To deposit Advance Tax, Self Evaluation tax and Common Evaluation Tax a person has to make use of challan ITNS-280. It may be paid each via web (on-line or e-payment) and at designated branches of banks empanelled with the Revenue Tax Division (offline). Our article Challan 280: Cost of Revenue Tax discusses the fundamentals of Cost of Revenue Tax. On this article we will clarify for a person what’s Challan 280, the best way to pay on-line?

You possibly can pay advance tax in India via two strategies: on-line or offline. Right here’s a breakdown of each:

On-line Cost:

- Go to the Revenue Tax Division’s e-payment web site: [income tax e payment ON Income Tax Department portal.incometax.gov.in]

- Enter your PAN and cell quantity and proceed after verification with OTP.

- Choose the Evaluation Yr (2024-25 for present state of affairs) and select “Advance Tax (100)” below Kind of Cost.

- Fill within the challan particulars like State Code, circle code (refer web site for particulars).

- Select the fee technique (web banking or debit card) and your financial institution.

- Preview the challan for accuracy and click on “Pay Now” to finish the fee.

Offline Cost:

- Obtain Challan 280 kind from the Revenue Tax Division web site.

- Fill the challan with particulars like your PAN, evaluation 12 months, tax kind (100 for Advance Tax).

- Point out the installment quantity (relies on the due date).

- Submit the finished challan at any financial institution licensed to gather tax funds.

Further Suggestions:

- Use an advance tax calculator to estimate your tax legal responsibility for correct fee.

- Make a copy of the challan (on-line fee receipt or Challan 280 copy) for record-keeping throughout ITR submitting.

- The final date for the present installment (March 2024) is March fifteenth, so make sure you pay earlier than the deadline to keep away from curiosity penalties.

Video on The right way to Pay Advance Tax On-line

Watch this video to know the best way to do Tax Cost utilizing “e-Pay Tax” Performance

Login to the net-banking web site with the person id/ password offered by the financial institution for net-banking objective and enter fee particulars on the financial institution web site.

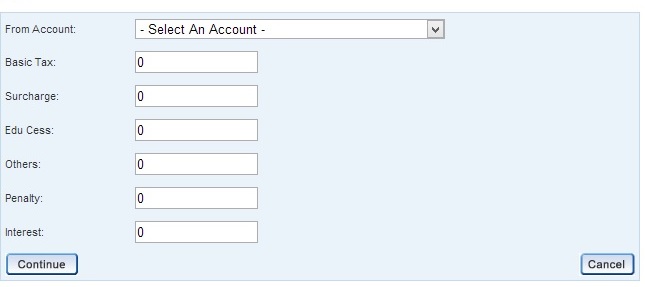

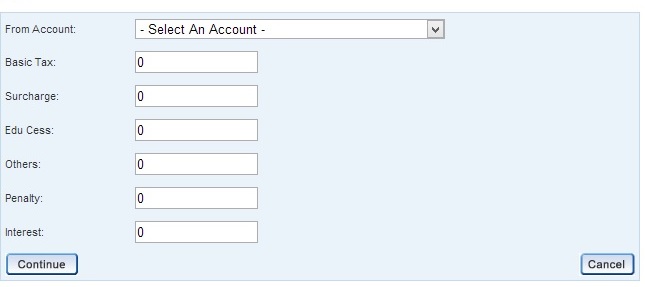

It’s essential to break up the tax payable into its parts, i.e. “Revenue Tax” and “Schooling Cess” and so on as proven in image under. There is no such thing as a Surcharge for FY 2012-13 and training cess is 3%.

- Primary tax is tax payable with none cess, curiosity and so on.

- Surcharge : is Not relevant. So Ought to be 0(zero)

- Penalty :is relevant provided that evaluation order is handed and also you obtain a discover from Revenue Tax Dept. Not relevant for Self Evaluation or Advance Tax.

- Schooling cess. : is 3% of the Primary tax.

- Curiosity : If one has to fill curiosity for late fee of advance tax and self evaluation tax 234B,234C or some other curiosity . Then it needs to be talked about right here.

- Others: Which doesn’t match into any of above class Except specifically requested ignore.

For Advance Tax: Filling solely primary tax.

For Self Evaluation Tax: One must pay training cess and likewise penalties calculated below Sections 234A/B/C and entered individually in Curiosity subject. When you’ve got detailed calculation say whereas submitting ITR fill within the values from it as proven in picture under. Else get the breakup of tax into training cess, curiosity and Primary tax.

