The phrase direct indexing is usually used to refer to 2 fairly various things:

- Index technology: making a customized (typically personalised) index

- Portfolio administration: buying and selling so {that a} portfolio tracks that index over time

If No.1 is a recipe, No. 2 is following that recipe utilizing (probably restricted) substances.

Index Development

An index is only a set of securities with totally different weights, usually chosen utilizing a course of reminiscent of market-cap weighting, trade sector restrictions, liquidity, and so forth. Direct indexing is, or ought to check with, an occasion the place a portfolio holds the person index constituents as an alternative of a fund (ETF, sometimes) that tracks that index.

There are numerous ETFs that observe well-known indexes. If I make up an index on the fly, no ETFs will observe it as a result of (a) it isn’t getting revealed, so no one would know what’s in it, and, extra essential, (b) no ETF Issuer will create an ETF for it if there isn’t any demand. Nonetheless, anybody can create their very own index and construct portfolios that observe it. With DI, the dearth of monitoring ETFs will not be a constraint anymore.

A number of firms are within the enterprise of making customized indexes, often from scratch, however typically by modifying an present index. The development also can use a consumer’s private preferences and/or ESG values.

Portfolio Administration

The output of the index building course of turns into an enter to the portfolio administration course of, whose purpose is to trace that index over time via buying and selling.

In some circumstances, that is straightforward:

- If we begin with $100,000 in money, shopping for all constituents at their index weights will observe the index completely.

- For the following few days, we might must do nothing. That is the case for inventory indexes denominated when it comes to fastened shares (virtually all, to the writer’s data), the place value motion can not trigger the portfolio to grow to be unbalanced.

Nonetheless, issues can get difficult rapidly. Examples:

- Money proceeds from promoting a eliminated inventory cannot be invested to yield a “good” portfolio if some shares have shopping for restrictions (e.g., to keep away from a wash sale).

- What if a inventory’s ESG rating drops? Promoting it’s going to enhance the portfolio’s ESG rating however might understand tax. It’s a trade-off.

- If a customized index relies on a well known revealed index, and that index drops or reduces the load of a inventory, the identical trade-off applies.

The primary complexity right here is evaluating the trade-offs (monitoring, tax, ESG, transaction price, holding price, returns expectations, and so forth.) topic to constraints.

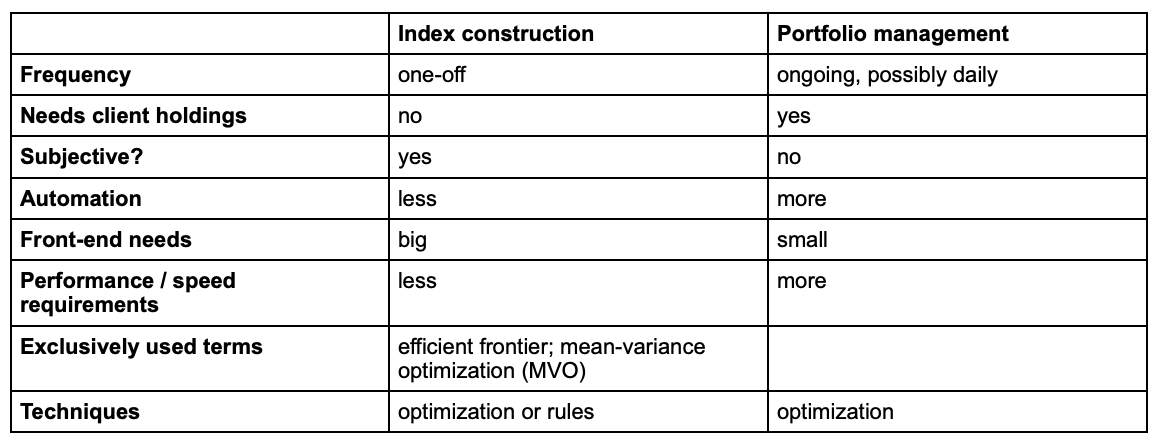

Abstract of variations:

Frequency: Robo advisors sometimes consider every day whether or not a portfolio ought to commerce, even when precise buying and selling must occur solely each few days. Human advisors might do it quarterly. Both approach, customized index building requires the consumer’s involvement, and purchasers won’t wish to be bothered each few days.

Wants consumer holdings: In follow, a customized index won’t (and mustn’t) incorporate a consumer’s different holdings. Whether or not a consumer already owns, for instance, AAPL, the overall they ought to personal must be the identical. Portfolio administration, nevertheless, must know consumer holdings in order to “push” towards the perfect possible portfolio by shopping for or promoting.

Subjective: Customized index creation incorporates folks’s private values, which is subjective, by definition. Portfolio administration is goal. One must enter many parameters to specify subjective elements, such because the index to be tracked (no matter the way it was created), or how a lot a consumer cares about monitoring versus tax effectivity. Nonetheless, given such parameters, there is just one finest reply.

Automation: Something subjective can’t be absolutely automated, since human involvement is required.

Entrance-end wants: Some people (advisors or, probably, buyers) want to check out totally different values and examine outcomes: For instance, if all shares with an ESG rating of 6 or much less are excluded, will there be too few shares left? Conversely, though a human can examine the order recommendations of a portfolio administration system, that’s not at all times needed; the orders can simply be despatched for execution. That is the case with robo advisors.

Efficiency/pace: If index building takes 0.1 or one second after a button is clicked, no human will discover. Nonetheless, if a whole bunch of hundreds of accounts are evaluated for buying and selling day by day, this distinction will add up.

Methods: Optimization might be summarized as “decrease one thing topic to constraints.” The mathematics and software program complexity comes from juggling competing objectives. Index building might contain such constraints (e.g., not more than 20% in any trade sector), however doesn’t need to contain minimization. I can assemble a customized index just by taking the S&P 500 Index, underweighting the three shares I dislike and normalizing all weights so as to add as much as 100%.

In abstract, direct indexing includes a sequence of (at the very least) two distinct logical steps. We hope this text clarified this distinction.

Iraklis Kourtidis is the founder and CEO of Rowboat Advisors, which builds investing software program for individually managed accounts with a deal with tax effectivity and direct indexing. He additionally constructed the primary absolutely automated model of direct indexing in 2013 for automated funding service Wealthfront.