A reader asks:

You talked about how child boomers have a lot cash for a era, and anecdotally so many monetary plans that I run for our people have them with far more than they want…they’re diligent savers and traders. So we have now all these boomers with extreme financial savings/investments which are unwilling to show the swap to truly spend that cash.

So my query turns into: do we have now a everlasting flooring of upper inflation sooner or later attributable to boomers really spending that money that they’ve in retirement, realizing they will’t take it to the grave OR as they move it to the following era who’re extra comfy with the spending aspect of the equation—that might create this persistent larger inflation fee for folks over the following decade or two?

I did inquire about the wealth profile of child boomers in a latest piece.

It’s true that boomers management a lot of the wealth on this nation (52% based on Federal Reserve information).

That is what I wrote in that beforehand talked about publish:

There isn’t a precedent for the boomer era. We’ve merely by no means had a demographic this huge with this a lot wealth dwell this lengthy earlier than.

We’ve got no historic information to look again at with regards to attempting to quantify the inflationary influence right here.

If all the boomers mentioned screw the youngsters and their inheritance and spent down all of their financial savings, certain you may argue that may be inflationary.

However with boomers residing longer than earlier generations, that might power them to unfold that spending out over a few years, which might mute the influence.

It’s attainable will probably be the millennials that can spend extra money.

Jean Twenge at The Atlantic took a sledgehammer to the concept that all millennials are broke.

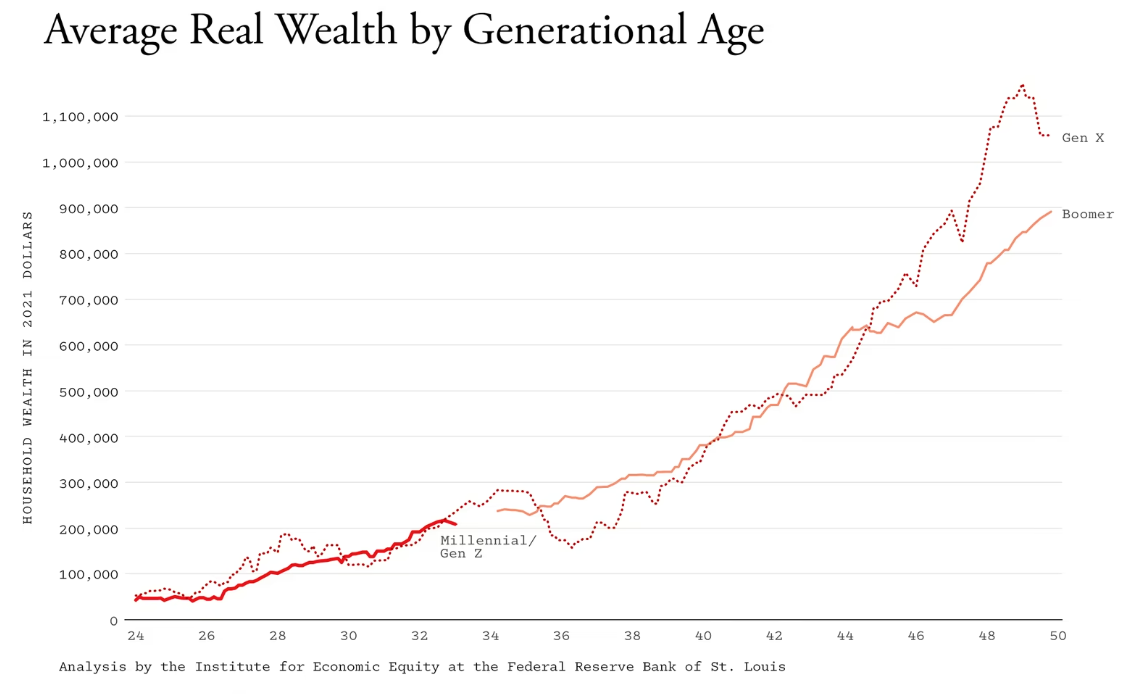

In the event you take a look at the long-term development of wealth, adjusted for inflation, millennials are proper on observe relative to earlier generations on the identical level of their lives:

And take a look at the Actuality Bites era — Gen X has surpassed the boomers by age 50!

The inflation-adjusted median revenue for millennials is round $10,000 larger than the boomers had on the identical age. And after they had been within the 25-to-39 yr age vary, 50% of boomers owned a house. That quantity is 48% for millennials.

Millennials like to complain however as an entire, they’re doing nice.

The counter-argument right here could be all the stuff that’s now costlier for millennials — housing, school, daycare, and so on.

However millennials would be the greatest, richest era sooner or later. It’s inevitable.

