Some random market ideas after a pleasant lengthy vacation weekend:

Tech shares don’t want decrease charges to go up. Tech shares acquired crushed final 12 months with the Nasdaq 100 falling greater than 30%. The Fed raised rates of interest from 0% to greater than 4% in order that didn’t assist long-duration property like progress shares.

However there was this idea many individuals latched onto that tech shares have been solely a charges play.

Within the 2010s and early-2020s charges have been on the ground whereas tech shares went bananas so it appeared obvious that there was an inverse relationship. When charges have been decrease tech shares would do effectively and when charges have been greater tech shares would do poorly.

Nevertheless, this 12 months the Fed has now taken charges over 5% and will proceed elevating charges one, possibly two extra occasions earlier than all is claimed and performed. In the meantime, the Nasdaq 100 is up greater than 30% in 2023.

Does this imply simple cash had nothing to do with tech inventory features? I wouldn’t go that far.

Low charges definitely helped long-duration property.

However low charges alone didn’t trigger Apple to extend gross sales from $170 billion to almost $400 billion in 10 years. Low charges don’t have anything to do with the AI hypothesis at present happening with NVIDIA shares.

Rates of interest are an vital variable in relation to the markets and economic system. However charges alone don’t inform you the entire story in relation to the place folks put their cash.

Tech shares have been additionally a elementary play on improvements which have now turn into an integral a part of all our lives.

The inventory market nonetheless likes disinflation. Over the previous 94 years the inflation charge has been greater from one 12 months to the subsequent 50 occasions and decrease 44 occasions.1

On common, the inventory market has significantly better returns in a 12 months when inflation is decrease than when it’s greater.

Because the late-Nineteen Twenties, the typical annualized return for the S&P 500 when inflation is greater 12 months over 12 months is 5.5%.

The common return when inflation is decrease 12 months over 12 months is 14.3%.

This doesn’t at all times work. Identical to rates of interest and tech shares, no market relationship is ready in stone.

But it surely appears like inflation is heading decrease and that’s in all probability an excellent factor for the inventory market if that pattern continues.

TV reveals are the brand new motion pictures. I noticed this checklist of the summer time’s most anticipated motion pictures:

Oof.

I’ll watch the brand new Mission Not possible as a result of it’s Tom Cruise and signal me up for Oppenheimer however the remainder of these are retreads and sequels that don’t encourage a whole lot of confidence in Hollywood’s creativity.

However, I simply acquired performed watching the finale for Succession this weekend and it’s simply the highest-quality present I’ve ever seen. The performing and writing have been phenomenal.

The present is now on my Mount Rushmore with Breaking Dangerous, The Sopranos and The Wire (Mad Males and Six Toes Below are in all probability subsequent in line).

I assume the individuals who used to make high-quality motion pictures have moved on to TV.

The economic system is extra resilient than anybody thought. Betting in opposition to the inventory market is normally a dropping proposition. You might in all probability say the identical factor about betting in opposition to the U.S. shopper.

We love spending cash on this nation and the pandemic appears to have accelerated this want.

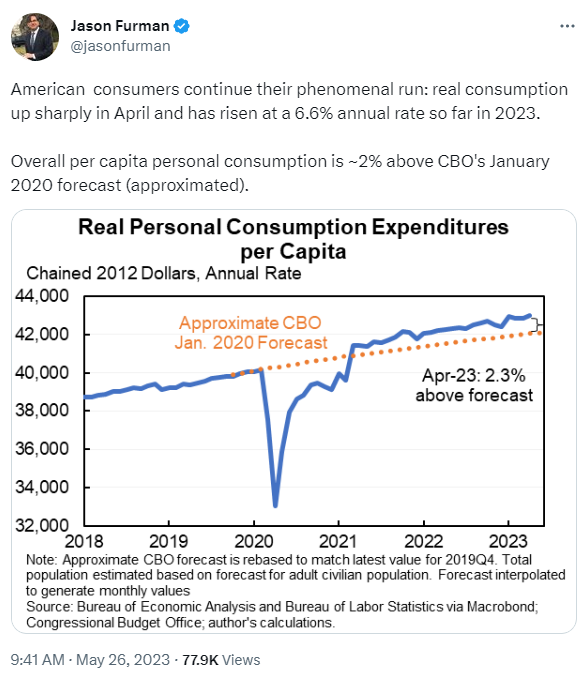

Jason Furman not too long ago shared a chart that reveals how far above-trend spending is:

