(Bloomberg Opinion) — Should you’re simply waking as much as the snapback rally in Treasuries, you’ve in all probability missed the enjoyable. Since Oct. 19, 10-year Treasury yields have dropped 82 foundation factors, erasing many of the almost three-month 103-basis-point surge that started with Fitch Scores’ downgrade of the US and got here to a head with the outbreak of the Israel-Hamas struggle.

That doesn’t imply that the summer time panic was an entire head pretend; simply that it was wildly overdone. Confronted with a sequence of unfavourable surprises, bond traders opted to promote first and ask questions later. Now, mercifully, we’ve entered the sober evaluation stage of the cycle. And my studying of the proof suggests the market as soon as once more has the story proper (for now).

Curiosity Charges

There are nonetheless quite a lot of excellent questions on what began the selloff within the first place, and it feels useful to start with what it wasn’t: a big realignment of rate of interest expectations.

A really primary mannequin of 10-year Treasury yields assumes they need to mirror common rate of interest expectations over the approaching decade (plus some “time period premium”; extra on that later).

Prior to now a number of months, the near-term financial coverage debate has revolved round whether or not or not the Federal Reserve would push charges one other 25 foundation factors larger to a peak vary of 5.5%-5.75% and the way lengthy they might keep there. On the peak of the hysteria, futures markets implied barely higher than even odds that central bankers would tighten once more. Theoretically, that shouldn’t have moved the needle on the 10-year yield by quite a lot of foundation factors. Fed funds futures present that markets fully priced out that final hike in the midst of November and, as a substitute, now assume about 125 foundation factors in cuts by way of the top of 2024.

One other variable, after all, is longer-term coverage price expectations. The place will charges settle when the inflation combat is over and the financial system has returned to regular state? For years, Fed policymakers have prompt that the long-run steady-state price was round 2.5%, an estimate that encompasses the idea that inflation will settle round 2% and a “impartial” actual price of about 0.5% could be acceptable to maintain it there. But when both of these assumptions had been now not right, it will justify a extra everlasting improve in 10-year Treasury yields.

And that certainly would be the case, after all. Some traders have argued that, amongst different issues, the world is getting into a interval of deglobalization — a shift that began with the populism of former President Donald Trump and was supported by the Covid-19 supply-chain debacles and, finally, the outbreak of main wars in Europe and the Center East. Because the argument goes, which will make the Fed’s 2% inflation goal tougher to realize.

But it surely’s uncertain the change is anyplace as huge because the preliminary Treasury transfer prompt — a minimum of in line with the measured calculations of major sellers. Eight instances a yr, the New York Fed asks its buying and selling counterparties the place they see coverage charges settling within the longer run. For years, these forecasters typically agreed with the Fed’s evaluation of two.5%, however there was a transparent shift upward within the survey interval that closed in late October to about 2.75%. If the shift in expectations holds and we assume coverage will quickly tread a gradual path again to the larger “regular state,” it will indicate a 10-year yield of round 3.1%.

‘Darkish Matter’