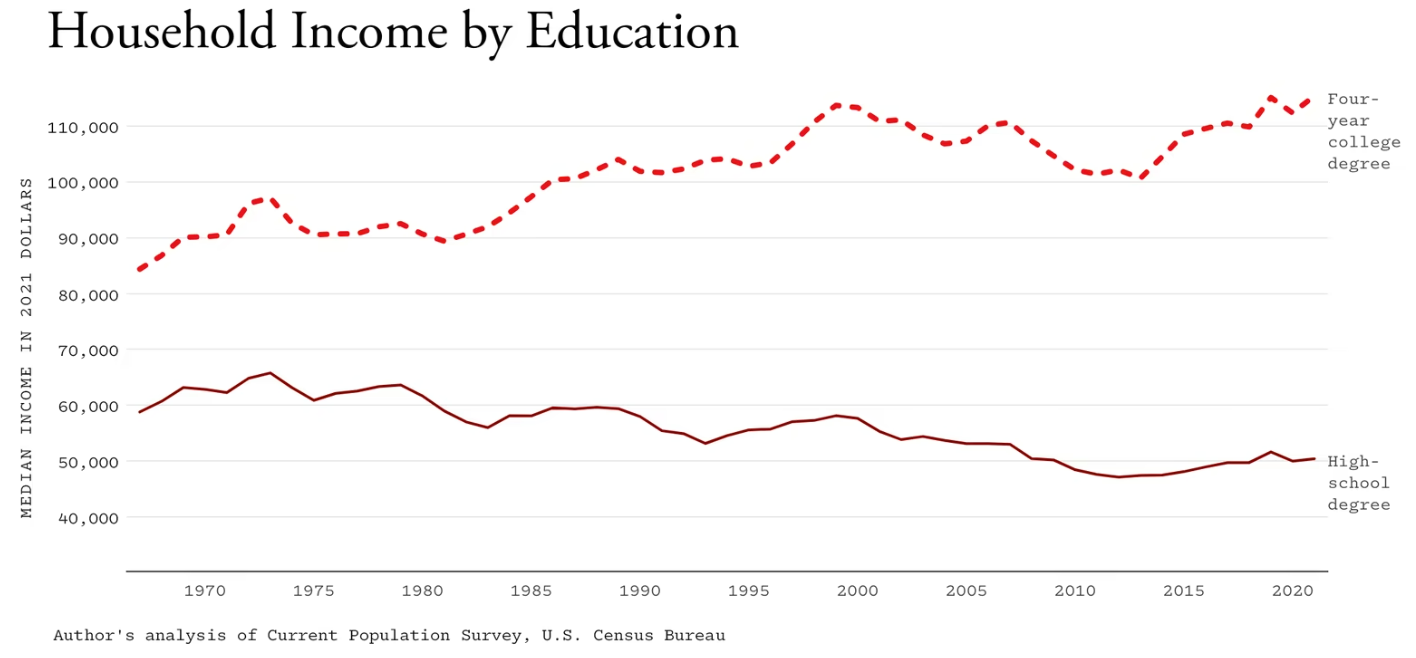

My era1 is probably the most well-educated era in historical past and meaning larger common incomes which are solely going to extend over time:

So let’s assume millennials are going to spend extra freely and management huge sums of wealth sooner or later from some mixture of their very own earnings and an inheritance from their boomer mother and father.

Will that translate right into a flooring beneath the inflation fee?

It’s attainable.

Researchers at The IMF appeared on the relationship between growing older and inflation:

We discovered that the bigger the proportion of younger and outdated within the whole inhabitants, the upper inflation. Put one other method, when the working-age inhabitants is bigger, the impact is disinflationary. This hyperlink between age and inflation holds for numerous international locations throughout all time durations.

These results are massive sufficient to elucidate most of development inflation. As an example, the infant boomers elevated inflation by an estimated 6 share factors in america between 1955 and 1975 and lowered it by 5 share factors between 1975 and 1990, after they entered working life. Development inflation is presently low and secure because the lowering share of younger folks offsets the results of the rising share of outdated folks within the inhabitants.

We’ve got a big proportion of outdated folks, which ought to be inflationary.