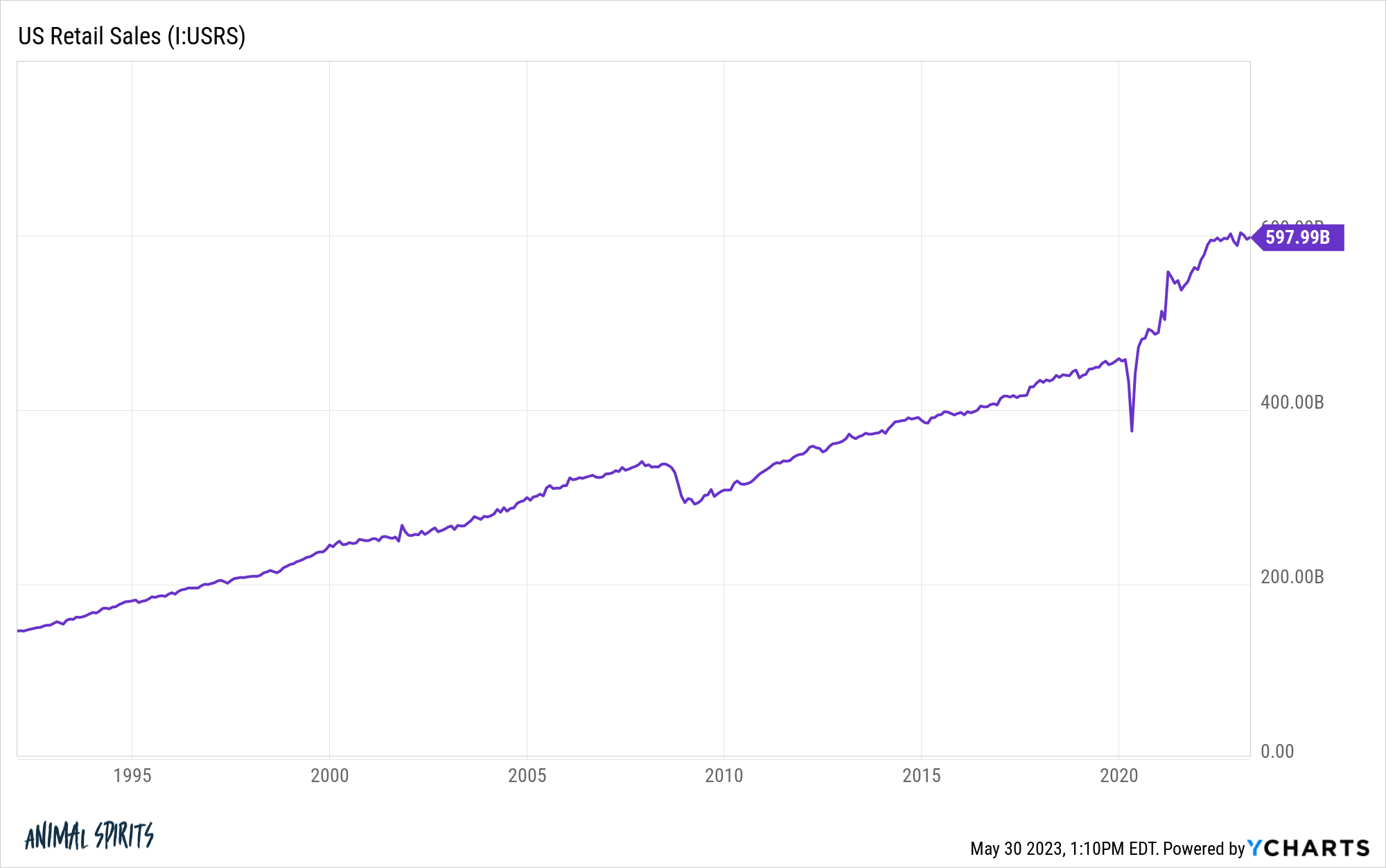

This one at all times blows me away too:

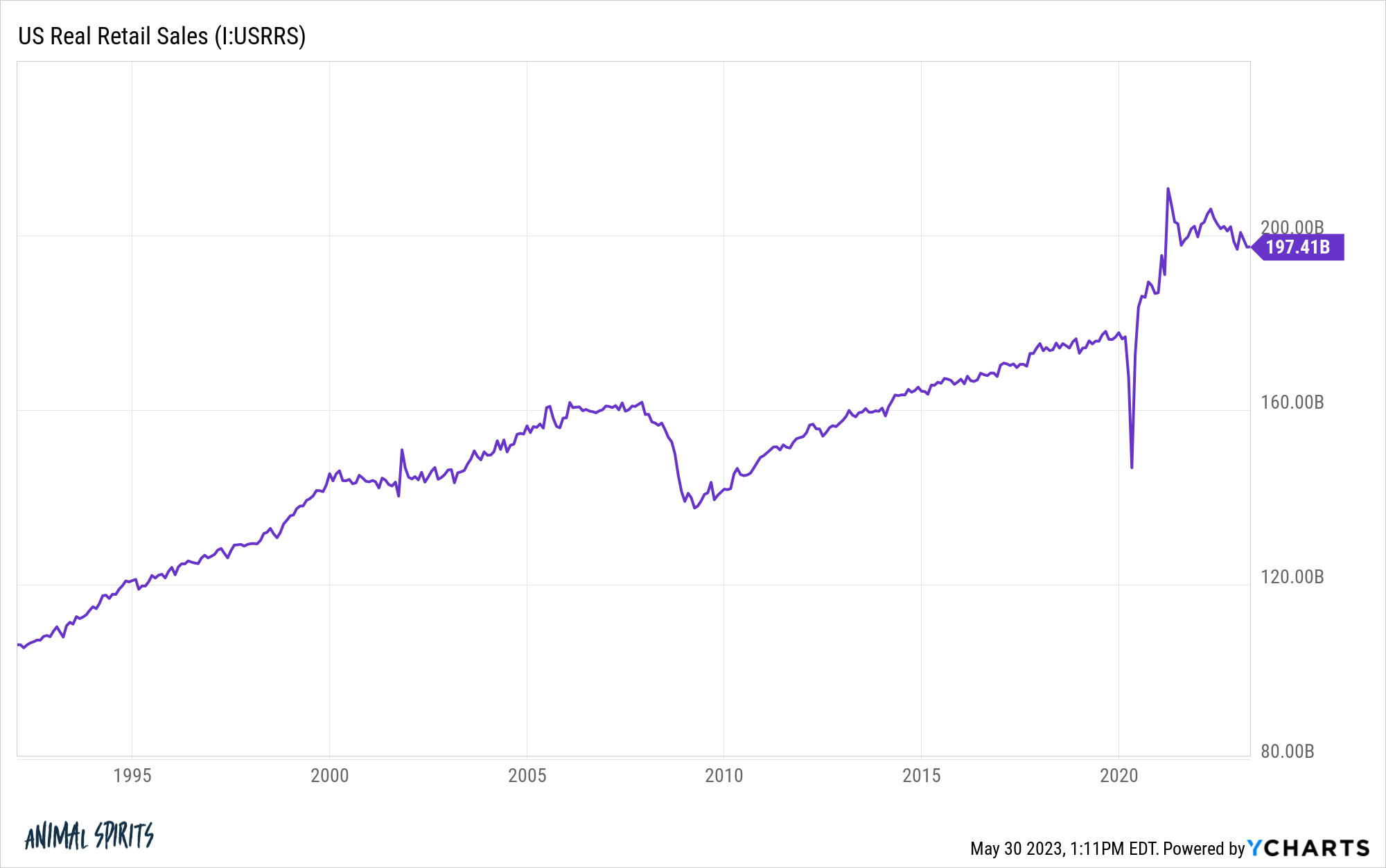

Certain a whole lot of this has to do with inflation, however even on an actual foundation the sum of money we’ve been spending is effectively above the earlier pattern:

There have been loads of individuals who assumed the economic system was hooked on 0% rates of interest. It felt just like the Fed couldn’t presumably increase charges this excessive, this quick with out breaking one thing.

Lots of people thought we have been already in a recession in 2021 and 2022. Take a look at this headline from final July:

Possibly these things works on a actually lengthy lag however shade me as shocked as the subsequent individual in relation to the resiliency of the U.S. economic system.

Greater charges and inflation don’t assure poor inventory market returns. There are a whole lot of market/econ individuals who suppose we could possibly be in a brand new regime of upper charges and better inflation.

It’s a risk value contemplating.

A lot of those self same folks assume this will probably be a nasty factor for markets. In any case, the previous 40+ years of economic market returns are all of a product of disinflation and falling charges, proper? Proper?

Not so quick.

These are the typical annual returns for the U.S. inventory market over a 40 12 months interval of rising inflation and rates of interest:

- 1940-1979: 10.3% per 12 months

And these are the typical annual returns for the U.S. inventory market over a 40 12 months interval of falling inflation and rates of interest:

- 1980-2019: 11.7% per 12 months

The outcomes are stunning.2

Issues have been higher through the 1980-2019 interval however not as a lot as one would suppose.3

I don’t know if we’re getting into a brand new regime of upper charges and inflation. But when we’re it doesn’t essentially imply the inventory market is doomed.4