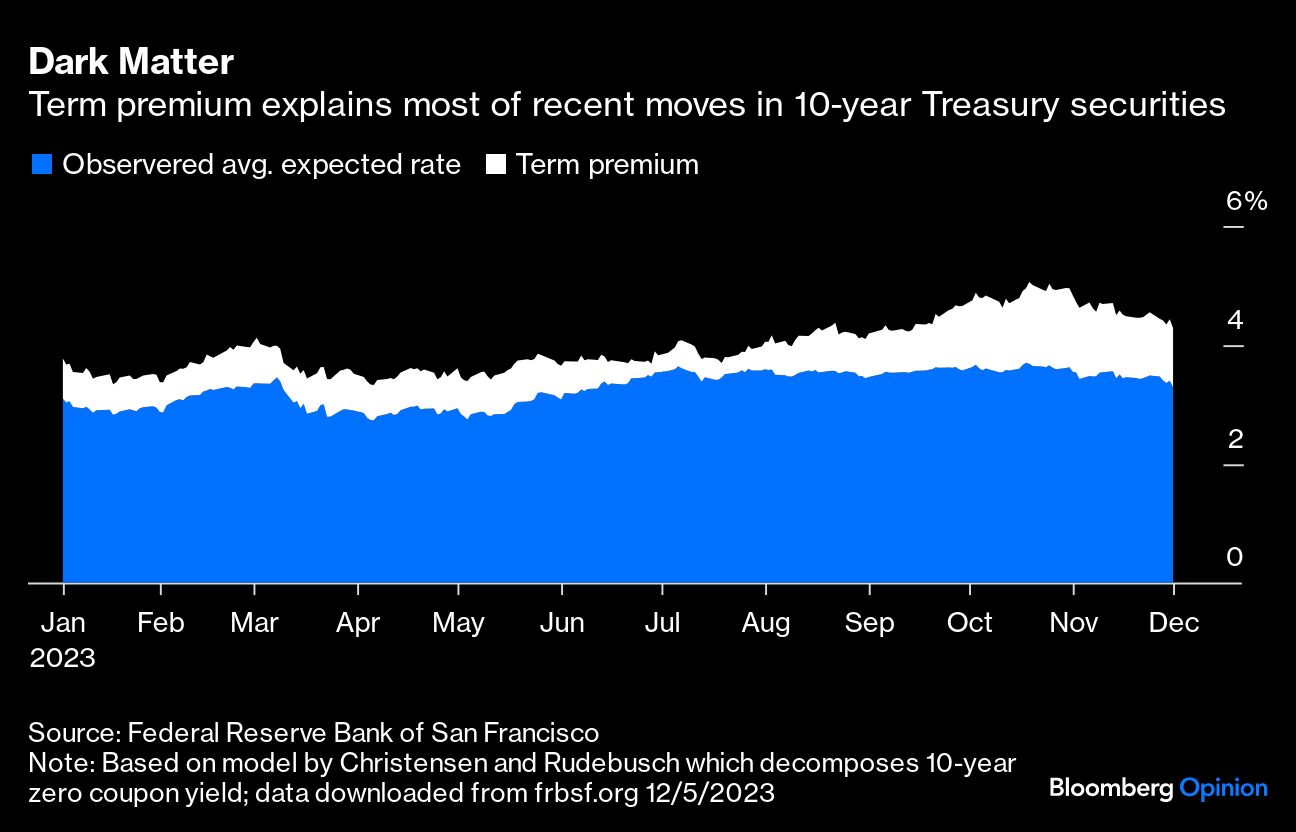

So how can we clarify the extra 106 foundation factors (give or take) that’s baked into prevailing market 10-year yields? That’s the “term-premium” — or as Minneapolis Fed President Neel Kashkari has characterised it, the “darkish matter.”

The time period premium is the plug quantity for all the pieces within the yield that we are able to’t clarify. It represents your hopes and desires; or, alternatively, your worries and nightmares — the stuff that sounds too nutty to incorporate in your baseline forecast. It’s itself very laborious to quantify, and the assorted off-the-shelf estimates of the time period premium are far and wide. However they typically all agree that the premium moved up by so much from August by way of October, and has since come again right down to a big diploma. And it’s the transfer in time period premium that has largely pushed the general transfer in yields.

Right here is a well-liked Treasury yield decomposition mannequin from Jens H.E. Christensen and Glenn D. Rudebusch that’s revealed by the San Francisco Fed:

Why did the time period premium transfer up? Mainly, it was a confluence of things that elevated that all-important worry and uncertainty. Geopolitics was clearly a near-term driver, and market individuals had been proper to fret. As my colleagues in Bloomberg Economics not too long ago described, the wars in Ukraine, Africa and now the Center East have killed greater than 100,000 individuals this yr and stand to actual the most important financial value for the reason that finish of World Conflict II.

For all of the very actual human tragedy, it’s at all times been laborious to say precisely how these occasions would have an effect on the broader world financial system and, subsequently, the long-run rate of interest surroundings. Some observers could have been scared by the run-up in oil costs after Hamas’s assault on southern Israel, whereas others might need centered on the notion that spreading army conflicts risked hastening the transfer towards deglobalization, primarily placing the deflationary results of offshoring and vibrant worldwide commerce networks in reverse.

However the preliminary spike in oil costs has been fully worn out, and the deglobalization hyperlink at all times concerned quite a lot of storytelling and guesswork. In the meantime, the worst-case state of affairs during which the Israel-Gaza battle unfold to contain the US and Iran appears to have light. One quantitative measure of every day geopolitical threat — an index created by Dario Caldara and Matteo Iacoviello — means that market uncertainty has certainly abated.

The opposite piece of the term-premium puzzle is the gaping US finances deficit and the associated glut of debt issuance. The deficit, after all, is clearly a problem that fiscal authorities within the US should deal with in the long term, and it has apparent ramifications for bond yields. Understandably, many individuals consider that credit score threat is a foolish notion within the US, as a result of the federal government controls the world’s reserve forex. It could actually print its approach out of any pickle. However whether or not you see the deficit as a credit score situation or an inflation situation, it’s clearly nonetheless an issue.

An issue for in the present day? In all probability not. In some unspecified time in the future, the nation must both bump up in opposition to some extraordinary good luck — a stellar run of robust productiveness and financial progress, as an illustration — or our leaders should transfer to a extra sustainable fiscal trajectory. But the expertise of 1 much more indebted nation — Japan — means that this state of affairs can drag on for a substantial time period.

As unhealthy because the US deficit has regarded in 2023, it has already begun to slender a bit as deferred tax revenues (Californians acquired a delay because of winter storms) have are available. Little question, the issue would get ugly once more shortly if rates of interest keep larger than financial progress (driving up curiosity bills quicker than tax income), however the gradual normalization of Fed coverage presumably beginning subsequent yr ought to allay these considerations.

Many years of latest US historical past present that bondholders typically agree that the US isn’t a credit score threat. Apart from a short interval within the early Eighties, bond yields and time period premia have proven primarily no relationship to the dimensions of the finances deficit. As soon as in a blue moon, a compelling narrative modifications that, as was the case within the early a part of the Reagan administration, when traders nervous that deliberate tax cuts and spending initiatives had been improper for an financial system nonetheless contending with inflation and excessive rates of interest.

In some unspecified time in the future, bond vigilantes could lose persistence once more, promoting securities to protest irresponsible fiscal coverage and forcing change. However the expertise of the previous a number of weeks means that we’re not there but.

So What?

Nobody is aware of what the “proper” time period premium is, after all. A number of fashions put the 20-year-average premium earlier than the Covid-19 pandemic at shut to 1 share level, and that looks as if pretty much as good an assumption as any for one thing so inherently unpredictable.

If rates of interest are set to common round 3.1% over the following decade (inclusive of present charges) and the time period premium settles in at round 100 foundation factors, then 4.1% is an inexpensive guesstimate for the 10-year Treasury yield. At 4.16% on the time of writing, we’re not very far off in any respect. So the times of stock-like whole returns in Treasury markets could also be behind us for some time. That’s the factor with markets pushed by sentiment and tales; in case you blink, they depart you within the mud. But when, as a substitute, the market is certainly shifting right into a interval of extra sober evaluation, then boring and predictable could be a welcome improvement.

Extra From Bloomberg Opinion:

Need extra Bloomberg Opinion? OPIN

To contact the creator of this story:

Jonathan Levin at [email protected]