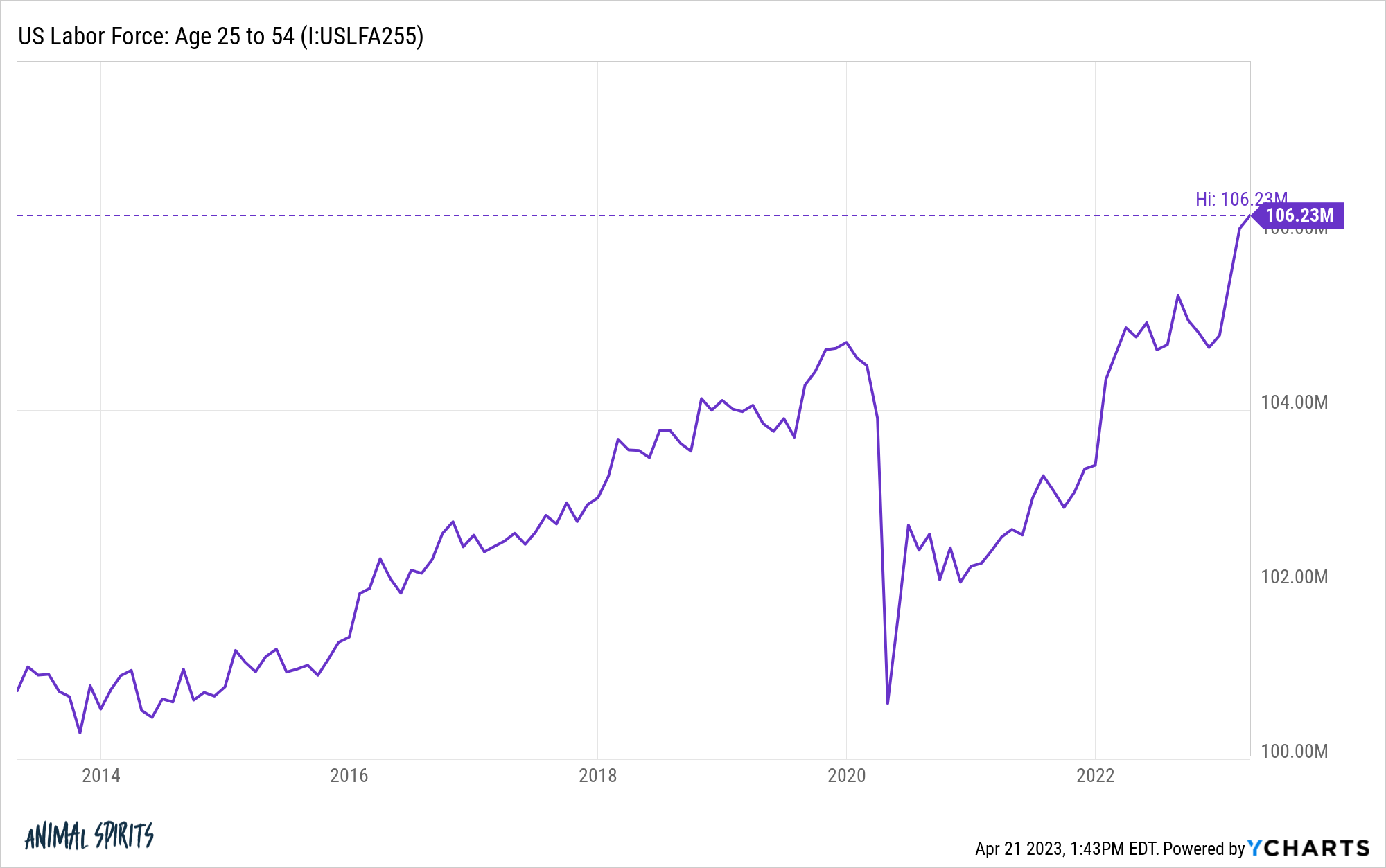

However we even have a big proportion of working-age folks, which ought to be disinflationary.

All of which is to say, it is a sophisticated matter that doesn’t have a clearcut reply (welcome to finance).

Inflation could possibly be larger if boomers spend down all of their financial savings or millennials don’t save as a lot.

Or AI might show to be a deflationary power that offsets any inflationary results of huge demographics.

If the previous 10 years have taught us something about macroeconomics, it’s that there’s a lot we nonetheless don’t learn about inflation.

The Fed tried its damnedest to extend inflation within the 2010s by holding charges low.

It didn’t work.

A pandemic hits, provide chains get disrupted, the federal government spends trillions of {dollars} and inflation goes bananas.

Now the Fed has aggressively raised charges to extend unemployment and sluggish inflation.

Inflation has slowed however the labor market stays sturdy.

Within the immortal phrases of Cousin Eddie, “She falls down a properly, her eyes go crossed. She will get kicked by a mule, they return. I don’t know.”

Predicting inflation is tough. Realizing the demographic make-up of the nation most likely doesn’t make it any simpler to foretell its future path.

Michael and I spoke about generational wealth and way more on this week’s Animal Spirits:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Demographics vs. the Inventory Market

Now right here’s what I’ve been studying these days:

1I don’t really feel like a millennial however was born in 1981 so technically I’m on of the oldest millennials within the nation.