There’s no denying we’re residing in a unprecedented time. The COVID-19 pandemic has had main implications for shoppers, companies, governments, and well being care methods around the globe. Within the wake of such uncertainty, traders are prioritizing the flexibility to mitigate ongoing dangers by integrating environmental, social, and governance (ESG) standards into their funding selections, to determine high-quality corporations which might be well-positioned for long-term progress.

In the course of the first-quarter downturn, ESG methods demonstrated distinctive resiliency relative to their friends, offering better draw back safety. This end result has crystallized conviction in ESG merchandise, whereas highlighting their aptitude to carry out throughout all market cycles. So, does this imply we’ve reached an inflection level in ESG investing as results of the coronavirus?

Assessing the Preexisting Panorama

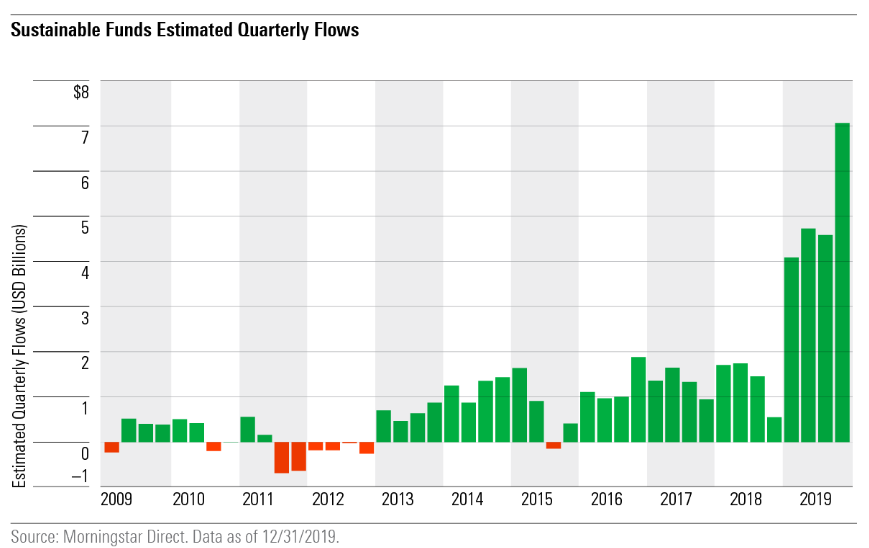

To handle this query, we should first consider the ESG panorama previous to the pandemic. Buyers’ urge for food for sustainable investments grew over the latter half of the previous decade, largely attributed to rising environmental, social, and company governance issues. From a capital allocation perspective, one in each 4 {dollars} underneath skilled administration within the U.S. employed a socially accountable technique in 2018, as reported by the USA Discussion board for Sustainable and Accountable Funding (USSIF). This translated to a exceptional complete of $12 trillion at the start of 2018, a stark improve from the $8.7 trillion at the start of 2016. Sustainable belongings reached one more report influx in 2019, raking in $20.6 billion of recent belongings within the U.S. alone. Most notably, the fourth quarter of 2019 attracted extra belongings than all of 2018 mixed, as proven within the chart beneath.

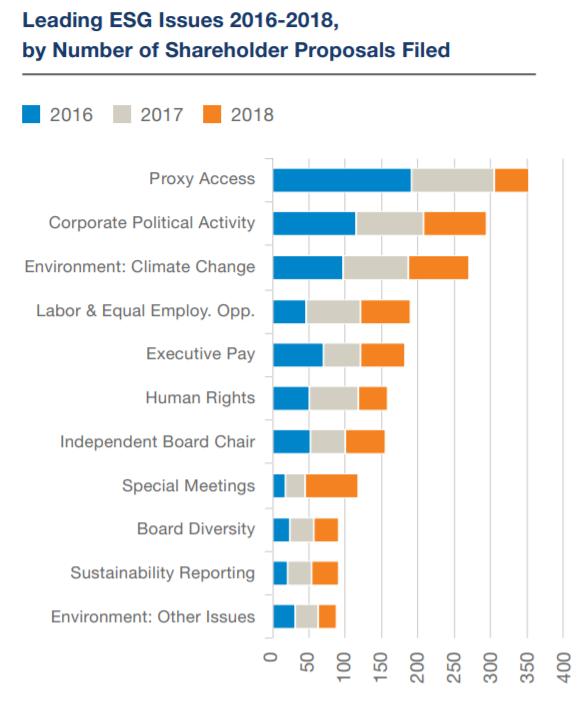

The continued curiosity and capital allocation commitments to ESG investing have gone properly past what many anticipated to be a short lived fad. Advocates have elevated tangible dangers regarding local weather change, shareholder activism, and equal employment alternatives. Shareholders additionally introduced range and human rights efforts to mild, whereas highlighting the necessity for better transparency with political spending and lobbyist exercise, as proven beneath.

