Most individuals know me as a life insurance coverage advisor and enterprise advisor. However I’ve been in gross sales for the reason that age of seven. No matter what you consider salespeople, the teachings I’ve discovered about promoting and downside fixing have served me effectively all through my profession, not solely as a monetary advisor, but additionally as a volunteer and officer of not-for-profit organizations. I consider gross sales expertise might help anybody, even should you’re an introvert by nature, don’t play golf and by no means considered your self as a pure salesperson or “nearer.”

Let me clarify.

After incomes my MBA as a younger man, my mom threw a match once I advised her I used to be going to promote insurance coverage for a dwelling. She supported me by means of 4 years of faculty and proudly watched work by means of graduate college to earn my masters. She wished me to be an lawyer, a banker or a company president—something however a life insurance coverage salesman. Although everyone knows there’s a component of promoting to each career, for some purpose my mother was completely against her son being knowledgeable salesman. This wasn’t her imaginative and prescient for me.

I suppose mother thought bankers and repair professionals have been above promoting, or that I’d finally develop uninterested in promoting and discover a “actual” profession. However the fact is, each profitable skilled has to promote their companies and concepts to achieve success.

Promoting cleaning soap door-to-door at age 7 was scary. I needed to knock on strangers’ doorways and attempt to have grownup conversations with them. Some weren’t very good to me. However I refined my pitch and finally received extra comfy beginning a dialog, transitioning to why I used to be there, explaining the product I used to be providing and, lastly, asking for the order. Finally I offered sufficient cleaning soap to pay for YMCA camp and loved the satisfaction of reaching a hard-earned aim.

In faculty, I offered sneakers, sporting items and home equipment for a significant division retailer. I beloved speaking to individuals and understanding what drove their shopping for selections. Was it a necessary want, or was it standing or psychology at play? I beloved making an attempt to unravel the puzzle. Through the summer season of my junior yr of faculty, I offered life insurance coverage to fellow college students. It was low-cost coverage with excessive quantities of assured insurability that could possibly be exercised at future occasions or ages with no proof of insurability. It was an incredible idea, and I offered many insurance policies.

Many consider that should you can promote life insurance coverage efficiently, you may promote something as a result of insurance coverage is an intangible, unselfish buy. It must be offered as a result of it’s not willingly purchased. Promoting insurance coverage taught me the right way to determine complicated issues, clarify complicated options, construct relationships and perceive how emotion, worry, greed and love encourage individuals to motion.

Whether or not discussing investments, trusts, exit planning methods or wealth safety (together with insurance coverage) the advisor’s position is to be a listener and facilitator. It’s about serving to shoppers decide what’s most vital to them, discovering the place they wish to enhance, serving to them make selections they’re avoiding and addressing their fears. Solely then are you able to advocate a services or products which may profit them and relieve nervousness.

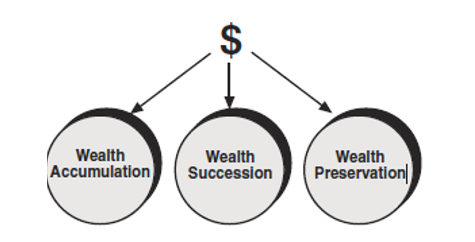

Three Circles of Wealth

Your first large “sale” with a brand new prospect isn’t a services or products; it’s the suitable to proceed a dialogue with them and their different advisors. Most profitable individuals wish to run vital monetary selections previous their most trusted advisors, particularly their lawyer and CPA.

I devised “The Three Circles of Wealth” (see beneath) to be a easy visible device to boost the factfinding and discovery course of with the potential shopper and their advisors. Should you don’t undergo a disciplined fact-finding and discovery course of first, you gained’t be able to advocate options – and even know if the potential shopper is an effective match for you. However, should you do, then you may start a dialogue like this:

“Mr. Smith, when now we have labored with enterprise homeowners such as you, I’ve discovered they’ve three main areas the place they make investments appreciable cash. I name these sectors, the Three Circles of Wealth:

- Wealth Accumulation;

- Wealth Succession; and

- Wealth Preservation.