Issues typically work out…more often than not. I tweeted this through the weekend of the SVB banking disaster once we nonetheless didn’t know if extra financial institution runs have been to return the next Monday:

I’m not naive.

Dangerous stuff does occur. The world is usually a merciless place.

However more often than not the world doesn’t finish. And if it does your portfolio positioning isn’t going to matter.

For this reason I wasn’t too involved about the debt ceiling discourse. Certain it might have led to a catastrophe and it’d sometime if a loopy politician takes issues too far.

I simply don’t see the necessity to default to a pessimistic view of the world simply because issues aren’t good on a regular basis.

I do know there have been be one other disaster sooner or later. We’ll have a recession. The inventory market will crash. Issues will look bleak.

‘Issues don’t at all times work out however more often than not they do’ will proceed to be my default stance.

In any case, what’s the purpose of investing within the first place if you happen to don’t suppose issues will get higher sooner or later?

Additional Studying:

Can We Get Bubble with Greater Curiosity Charges?

1After I say decrease I don’t essentially imply deflation. It could possibly be going from 3% inflation to 2% inflation. Nonetheless up however simply at a decrease charge of change.

2Clearly actual returns have been decrease within the first 40 12 months interval than the second. Inflation averaged 4.3% from 1940-1979 and three.2% from 1980-2019. Nonetheless nearer than you anticipated proper?

3Bond returns had a a lot greater vary. From 1940-1979 the 5 12 months treasury returned 3.4%. From 1980-2019 they returned 7.1% per 12 months. However this had extra to do with greater beginning yields in 1980 and decrease beginning yields in 1940 than rising or falling rates of interest.

4I do know it looks like two inflation stats on this put up are in battle with each other however my takeaway is inflation issues extra to shares within the short-run than the long-run.