Supply: USSIF Government Abstract

Trade leaders have additionally taken a stand. BlackRock’s Larry Fink addressed the severity of the present local weather disaster in his 2020 letter to CEOs, proclaiming “local weather threat is funding threat.” That’s a fairly exceptional declaration coming from the CEO of the world’s largest asset supervisor. Fink additionally pledged an ongoing dedication to “placing sustainability on the heart of how we make investments” and that his agency would make a degree to eschew corporations that offered a excessive sustainability-related threat. Moreover, the 2020 World Financial Discussion board harnessed the theme of sustainability to handle the severity of environmental affairs among the many world’s foremost enterprise, political, and cultural leaders.

With demand stronger than ever, many corporations have chosen to launch their very own ESG mutual fund or ETF merchandise, together with Goldman Sachs, BlackRock, and State Avenue International Advisors. In keeping with Morningstar information, this explosion of ESG funds totaled simply shy of 600 funds, or about $900 billion in belongings underneath administration in 2019. Upon additional evaluation, traders have indicated a transparent desire for passive methods relative to lively, with ETFs capturing a majority (60 %) of sustainable flows in 2019—sometimes in low-cost merchandise (e.g., iShares and Vanguard).

Now that we’ve unpacked the state of sustainable investing and ESG methods previous to the coronavirus, let’s dive into 2020 and the traits we’re at the moment seeing within the area.

2020: A Turning Level for ESG Investing?

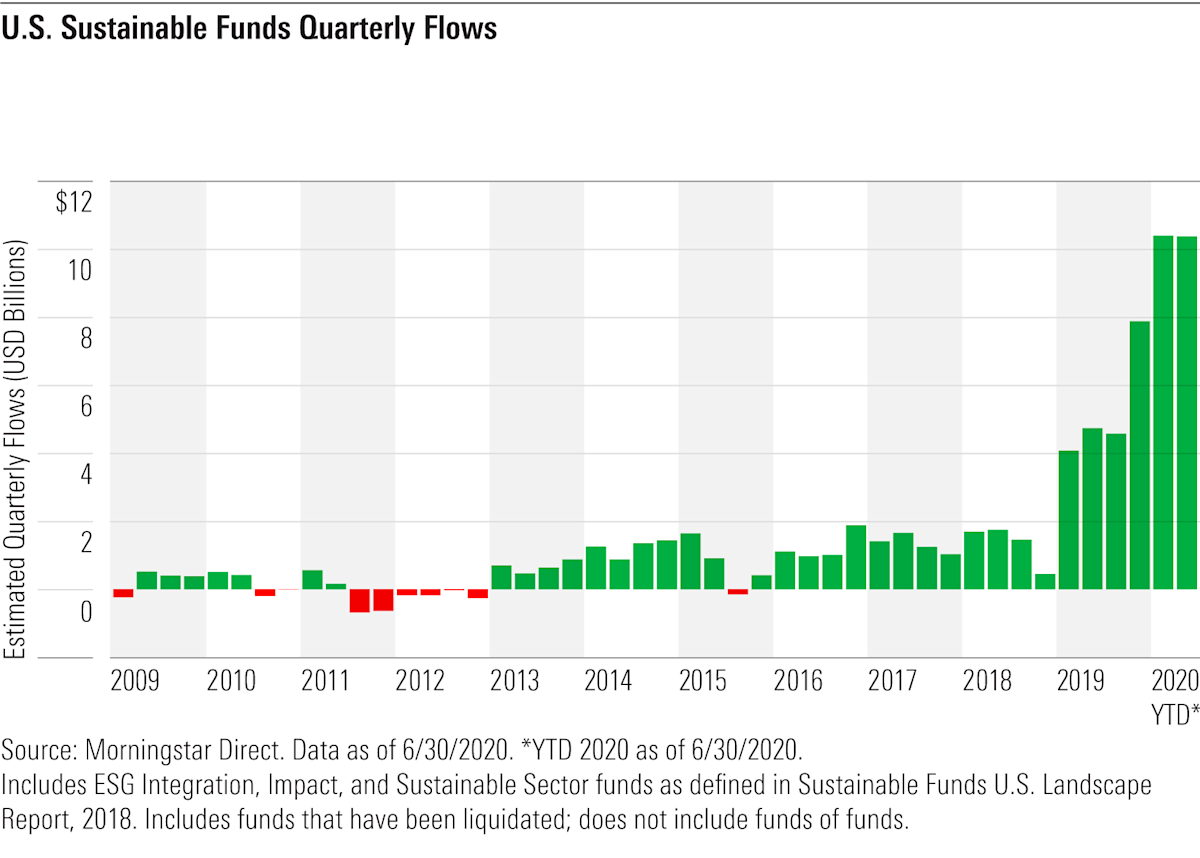

Sustainable investing skilled a prolific uptick of quarterly flows within the first half of 2020, as proven within the chart beneath. Largely, this enlargement could be attributed to the stark actuality the coronavirus solid on many companies, which have been pressured to enact contingency plans and put worker administration techniques to the check. In the meantime, shoppers crafted their very own conclusions on the businesses they routinely entrust with their capital, assessing their underlying operations on this disheveling interval.

