After budgeting with YNAB for 11 years, I’m now utilizing Qube Cash, a digital money envelope budgeting and banking answer. Since switching to Qube this 12 months, my husband and I’ve saved a lot money and time. Plus, my husband – who sometimes isn’t the cash supervisor in our house – feels extra in command of our finances than ever earlier than.

Let me present you the way it all works on this full Qube Cash evaluation.

Click on right here to obtain the Qube Cash app and get began budgeting with Qube at no cost!

Is YNAB nonetheless an unimaginable software? In fact! For features of our cash planning, we nonetheless use it and in the event you just like the spreadsheet finances technique it may be best for you. We’ve simply discovered that personally Qube now saves us time and makes it simpler to remain on the identical web page as a pair. Study extra about YNAB right here.

What’s Qube Cash?

With Qube, you get an FDIC insured checking account, a Qube debit card, and the Qube Cash app. Contained in the app, you create Qubes (“envelopes”) for the classes you most frequently spend on. My husband and I began with our 10 classes the place we’re more than likely to be out and about spending cash. And then you definately put cash in these envelopes.

What’s distinctive about Qube, is that as a default, your Qube debit card has no cash on it. To have the ability to use your card, you go into the app and activate the Qube you need to spend from. Then, the cash from simply that Qube is instantly funded to your card, you make a transaction and no matter is remaining is put again in your Qube.

You possibly can solely spend cash you’ve got and that you just’ve actively chosen to spend from a sure class.

This makes budgeting so, so easy.

Why Do We Love Qube?

There are such a lot of causes my husband and I like utilizing Qube Cash, over and above it saving us money and time. However let’s get into some specifics.

You’re Budgeting Proactively As an alternative of Reactively

Anytime you’re utilizing a budgeting app and even simply pen and paper, you’re reconciling what you’ve spent and the way a lot cash you’ve got left after the very fact. For this reason typically you sit all the way down to do your finances on Friday and also you notice, “Oh my goodness, once more, I overspent on groceries or once more!” And also you’re making an attempt to repair it after the very fact.

With Qube, it’s a must to make a aware option to open a Qube earlier than you spend within the second. You understand that that cash is there. And if there’s not cash obtainable, you both want to vary your priorities and shift cash from one Qube to a different or simply notice you’ll be able to’t make that expense. It stops the transaction earlier than it occurs. Stopping overspending and serving to management impulse spending.

The advantages of those spending restrictions are the rationale that money envelopes have labored for thus many individuals. However whereas money envelopes are extremely troublesome to handle – particularly with a associate – Qube makes issues simple.

Qube Retains You and Your Companion on the Similar Web page

In case your associate isn’t the one which historically manages your finances, it could be onerous to keep on the identical web page as a pair. Whereas my husband and I’ve a behavior of getting common finances conferences, day-to-day he wasn’t at all times positive if what he was seeing within the finances was really what was obtainable. Particularly for classes we didn’t at all times speak about, like house upkeep.

With Qube, you and your associate are each seeing what is on the market – and the way you’ve chosen to prioritize your cash – in actual time. And you’re each restricted to spending what’s there.

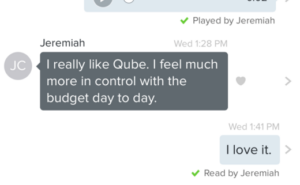

At first, my husband was cautious of Qube. He thought it may be a trouble to should open a Qube each time he spent cash. However he agreed to strive it and some weeks in, he despatched me this textual content…

I actually like Qube. I really feel rather more in management with the finances each day. – Jeremiah

And that may be a implausible, lovely factor.

Qube is Extra Safe Than Money Envelopes & Debit Playing cards

With Qube, you don’t have to fret about your money envelopes being misplaced or stolen. And with extra debit playing cards having Visa or Mastercard performance (once you don’t should enter our pin) theft threat is excessive with these playing cards as nicely. Particularly once you’re spending on-line. However with Qube, because it’s default is to have a $0 steadiness until you open a Qube – and it doesn’t have overdrafts – even when somebody steals your card they will’t spend your cash.

