These had been a few of the prevailing narratives from the post-GFC world:

- We solely had a bull market within the 2010s due to the Fed juicing the financial system.

- The one motive tech shares did effectively is due to low rates of interest.

- The one motive shares saved recovering from each correction so shortly is due to the Fed put.

These narratives all have a kernel of reality to them.

The Fed was attempting to juice the financial system within the 2010s to get us out of the Nice Monetary Disaster malaise. Know-how firms did profit from low borrowing prices. And the Fed did step in throughout a handful of the downturns we’ve skilled.

However many individuals took these narratives as gospel.

That gospel was put to the check in 2023 and it seems it wasn’t written in stone.

The Federal Reserve performs an necessary function in our financial system and the functioning of the credit score markets. However buyers give the Fed far an excessive amount of credit score and blame for the way issues shake out within the monetary markets.

The Fed does management extremely quick rates of interest by setting the Fed Funds Price however they don’t management the lengthy finish of the curve.

Simply have a look at 10 Treasury yield this 12 months alone:

The ten 12 months went from a low of three.3% within the spring then shot as much as 5% this fall for no obvious motive by any means. Since then yields have fallen again to 4.2% in a rush. That’s not the Fed; that’s the market.

Lots of people wish to blame the Fed for permitting inflation to get uncontrolled following the pandemic. I do agree the Fed ought to have acted sooner.

However would it not have mattered as a lot as individuals suppose?

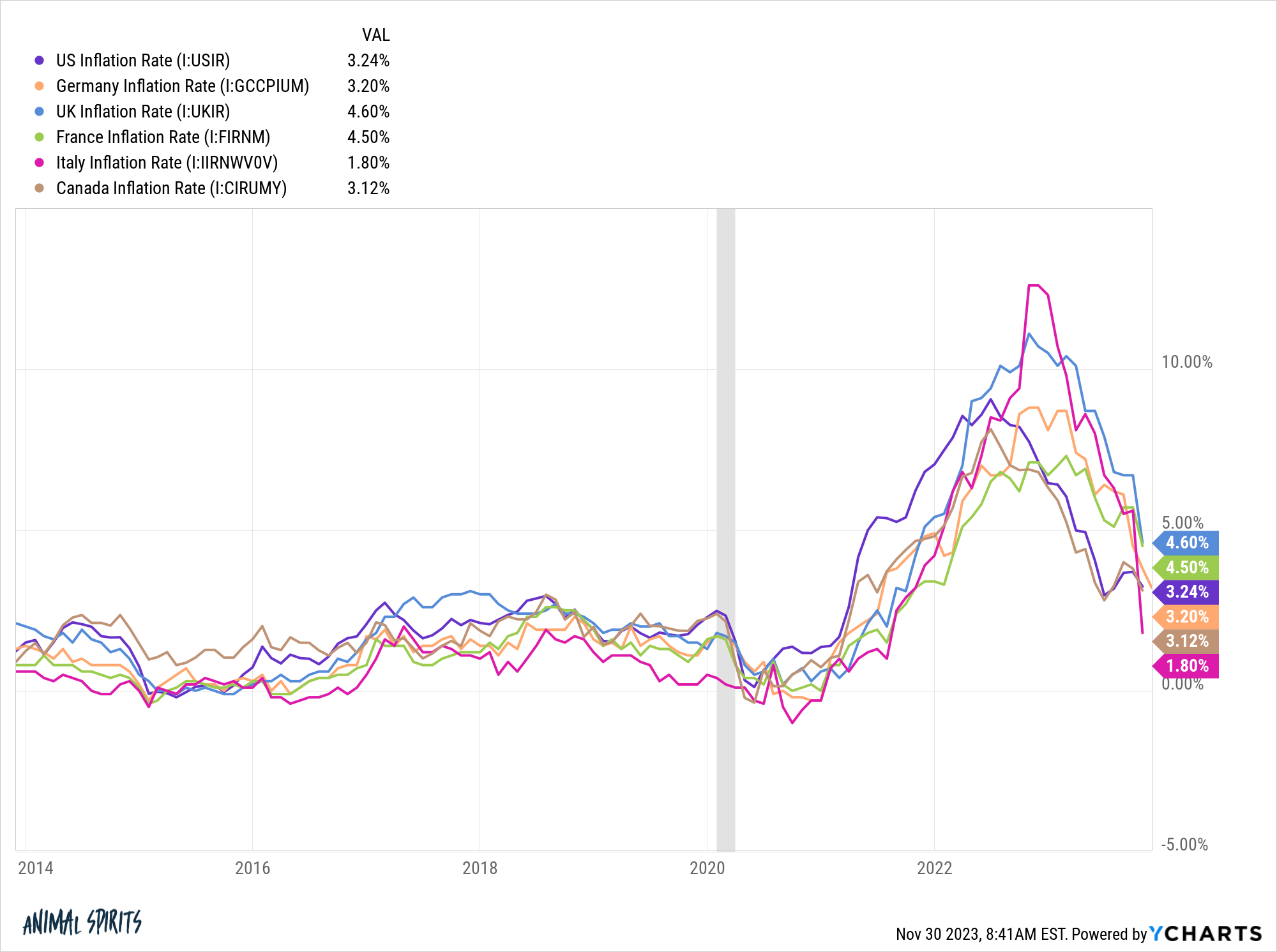

Simply have a look at the trail of inflation readings throughout different developed economies:

All of those international locations had completely different fiscal and financial coverage responses to the Covid outbreak. And but inflation charges all went up on the identical time and fell on the identical time.