The coronavirus has critically broadened traders’ views in the case of sustainable investing, graduating from a mere values-based method to a viable manner of investing in high-quality corporations poised for long-term progress, typically with much less risky earnings. In consequence, traders are beginning to see the chance mitigation benefits, studying to keep away from corporations that don’t combine ESG practices, given they’re possible poised for better monetary threat. Analysis by the CFA Institute helps this concept, revealing that corporations with strong ESG metrics are likely to exhibit larger profitability and stronger steadiness sheets—in the end rendering better sturdiness to climate durations of market stress.

However What About Efficiency?

When assessing efficiency—a typical barrier to entry for a lot of skeptics—ESG funds really outperformed their respective peer teams through the first two quarters of the 12 months. In keeping with Jon Hale, director of sustainable investing at Morningstar, “65 % of ESG (fairness) funds outperformed their friends, with greater than twice as many ending of their class’s prime quartile than within the backside quartile.”

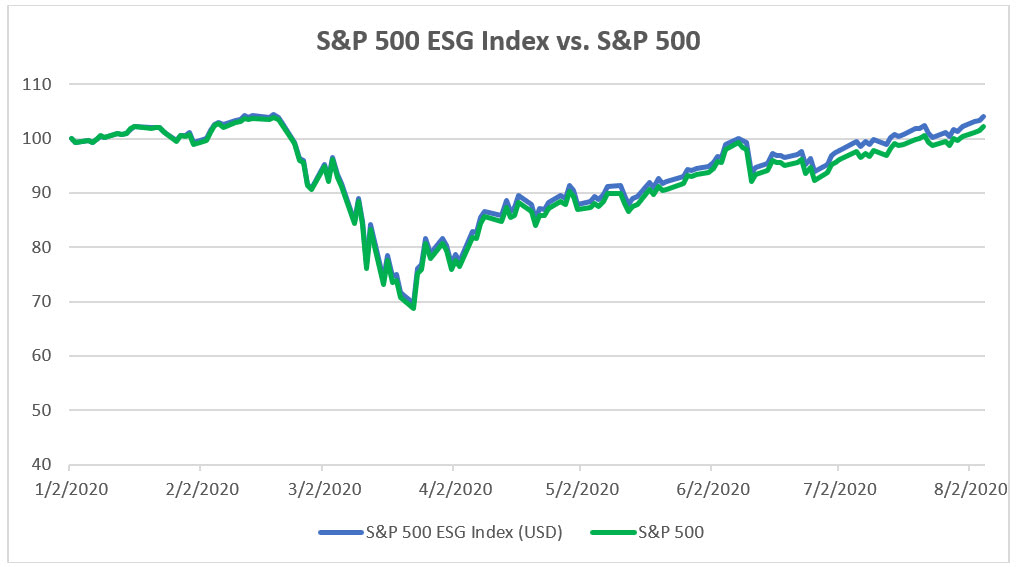

Moreover, this era has demonstrated the flexibility for ESG index funds to offer better draw back safety than their non-ESG index counterparts. As evidenced beneath, the S&P 500 ESG Index outperformed the standard S&P 500 benchmark by 3 % year-to-date. Analysis by BlackRock additional revealed the flexibility for sustainable merchandise to ship higher risk-adjusted efficiency, with 94 % of sustainable indices outperforming their mum or dad benchmarks within the first quarter. As we will see, the information additional solidifies that ESG integration can in reality result in aggressive, if not superior, efficiency.

Supply: SPDJI

Nonetheless within the Early Phases

Demand for sustainable investments (and asset flows!) has exponentially amplified all through the course of the 12 months; nonetheless, it’s too quickly to conclude whether or not the coronavirus has precipitated an inflection level within the area. The fact is, we’re nonetheless within the early phases of embracing all that ESG investing has to supply. There’s actually room for enhancements, when it comes to information availability and fostering common adoption. However there’s little question we are going to proceed to witness the benefits of this method to investing for years to return.

Environmental, social, and governance investing includes the exclusion of sure securities for nonfinancial causes. Ahead-looking statements should not ensures of future efficiency and contain sure dangers and uncertainties, that are tough to foretell. There is no such thing as a assure that any investing objective will probably be met.

The S&P 500 ESG Index is a broad-based, market-cap-weighted index that’s designed to measure the efficiency of securities assembly sustainability standards whereas sustaining comparable total business group weights because the S&P 500.

Editor’s Observe: The unique model of this text appeared on the Unbiased Market Observer.