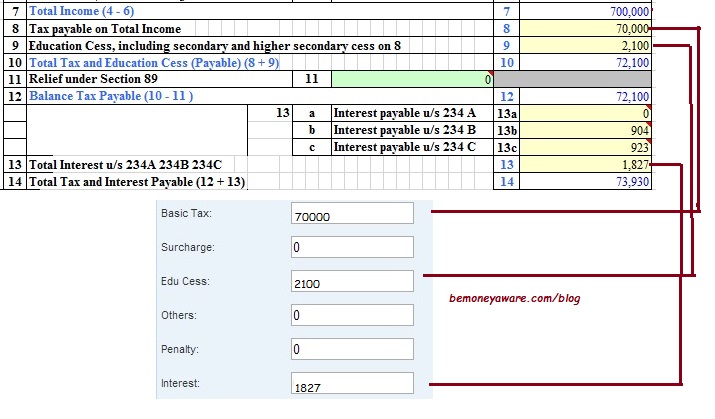

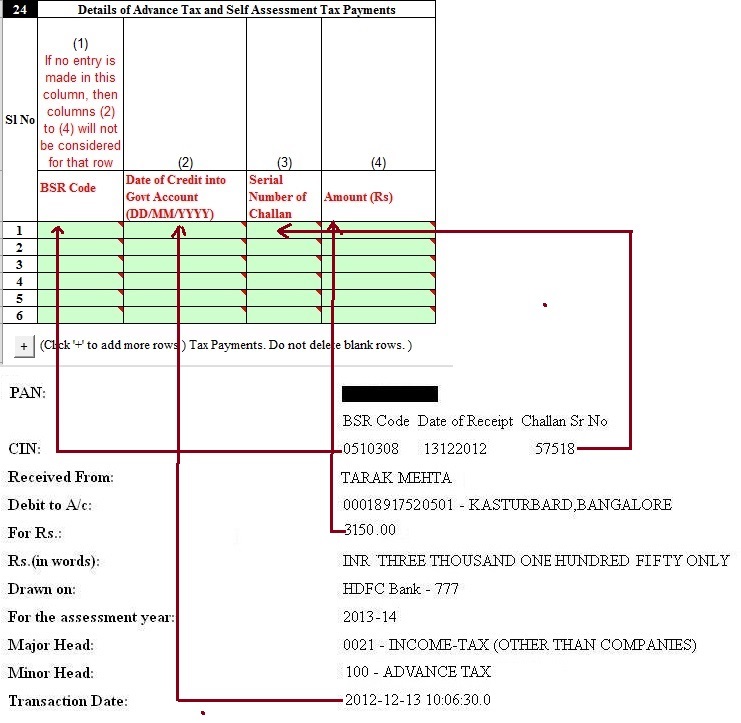

Step 5: Your financial institution will course of the transaction on-line by debiting the checking account indicated by you and on success generate a printable acknowledgement indicating the Challan Identification Quantity (CIN). Challan counterfoil will include CIN, fee particulars and financial institution title via which e-payment has been made. This counterfoil is proof of fee being made. You possibly can confirm the standing of the challan within the Challan Standing Inquiry at NSDL-TIN web site utilizing CIN after every week, after making fee.

Challan 280 e fee counter foil

If any drawback encountered

- on the NSDL web site whereas coming into non-financial knowledge then contact the TIN Name Middle at 020 – 27218080 or write to at

- Whereas coming into the monetary particulars on the net-banking webpage of your financial institution, then it is best to contact your financial institution for help.

This technique is helpful as one shouldn’t be required to personally go to the financial institution to make the funds. Cost will be made electronically at one’s comfort from anywhere the place an web facility is accessible e.g. workplace, residence, and so on. Additional, you get the Challan Identification Quantity (CIN) on-line, which is required by you while you file your return.

After paying earnings tax via Challan 280 what subsequent?

You possibly can confirm challan utilizing CIN in reciept on-line via your Type 26AS or via Challan Standing Enquiry on TIN webpage. You additionally must quote CIN quantity whereas submitting your earnings tax. Our article , Challan 280: Cost of Revenue Tax, discusses verification, correction course of intimately

When you’ve got paid Self Evaluation tax via Challan 280 fill within the particulars in Tax paid and ensure that your tax legal responsibility is 0 earlier than submitting the return as defined for ITR1 in our article Fill Excel ITR1 Type : Revenue, TDS, Advance Tax Our article Self Evaluation Tax, Pay Tax utilizing Challan 280, Updating ITR discusses it intimately.

Fill Self Evaluation Tax Particulars in ITR utilizing Challan 280

Reprint Challan 280

Revenue Tax Returns will be filed provided that now we have paid the Tax as a result of authorities. If you happen to submit the ITR with out paying then your Revenue Tax Return will be declared Faulty.

After paying Self Evaluation/Advance Tax one must obtain the Challan 280 reciept and replace Revenue Tax Return. However at instances many individuals overlook to obtain the receipt. A lot of the financial institution supply the power of re-generation of Cyber Receipt/ Challan for the e-Cost of Direct Taxes via TIN-NSDL web site.

Banks add challan particulars to TIN in 3 working days foundation after the conclusion of the tax fee. On the day after the financial institution uploads the small print of self evaluation/advance tax to TIN, it will likely be robotically posted into your Type 26AS.

However what if you wish to get particulars of your challan now and may’t need for Type 26AS Updation. For instance submitting ITR close to the deadline. Then you definately want facility to regenerate Challan 280/reprint Challan 280. Many Banks present this facility. Now we have up to date particulars from SBI, HDFC financial institution and ICICI Financial institution in our article Reprint Challan 280 or Regenerate Challan 280

For extra queries : Examine TIN-NSDL’s Ceaselessly Requested Questions (FAQ) on e-payment

Disclaimer: Please do not construe this as skilled monetary recommendation. Whereas efforts have been made to offer right info, that is our understanding of the Revenue tax regulation. Apologies upfront for any errors. Please tell us and we are going to right. Please don’t ship us emails asking us to test your earnings tax element. However if in case you have any doubt on the article or some clarification is required otherwise you really feel some info is improper. Please go away it in remark part so that every one readers can profit. For particulars test our Disclaimer.

[poll id=”33″]

On this article now we have tried to cowl the best way to pay earnings tax utilizing challan ITNS-280. Do you pay Challan 280 on-line or offline? Do you pay Schooling cess whereas filling the Advance Tax? What have been your expertise in paying via Challan 280? Did you just like the article?