Most traders are danger averse, main them to dislike securities exhibiting destructive skewness (longer/fatter left tails, with the danger of a giant loss), making a danger premium for these securities. Property with destructive skewness are related to larger anticipated returns. Nonetheless, as skewness will increase and turns into constructive, the relation between volatility and returns turns into destructive—traders might settle for low returns and excessive volatility as a result of they’re interested in excessive constructive skewness. That is known as the “lottery impact”—a big probability of a destructive final result, with a small probability of an excessive constructive final result).

Attracted by the low nominal value of choices (offering leverage) and their lottery-like potential outcomes, together with the perceived potential for producing fast earnings, buying and selling in choices by retail traders has exploded. Most choices trades by retail traders are buys, as they’ve constructive skewness (the lottery-like distribution), whereas sells have destructive skewness (the revenue is proscribed to the dimensions of the premium). The latest observe of charging zero commissions has additionally inspired buying and selling. Cost for order stream (PFOF), whereby the market makers to whom a brokerage agency routes its orders for execution pay for the orders they obtain, pioneered by the cell app Robinhood in 2015, creates an incentive for brokerages to encourage traders to commerce extra and to commerce belongings with bigger spreads. That’s the reason the chance to commerce choices is displayed prominently on gamified investing apps utilized by the brand new era of traders—more likely to their detriment. In 2021 the annual PFOF from choices was $2.4 billion in comparison with $1.3 billion from equities.

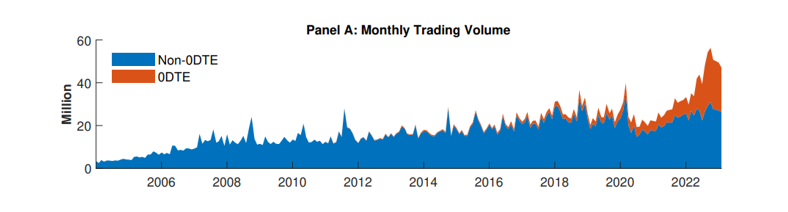

As a result of retail traders love the low nominal value of choices, similar (zero) day choices are interesting as a result of the shorter the time to expiration, the decrease the nominal value. To that finish, in 2005 the Chicago Board Choices Change initiated a pilot program that launched weekly choices with expiration dates on every Friday. In 2016, Monday and Wednesday expirations had been added. And in Might 2022, it launched choices that expire on every weekday.

Lately, so-called “0DTE” choices (quick for zero days to expiration) represented greater than 75% of the overall quantity retail traders transacted in S&P 500 Index choices. Virtually all the development in S&P 500 choices buying and selling over the previous couple of years may be attributed to those ultra-short-term contracts.

Serving to to create the speculative demand are quite a few web sites geared toward instructing retailers commerce these choices, and “0DTE” is incessantly mentioned on the favored wallstreetbets discussion board on Reddit.

Are retail traders benefiting from these improvements, or are the winners the exchanges and broker-dealers (the “on line casino operators”)? Heiner Beckmeyer, Nicole Branger and Leander Gayda, authors of the March 2023 research “Retail Merchants Love 0DTE Choices… However Ought to They?,” sought to reply that query. Their full information set of intraday commerce information began in January 2005 and resulted in February 2023. Their information set of 0DTE choices spanned the interval January 2021-February 2023. Listed here are their key findings:

The entire share of retail buying and selling of 0DTE choices exceeded 6%, and round 75% of all retail trades in S&P 500 choices had been in 0DTE choices. Greater than 40% of all traded contracts expired on the identical day, and most positions in these ultra-short-term choices had been closed earlier than maturity. Retail traders additionally favored small order sizes, with 72.2% of all orders buying and selling a single possibility, 25.2% buying and selling between two and 5 choices and solely 2.6% buying and selling between six and 10 choices.

Efficient spreads had been decrease for retail trades: 6.1% for calls and 4.9% for places in comparison with 13.1% and 10.1% for non-retail trades. Non-retail traders choose to commerce in small tons due to market affect prices. Nonetheless, greater than half of their quantity was transacted by orders of 11 or extra contracts. Regardless of spreads widening as the choice approached expiration, retail traders continued to commerce 0DTE choices with lower than an hour till expiration.

Retail traders purchased extra 0DTE choices than they bought—leaving the choices market maker with a net-short place. The mixture net-short place of market makers in 0DTE choices has grown significantly in latest months. Possibility market makers’ hedging exercise has the potential to exacerbate intraday market swings.

Retail traders persistently misplaced cash. Throughout the pattern interval of a bit over two years, retail traders misplaced greater than $70 million. Retail losses from 0DTE choices have grown over time, particularly because the introduction of choices expirations on each weekday. Whereas common day by day retail losses had been $184,000 for all the pattern, since Might 16, 2022 (the introduction of a day by day expiration calendar), day by day retail losses grew to $358,000. About 60% of day by day losses had been the results of transaction prices, 60% had been pushed by investments in 0DTE put choices, and retail buys confirmed significantly poor efficiency (patrons of choices pay the variance danger premium and have destructive anticipated returns even earlier than bills).

Whereas lengthy positions in choices misplaced cash on common, quick positions had been worthwhile even after charges (by offering insurance coverage, sellers can seize no less than a portion of the variance danger premium). Whereas the common lengthy place of retail traders misplaced 53% of its worth throughout the total pattern and 61% for the pattern since Might 2022, promoting insurance coverage earned a big premium for the common commerce, with returns of 48% and 56%, respectively. Sadly, retail traders had been extra typically lengthy than quick, leading to internet combination losses.

Finally, market makers profited from retail demand in 0DTE choices by excessive ranges of charges, bigger than for the remaining retail orders, together with short-term choices with solely per week to expiration.

Their findings led Beckmeyer, Branger and Gayda to conclude: “Retail merchants exhibit a robust choice for high-risk, lottery-like belongings and have discovered the proper funding car in 0DTE choices.” Sadly, it appears they fail to account for the appreciable spreads they incur when buying and selling. “Their starvation for lottery-like belongings results in giant combination losses.”

The authors’ findings are in line with these of Svetlana Bryzgalova, Anna Pavlova and Taisiya Sikorskaya of their April 2022 research “Retail Buying and selling in Choices and the Rise of the Huge Three Wholesalers.” They analyzed the choices buying and selling of retail traders and its profitability and located that from November 2019 by June 2021, after buying and selling prices retail trades misplaced greater than $4 billion! They concluded “retail traders’ motives for buying and selling look like playing and leisure and that they incur substantial losses on their choices investments”—a lot bigger than their losses on fairness trades.

Investor Takeaways

Elimination of commissions has fueled a retail participation growth in monetary markets, an increase in day buying and selling and the “gamification” of investing. The success of the zero-commission enterprise mannequin depends on funds for order stream from intermediaries that execute retail orders. That mannequin incentivizes brokerages to induce extra buying and selling. On condition that retail traders are mainly uninformed and are drawn to lottery-like investing, wholesalers (like casinos) are extracting billions in spreads from the pockets of naive people. As a result of bid-ask spreads on choices exchanges are significantly larger than these on inventory exchanges, market makers that obtain retail purchase and promote orders are more likely to profit extra from executing transactions in choices, typically crossing these trades. Including to the losses brought on by costly buying and selling is the failure of naive retail traders to optimally train choices.

Larry Swedroe has authored or co-authored 18 books on investing. His newest is Your Important Information to Sustainable Investing. All opinions expressed are solely his opinions and don’t replicate the opinions of Buckingham Strategic Wealth or its associates. This data is offered for basic data functions solely and shouldn’t be construed as monetary, tax or authorized recommendation.