance of rigorously managing rates of interest to mitigate the affect on authorities funds.

How does $1.6 trillion examine to different U.S. authorities liabilities?

Let’s think about one measure: U.S. curiosity expense versus protection spending and Social Safety spending. Gross curiosity expense has already exceeded protection spending and is on observe to surpass Social Safety spending.

This example highlights a difficult dilemma for the federal government. The Federal Reserve can’t afford to lift rates of interest additional with out risking the financial collapse of our nation.

Tame Your Expectations About Mortgage Price Declines

Should you’re eagerly anticipating a decline in mortgage charges as a result of imminent Fed charge cuts, mood your expectations. Not solely will the Fed’s affect on mortgage charges be restricted to about 50%, however it’s additionally prone to take a few years and even longer for the Fed to scale back charges to ranges that really feel extra accommodating for debtors.

Given the numerous pent-up demand for actual property ensuing from excessive mortgage charges since 2022, the Fed can’t enact fast cuts. Doing so might set off a surge in demand, additional driving up residence costs.

Consequently, you need to think about how lengthy you are prepared to delay your plans earlier than buying your dream residence. The longer mortgage charges keep excessive, the larger the pent-up demand given life goes on, e.g. marriage, youngsters, job relocation, divorce, and so forth.

Personally, as a middle-aged particular person, I used to be unwilling to place my life on maintain. With my youngsters aged three and 6 on the time of my residence buy in October 2023, I needed to maneuver ahead with life as quickly as potential. I acknowledged that after they attain maturity, I will not have as a lot time to spend with them.

Now that you simply higher perceive the elements that have an effect on mortgage charges, hopefully, you will make a extra rational residence buying resolution. By way of the place rates of interest will go long run, I consider rates of interest will finally revert to its 40-year pattern of down.

Reader Questions And Recommendations

Had been you conscious that the Fed is just partially accountable for the rise and fall of mortgage charges? Do you suppose the Mortgage-Treasury Unfold will revert to its long-term imply of 1.7 share factors? What different elements have an effect on mortgage charges?

Should you’re on the lookout for a mortgage, examine on-line at Credible. Credible has a community of lenders who will compete for your small business. You will get no-obligation personalised prequalified charges in a single place.

Disclaimer

“Prequalified charges are based mostly on the knowledge you present and a smooth credit score inquiry. Receiving prequalified charges doesn’t assure that the Lender will lengthen you a proposal of credit score. You aren’t but accredited for a mortgage or a particular charge. All credit score selections, together with mortgage approval, if any, are decided by Lenders, of their sole discretion. Charges and phrases are topic to alter with out discover.

Charges from Lenders could differ from prequalified charges as a result of elements which can embrace, however should not restricted to: (i) adjustments in your private credit score circumstances; (ii) further data in your onerous credit score pull and/or further data you present (or are unable to supply) to the Lender throughout the underwriting course of; and/or (iii) adjustments in APRs (e.g., a rise within the charge index between the time of prequalification and the time of software or mortgage closing. (Or, if the mortgage possibility is a variable charge mortgage, then the rate of interest index used to set the APR is topic to will increase or decreases at any time). Lenders reserve the appropriate to alter or withdraw the prequalified charges at any time.”