You get the advantages of money budgeting with out the chance!

Your Qube Finances is At all times Correct

With a standard finances, in the event you haven’t up to date it in just a few days (or weeks) you don’t know in the event that they cash you’re seeing as “obtainable” to spend hasn’t really already been spent.

Qube just isn’t depending on whether or not or not you’ve remembered to go in and replace these transactions. It doesn’t matter in the event you’ve been on trip and have forgotten to reconcile your finances in every week or two. Your Qube account and finances is simply updated as a result of it’s instantly reconciling that expense within the second you’re spending.

Not having to spend 20 to half-hour every week, or a couple of minutes every day, getting into transactions in your finances means you’re extra more likely to stick with your spending plan!

You Are Making Aware Selections About Your Spending

One of many issues I at all times liked about YNAB – and why I budgeted with them for thus lengthy – was their zero-based budgeting technique. You have been anticipated to provide each greenback a job. Which meant purposefully deciding tips on how to use your cash to realize your objectives.

With Qube, you do the identical factor. Not solely do it’s good to decide your cash priorities once you allocate your funds out of your Qube Cloud to your Qubes, however you additionally have to make that call once more on the level of buy.

I imagine that cash is a software to assist us create lives we love. Which suggests being intentional about how we use our cash and frequently interested by what we most need. Qube forces us to verify in on our spending values and priorities each time we spend, which suggests getting extra of what we would like. And losing much less on the impulse purchases that pull us away from our dream life.

How A lot Does Qube Price?

Qube Cash presently has three completely different service ranges – Fundamental, Premium, and Household (to-be launched). And you may get began fully at no cost.

Qube Fundamental Plan

Qube’s Fundamental Plan is totally free (together with the no-fee, FDIC insured checking account) and consists of as much as 10 Qubes, the flexibility to make use of Apple and Google Pay and peer-to-peer transfers. You’ll additionally get issues like subscription controls, payday as much as 2 days early with direct deposit, and their Default Zero know-how. Because of this as an alternative of a transaction overdrafting your account if there isn’t sufficient cash in your card, Qube will simply deny the transaction. No overdrafts or overdraft charges.

Qube Premium Plan

Qube Cash additionally has a Premium Plan for $6.50. That is the plan my husband and I are presently on, because it gives every thing from Fundamental plus limitless Qubes, associate notifications, instantaneous card deposits, and upcoming options like Invoice Pay and Finances Automation.

In case your finances is a bit more sophisticated or your need to use Qube together with your associate, the Premium Plan is a good choice! At $6.50 a month, it is a nice deal particularly as Qube can substitute every other budgeting instruments you employ, subscription management providers like Truebill, and extra.

Qube Household Plan

Lastly, Qube might be rolling out a Qube Household Plan for $11.50 per thirty days by the top of the summer season. This can add the flexibility to have as much as 10 child accounts, the place your youngsters get their very own card and Qube finances. You’ll have the ability to handle allowance, chores, and have oversight on their spending. As well as, Qube Household may have in-app cash requests so youngsters can request cash from their dad and mom.

As Henry is approaching being prepared for digital allowance, we plan to improve to the Household Plan when it’s obtainable. The additional $5 per thirty days is similar to different allowance playing cards like FamZoo and Greenlight, however with the additional benefit of conserving the entire household on the identical monetary eco-system.

Is Qube Proper for You?

What cash administration system goes to be just right for you and your loved ones goes to rely in your persona, your values and your objectives.

I can let you know that personally for me, in my family, Qube has saved us a ton of time updating budgeting transactions. We’ve saved a ton of cash overspending when my partner and I simply didn’t talk fairly completely. And now we will at all times see precisely what’s taking place in our finances.

I’m so excited to make use of Qube for years to come back, particularly as their new options proceed to roll out this summer season. I’m wanting ahead to bringing our boys onto the Qube app as nicely, so we will have an all-in-one place the place, as a household, we’ll at all times be making aware proactive selections with how we spend our cash. That method, we will use cash as a software to proceed to construct the life we most need to stay.

Prepared to vary your cash life with Qube? Click on right here to obtain the app at the moment and get began at no cost.