In keeping with the Nationwide Affiliation of Realtors, the median value of a home in the USA is value $190,000 greater than it was a decade in the past.

When you’ve owned a home for greater than 3 years or so, you’re seemingly sitting on some good good points.

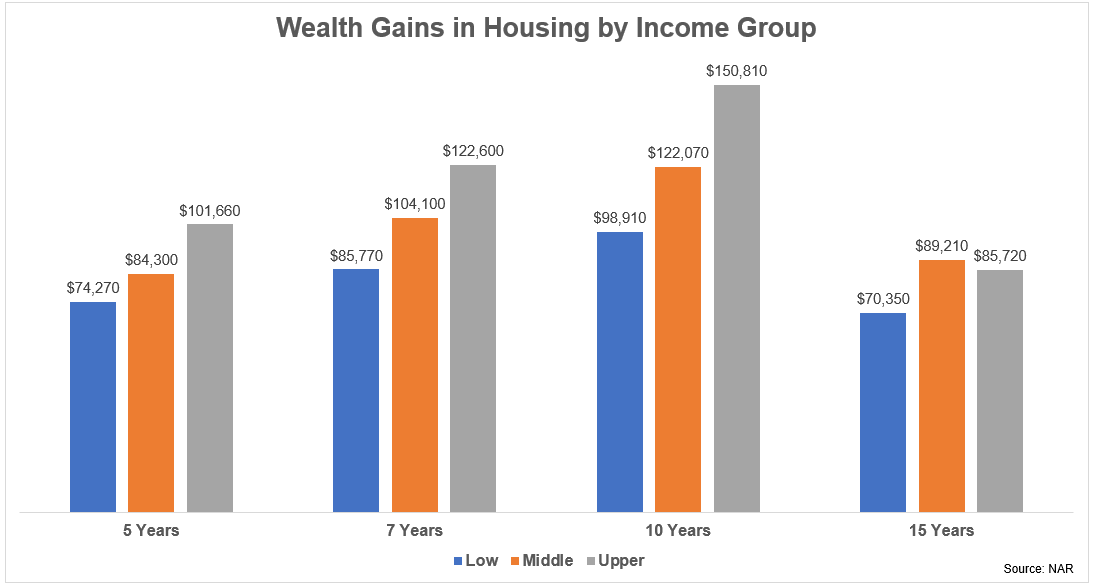

These good points weren’t evenly distributed however throughout the varied earnings ranges, owners have made a very good chunk of change:

The pandemic-related housing good points are in contrast to something we’ve ever seen earlier than so it’s not like you must anticipate this to proceed.

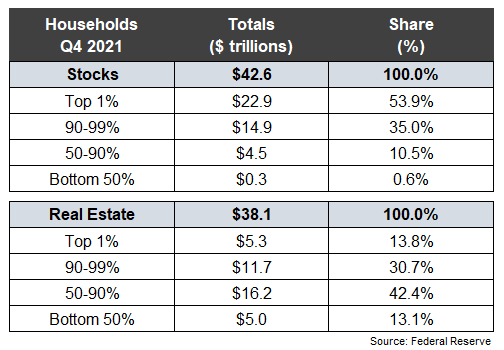

However the housing market is extra essential for the center class than the inventory market for the straightforward proven fact that possession of residential actual property is extra widespread.

The highest 10% controls practically 90% of the inventory market whereas the underside 90% owns greater than 55% of the housing market:

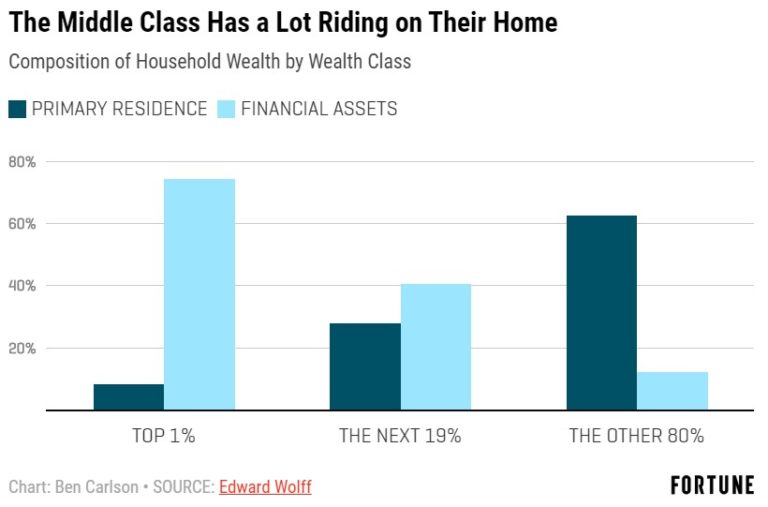

It’s no enjoyable for many who have missed out on the good points we’ve seen throughout this cycle however it is a good factor for many who don’t maintain as many conventional monetary property like shares and bonds:

There may be, nonetheless, an issue with having your wealth so concentrated in your house.

For one factor, the wealth good points cited within the analysis by the NAR are on a gross foundation.

You must internet out the entire ancillary prices concerned with homeownership to get the actual quantity. Issues like realtor charges, closing prices, property taxes, shifting bills, insurance coverage, repairs and upkeep can take an enormous chunk out of any nominal value will increase.

Plus, having your wealth tied up in your home is far totally different than proudly owning monetary property or having that cash within the financial institution.

A house is an illiquid asset. It’s troublesome to faucet your fairness. There are various choices however none of them are a slam dunk:

- You possibly can open up a house fairness line of credit score or do a cashout refinance however that requires borrowing extra money.

- You possibly can use your fairness as a down fee for a brand new residence however that additionally means paying the now larger housing costs.

- You possibly can promote your home to both downsize or turn out to be a renter however you’re all the time going to should dwell someplace.

- You possibly can carry out a reverse mortgage while you retire however that’s an advanced course of.

- You possibly can dwell some place else and hire out your own home to supply some earnings however there are nonetheless a whole lot of prices and potential complications concerned in that course of (and once more you must dwell someplace).

I’m not making an attempt to speak folks out of proudly owning a house. There are many advantages to being a house owner.

It’s a type of pressured financial savings. It’s a very good hedge towards inflation. It lets you lock in a hard and fast month-to-month price and develop into your fee over time. And there’s the psychic earnings element that comes from making it your individual and residing in your required group.

Clearly, rising housing costs are higher than the choice if you happen to personal your home. The good points we’ve seen have helped households within the center and decrease class construct wealth in an enormous approach over the previous decade or so.

However unlocking the worth in your house isn’t as simple as one may suppose.

Constructing wealth in your house is sweet however it’s essential to diversify into different monetary property as nicely.

Additional Studying:

Why the Housing Market is Extra Essential Than the Inventory Market