In 1950 long-term U.S. authorities bonds yielded slightly greater than 2%.

By the top of that decade they might hit 4.5%. Yields jumped to six.9% by the top of the Sixties and 10.1% by the top of the inflationary Nineteen Seventies.

Then they skyrocketed within the early-Nineteen Eighties, going from simply over 10% on the finish of 1979 to almost 15% by the autumn of 1981.

In slightly over 30 years, bond yields went from 2% to fifteen%.

Absolutely, the bond market crashed…proper?

Surprisingly no.

Lengthy-term bond efficiency wasn’t nice, that’s for certain, returning simply 2.2% per yr from 1950-1981. However there wasn’t a crash like we’re seeing at the moment.

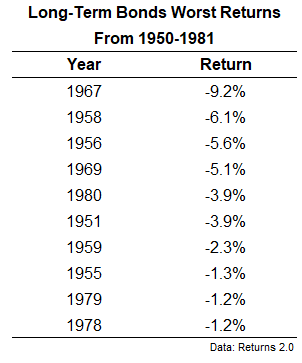

In actual fact, the worst calendar yr return for lengthy bonds on this interval was in 1967 once they fell slightly greater than 9%.

We’ve seen far better losses in lengthy bonds this century. Final yr they had been down 26%. In 2013 long-term Treasuries fell 12%. In 2009 they declined by almost 15%.

The bond bear market of the Fifties by means of the early-Nineteen Eighties was extra of a death-by-a-thousand cuts. And the supply of these cuts was inflation. Certain, annual nominal returns had been optimistic at slightly greater than 2% per yr however inflation was within the 4-5% vary over that interval.

The lengthy bond crash was on an actual foundation, not nominal. From 1950 by means of the autumn of 1981, long-term Treasuries misplaced nearly 60% of their worth on an inflation-adjusted foundation.

The change in charges again then was gradual. That’s not been the case this time round.

Yields on 30 yr Treasuries have gone from a low of round 1% in March 2020 to almost 5% slightly greater than three years later.

That aggressive re-rating in yields has led to a crash this time round.

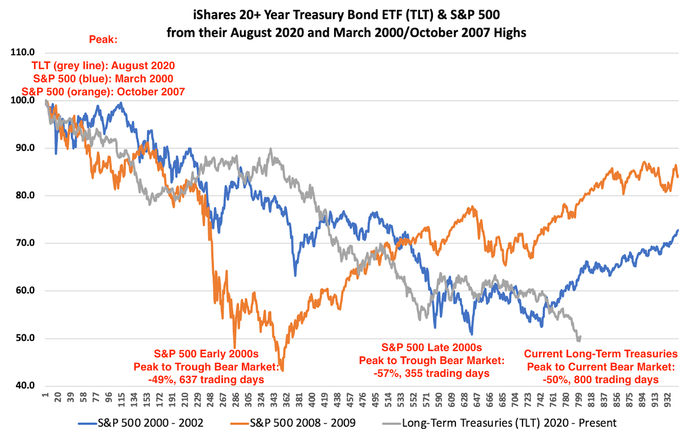

This chart from Datatrek exhibits the crash in long-term bonds is now roughly the identical magnitude because the crashes within the inventory market through the dot-com bust and the Nice Monetary Disaster:

Plus the crash is longer in bonds than it was for these two inventory market blow-ups.

Lengthy-term bonds are getting massacred.

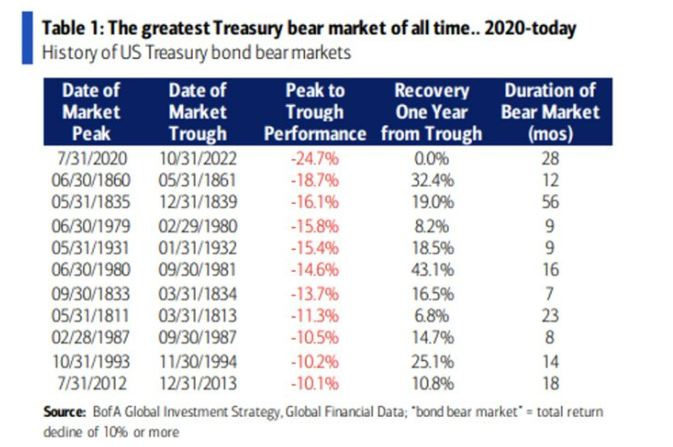

The identical is true of 10 yr Treasuries. Financial institution of America says that is the worst bear market within the benchmark bond ever:

I really needed to lookup what occurred from 1835-1839 to trigger a 56 month bear market in bonds. Apparently, President Andrew Jackson made it his objective to repay the nationwide debt in the US in its entirety. It led to one of many greatest monetary crises in American historical past. The U.S. economic system cratered 33%.

Whoops.

One of many unusual components about dwelling by means of the worst bond bear market in historical past is there doesn’t appear to be a way of panic.

If the inventory market was down 50% you higher consider buyers could be dropping their minds.

Sure, some individuals are involved about greater rates of interest however it feels fairly orderly all issues thought of.

So why aren’t individuals freaking out about bond losses extra?

It could possibly be there are extra institutional buyers in lengthy bonds than people. There are many pension funds and insurance coverage firms that personal these bonds.