We’ve discovered that enterprise homeowners are sometimes spending 1000’s of {dollars} in every of the circles of their try to unravel issues and obtain their aims.” (I then draw three circles facet by facet however not touching.) Let’s see how this has performed out for you.”

Now you may proceed as follows: “As soon as I perceive your targets and what you’ve already put into place, we are able to consider whether or not there is perhaps alternatives to double or triple the effectiveness of your cash — the cash you have already got working for you.”

Right here you wish to remind the potential shopper that they don’t should put extra {dollars} into their cash machine to make the Three Circles work for them.

- 1. The Wealth Accumulation Circle represents all the instruments used to construct wealth utilizing each firm {dollars} and private {dollars}. Pension plans, revenue sharing, Inner Income Code Section401(okay)s, thrift plans and nonqualified plans are all frequent instruments used to transform taxable earnings into capital.

- 2. The Wealth Succession Circle represents all of the frequent methods used to cross possession from one technology to a different or from the household administration crew to knowledgeable administration crew. These instruments are purchase/promote agreements, inventory choices, inventory redemptions and cross buy agreements. However these instruments may also embody compensation planning, bonus constructions, gross sales compensation and fringe advantages.

- 3. The Wealth Preservation Circle refers to all of the methods they will cross their belongings from one technology to a different on the lowest tax price. These instruments embody charitable trusts, certified terminable curiosity property trusts, grantor trusts, a marital deduction belief and fixing liquidity considerations.

Inter-Relationship with the Advisors

Once more, most profitable individuals encompass themselves with watchdogs whose job is to guard them from doing one thing impulsive. You’ll discover some watchdogs very gifted and competent. In that case, you wish to meet them and begin growing a relationship with them. The Three Circles provides you a chance to speak your worth and to work as a facilitator to convey all of the events collectively and to remove the inefficiencies you’ve discovered of their planning for the shopper.

Different occasions you’ll discover the potential shopper doesn’t like their lawyer or CPA a lot. Now you have got a referral alternative to your crew of advisors. Prospects very hardly ever will say no to The Three Circles. It’s easy to know, and so they suspect there are gaps and inefficiencies within the planning even when they will’t articulate them. Along with your assist, now they will.

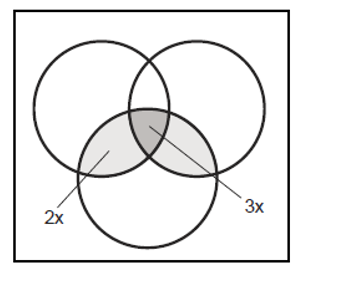

Now you may say: “Mr. Smith, this lack of coordination between the Circles creates a possibility for us to work collectively by combining the three circles.” (Now I draw them like Olympic rings.)

“Discover how every circle overlaps the opposite ones. This represents the various alternatives to mix instruments and remedy frequent issues with the identical {dollars}. You’ve already made the choice to speculate substantial {dollars} in your planning options. Might I present you the right way to get double or triple responsibility out of your present {dollars}?”

At this level, both the prospect goes to conform to allow you to present a second opinion of their present monetary plan” or you could get additional questions. Both method, you’re now positioned to maneuver ahead.

They’ll seemingly ask you ways you get compensated earlier than turning over private particulars to you. It’s worthwhile to be clear about how your price construction works and the way a lot it’s going to seemingly price the shopper to work with you.

A Win-Win

With this strategy, there’s no threat to the prospect to search out out about different choices for his or her planning. In case your diagnostic course of is effectively established, offering a complimentary second opinion gained’t require a number of time. And whereas the prospect is deciding about working with you, you’ll have loads of knowledge to resolve if you wish to work with them.

I name {that a} win-win-win — the perfect of the three circles and your skills.

Dr. Man Baker, CFP, CEPA, MBA is the founding father of Wealth Groups Alliance (Irvine, Calif.). He’s a member of the Forbes 250 Prime Monetary Safety Professionals Listing and creator of Maximize the RedZone, a information for enterprise homeowners in addition to The Nice Wealth Erosion, Handle Markets, Not Shares and Funding Alchemy. He acquired the 2019 John Newton Russell Memorial Award for lifetime service achievement within the insurance coverage