Was the Fed and U.S. authorities spending actually in charge for inflation across the globe?

And might we actually give the Fed credit score for bringing inflation down by way of rate of interest hikes if inflation fell in these different international locations concurrently?

Hear, I’m not saying the Fed’s charge hikes had no bearing on inflation. It actually helped sluggish sizzling sectors of the financial system just like the housing market. And shoppers attempting to borrow are feeling the ache of upper charges.

However their actions have mattered far lower than you suppose throughout this weird pandemic-induced financial cycle.

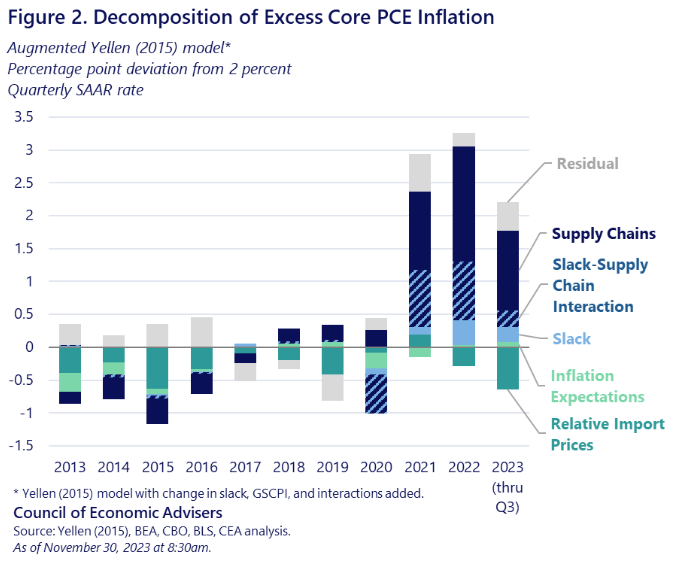

Take a look at this chart that breaks down the surplus inflation we’ve skilled these previous few years:

Most of it got here from provide chain shocks.

Clearly, the elevated shopper demand that took place due to the fiscal coverage response performed an enormous function in these provide chain issues. Inflation took place from provide issues that coincided with pent-up shopper demand.

However that wasn’t the Fed’s doing. The federal government was attempting to maintain the financial system afloat whereas companies had been getting ready for armageddon.

The Fed’s low rate of interest insurance policies don’t management the inventory market both. Charges matter however they’re not the be-all-end-all.

Sure, rising rates of interest had been one of many causes for the bear market in 2022. Going from 0% to five% in such a brief time period actually modified the dynamic within the markets. However that doesn’t imply the inventory market solely goes up when rates of interest are low.

That’s foolish discuss.

The Fed raised charges 375 foundation factors final 12 months and the inventory market bought off. However the Fed raised charges one other 150 foundation factors and has shrunk the scale of its steadiness sheet in 2023. The Nasdaq 100 is up virtually 50% on the 12 months. The S&P 500 has risen 20%.

Shares went right into a bear market and the Fed saved slamming on the breaks. There was no Fed put this time round. The Fed didn’t step in to decrease charges like they did throughout the 2018 bear market.

Nope, the inventory market has come charging again to inside spitting distance of latest all-time highs regardless of the actions of the Fed, 40 12 months excessive inflation, two wars, mortgage charges going from 3% to eight%, authorities bond yields spiking and Taylor Swift live performance tickets promoting for $2,500.

I do know everybody desires to say the one motive we had a bull market within the 2010s is due to the Fed however isn’t it attainable shares went up loads as a result of they crashed 60% through the Nice Monetary Disaster?

And if low rates of interest are the only real motive shares go up, why didn’t we see large bull markets in European and Japanese shares within the 2010s as effectively? Their charges had been even decrease than ours.

There are a great deal of completely different variables that affect the monetary markets and the financial system. Financial coverage is a type of variables but it surely’s a blunt device.

The Fed saved rates of interest on the ground for almost all of the 2010s in hopes of accelerating inflation and progress. It didn’t occur. Then they stated they wished inflation to run just a little sizzling popping out of the pandemic. As a substitute it was scorching sizzling.

The Fed doesn’t management the financial system or the inventory market identical to the president doesn’t management fuel costs or inflation or wages or financial progress.

Life can be loads simpler if authorities officers may pull a lever to make inventory costs go up and shopper costs go down but it surely doesn’t work that manner.

The Fed might help because the lender of final resort throughout a monetary disaster. They will additionally make the bubbles greater throughout a increase in the event that they’re not cautious and have carried out so previously.

The Fed doesn’t matter as a lot as you may suppose in the case of one thing as huge and sophisticated because the $27 trillion U.S. financial system or the $50 trillion U.S. inventory market.

Additional Studying:

Bear in mind Don’t Battle the Fed?