It’s going to take a really very long time for buyers to get made complete however you may maintain these bonds to maturity to receives a commission again at par.

The risk-reward set-up in lengthy period bonds in 2020 was terrible. There was solely draw back with little-to-no upside. Traders have had an escape hatch in bonds in T-bills and short-term bonds. It’s not like particular person buyers maintain lengthy bonds for his or her whole mounted revenue publicity.

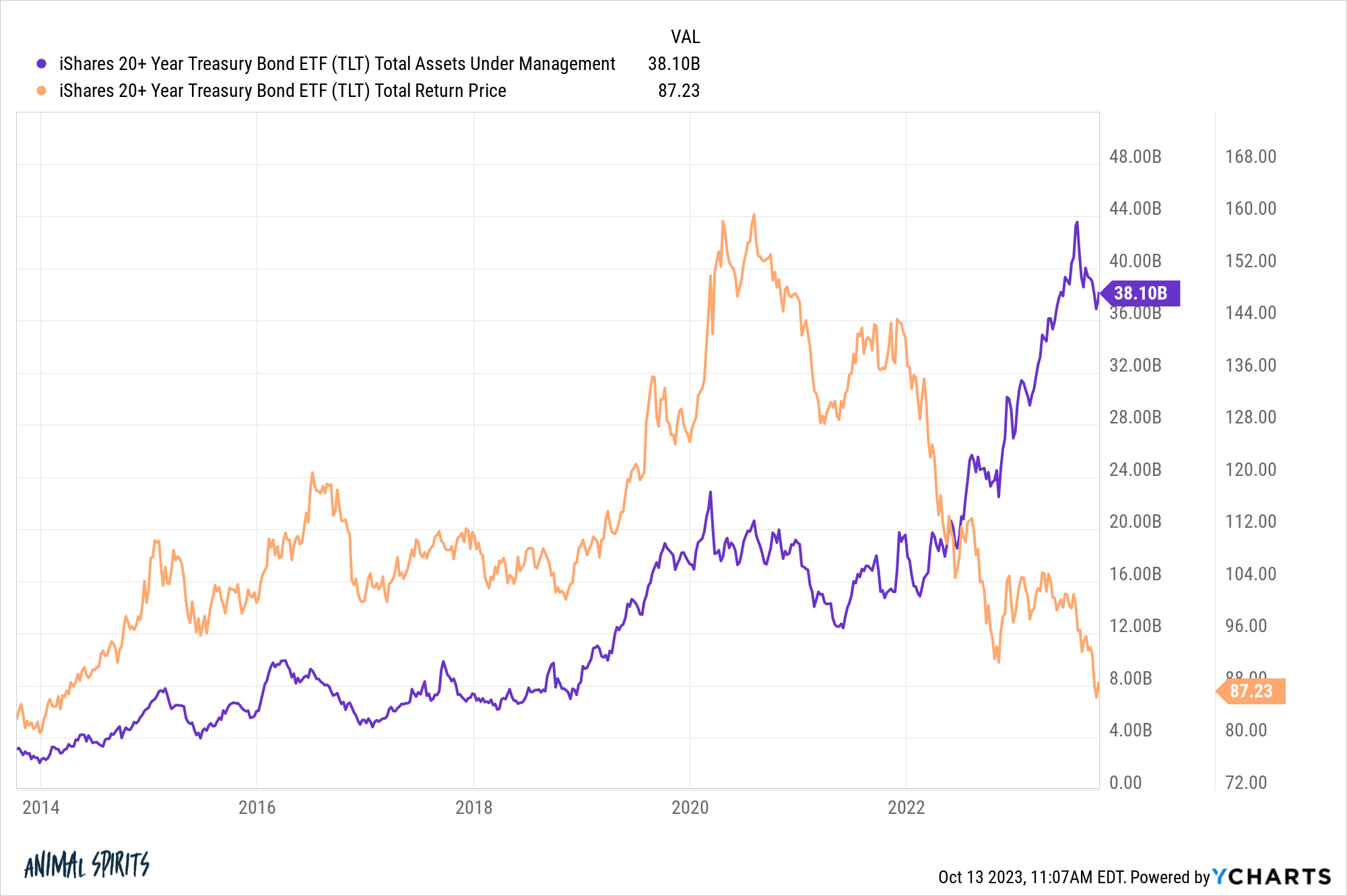

Don’t get me fallacious, there are many buyers who’ve misplaced their shirts in long-term bonds. Simply have a look at the expansion in property versus the efficiency of TLT:

Cash has been flowing into this fund through the crash. Traders have been fallacious attempting to catch a backside right here (or a prime in charges I ought to say) however this is sensible within the context of rates of interest.

Charges on bonds are greater now than they’ve been since 2007 nearly throughout the board.

The crash has been painful to reside by means of however ripping the bandaid off this time round versus the death-by-a-thousand cuts over the past bond bear market must be preferrable to buyers.

Certain, charges and inflation may maintain going up from right here. However rates of interest are actually a lot greater to behave as a margin of security.

That didn’t exist on the outset of this bear market.

Michael and I mentioned the bond bear market and far more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

The Bond Bear Market & Asset Allocation

Now right here’s what I’ve been studying currently:

Books: